Between your resort, theme park tickets, souvenirs and Mickey-shaped snacks, the price of a Disney trip can really feel like something however a fairy story. Fortunately, there are a number of bank cards that may reduce or assist offset the price of your trip.

This is a take a look at the perfect bank cards for Disney journeys.

Overview of the perfect bank cards for Disney holidays

Associated: Suggestions for visiting Disney World in 2025: 17 methods to economize and have extra enjoyable

Capital One Enterprise X Rewards Credit score Card

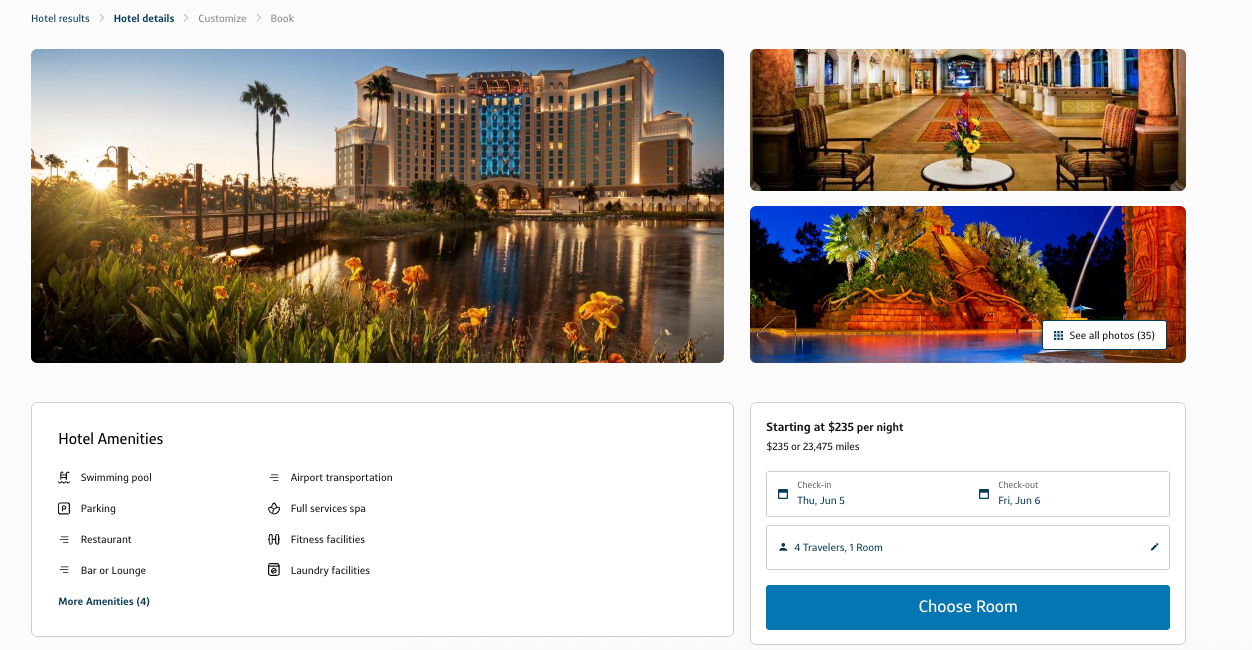

These may be helpful irrespective of the place you journey, however a number of issues make the Enterprise X particularly useful for Disney journeys. First, you’ll be able to e-book most Disney World and Disneyland resorts within the Capital One Journey portal.

Should you pay to your resort by means of the portal with this card, you may earn 10 Capital One miles per greenback, and you’ll set off the cardboard’s $300 annual journey credit score, permitting you to earn again a portion of your resort keep through an announcement credit score.

Or, if you have already got a stash of Capital One miles, you’ll be able to redeem these at a fee of 1 cent per mile towards any of the Disney resorts out there within the portal.

Along with utilizing Capital One Journey to earn or redeem miles on Disney resorts, you should use your miles to offset any buy that codes as journey in your assertion at a fee of 1 cent per mile. Lodges code as journey, nevertheless, theme park tickets sometimes code as leisure. One potential work-around that will code your buy as journey is in the event you e-book a Disney trip by means of a certified trip planner or instantly by means of Disney.

Every day Publication

Reward your inbox with the TPG Every day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

For extra particulars, take a look at our full evaluation of the Capital One Enterprise X.

Associated: How to economize at Disney World so you do not go bibbidi-bobbidi-broke

Chase Sapphire Reserve

There at present are no Disney World or Disneyland resorts listed within the Chase Journey portal, however the $550 annual payment card comes with a $300 annual journey credit score that you should use towards purchases that code as journey.

This card additionally earns 3 Final Rewards factors per greenback spent on journey expenses, so you’ll be able to earn factors and redeem your journey credit score on Disney resorts, tickets and trip packages that code as journey (although you will not earn factors on the portion of the costs offset by the $300 journey credit score).

As with the Enterprise X, resorts or hotel-and-ticket packages booked instantly by means of Disney or a certified Disney journey planner will code as journey, however ticket-only purchases booked by means of Disney won’t. If you’re solely buying tickets, make sure you use our ticket resale companion, Undercover Vacationer.

This annual credit score is along with different Sapphire Reserve perks, similar to entry to Chase Sapphire lounges and Precedence Move lounges, a free DoorDash DashPass subscription (when activated by Dec. 31, 2027), as much as $25 per thirty days in DoorDash credit (by means of Dec. 31, 2027) and an as much as $120 assertion credit score towards the applying payment for International Entry or TSA PreCheck.

For extra particulars, take a look at our full evaluation of the Chase Sapphire Reserve.

The Platinum Card from American Categorical

If you e-book Superb Lodges + Resorts properties by means of Amex Journey, you’ll be able to earn or redeem Membership Rewards factors and take pleasure in a collection of advantages (when out there) like early check-in, late checkout, room upgrades, complimentary day by day breakfast for 2 individuals and a property credit score to make use of on issues like eating or spa companies.

Amex Platinum Card holders additionally obtain a $200 annual resort credit score to make use of towards resorts which are a part of Superb Lodges + Resorts and The Lodge Assortment. (The Lodge Assortment bookings have to be a minimal of two nights for the credit score to use.)

If you’re trying to make use of factors to e-book your flights to Disney, you can even reserve flights by means of the Amex Journey portal. Should you choose to pay with money, Amex Platinum Card holders can earn 5 factors per greenback spent on flights booked by means of Amex Journey or instantly with an airline. Notice, although, that after $500,000 in flight purchases per calendar yr, the incomes fee drops to 1 level per greenback.

For extra particulars, take a look at our full evaluation of the Amex Platinum.

Associated: 6 shocking methods to make use of your on-property credit at resorts

Citi Strata Premier Card

The Citi Strata Premier Card has a strong listing of advantages for a $95 annual payment.

Along with incomes 10 Citi ThankYou Rewards factors per greenback spent on resorts, automobile leases and attraction tickets booked on cititravel.com and three factors per greenback spent on air journey, different resorts, eating places, groceries, gasoline and EV charging purchases, cardholders get an annual $100 resort credit score for a single resort reserving of $500 or extra (excluding taxes and costs) made by means of the Citi journey portal.

The easiest way to make use of these advantages for Disney journeys is by reserving your Disney resort by means of the Citi journey portal. Should you pay with money, you may earn 10 factors per greenback and set off the $100 resort credit score (so long as your keep is greater than $500). Or, you’ll be able to redeem Citi ThankYou Rewards factors at a fee of 1 cent apiece for Disney-area resorts booked by means of the portal.

You most likely will not discover any official Disney resorts within the portal, however you’ll be able to e-book resorts just like the Walt Disney World Swan, Dolphin and Swan Reserve and the Disney Springs resorts.

Though the Citi Status® Card is now not open to new candidates, in the event you maintain it, you can even get your fourth evening free on resorts booked by means of the Citi journey portal.

The knowledge for the Citi Status has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or supplied by the cardboard issuer.

For extra particulars, take a look at our full evaluation of the Citi Strata Premier.

Disney Premier Visa Card

Though the Disney Premier Visa Card would not have as sturdy of an incomes fee as different playing cards on this listing, it provides frequent Disney guests priceless perks.

The Disney Premier Visa has a $49 annual payment and earns 5% in Disney Rewards {Dollars} on card purchases made at disneyplus.com, hulu.com or espnplus.com; 2% on purchases made at gasoline stations, grocery shops, eating places and most U.S. Disney places; and 1% on all different purchases.

With such a low annual payment, although, you should still think about this card for the in-park procuring, eating and leisure reductions. Disney Premier cardholders can save 10% on choose bank card purchases at disneystore.com.

As a cardholder, you may additionally get 10% off eligible merchandise and eating purchases at choose in-park places at Disneyland and Disney World, 15% off the nondiscounted worth of choose guided excursions, 10% off choose recreation experiences, a 20% low cost on tickets to Cirque du Soleil’s “Drawn to Life” at Disney Springs and complimentary photo-ops solely out there to Disney Visa cardholders.

Disney additionally usually releases unique trip provides only for Disney Visa cardholders that may assist you save in your trip.

And, as soon as you have constructed up a stash of Disney Rewards {Dollars}, you’ll be able to redeem them towards theme park tickets, resort stays, procuring and eating at U.S. Disney parks or for an announcement credit score towards airline purchases utilizing Chase’s Pay Your self Again function.

For extra particulars, take a look at our full evaluation of the Disney Premier Visa Card.

Associated: Disney Visa card provides: Earn as much as $400 towards your subsequent trip

The very best resort bank cards for off-site resort stays

There are a number of factors resorts close to Disney World. Many provide Disney perks like complimentary transportation or early theme park entry along with the advantages of being an elite member of a specific resort model.

For instance, you probably have the Marriott Bonvoy Boundless® Credit score Card (see charges and costs) and need to keep on the Gaylord Palms Resort & Conference Heart close to Disney, you may use the 35,000-point certificates that you just obtain at every annual account renewal to cowl one evening of your keep.

This card additionally comes with computerized Silver Elite standing, which grants you advantages like bonus factors earnings on Marriott resort stays and late checkout.

If you’re loyal to Hilton resorts, Hilton Honors members with elite standing can get their fifth evening free on award stays at Disney Springs properties just like the Hilton Orlando Buena Vista Palace — Disney Springs Space and the Hilton Orlando Lake Buena Vista — Disney Springs Space.

Should you do not journey typically sufficient to construct up the nights wanted to succeed in elite standing, you’ll be able to fast-track your approach to Hilton standing with a card just like the no-annual-fee Hilton Honors American Categorical Card (see charges and costs) or the Hilton Honors American Categorical Surpass® Card ($150 annual payment; see charges and costs).

This listing is not exhaustive, however our tip right here is two-fold: If you have already got a cobranded resort bank card, test to see if there are any resorts within the Disney space the place you’ll be able to earn or redeem factors and use your elite standing perks.

Or, if you already know you may be touring to Disney quickly and need to keep in a points-friendly resort, learn up on our favourite resort bank cards earlier than you e-book.

Associated: 5 the explanation why Marriott is the perfect resort model for theme park followers

Backside line

There are a number of playing cards that may assist reduce or cowl the price of your subsequent Disney trip.

Whether or not you select to pay with money and rack up some further factors or miles towards your subsequent Disney journey or redeem your factors or miles to cowl all or a part of your trip, these playing cards are our favorites for making your Disney visits much more magical.

Associated studying:

For charges and costs of the Amex Hilton Honors card, click on right here.

For charges and costs of the Amex Hilton Honors Surpass, click on right here.