In September 2022, we noticed the Marriott Bonvoy Sensible® American Specific® Card improve its annual charge to $650 (see charges and charges) and swap its simple-to-use annual Marriott Bonvoy credit for month-to-month eating credit.

Whereas the quantity of the annual profit remained the identical — as much as $300 in assertion credit per calendar 12 months — we predict the change was general unfavourable.

Here is every thing it’s essential to learn about utilizing the as much as $25 month-to-month eating assertion credit out there in your Marriott Bonvoy Sensible Amex.

Which purchases usually set off the Marriott Bonvoy Sensible eating credit score?

Any buy that codes as a restaurant, cafe or related ought to set off the month-to-month eating assertion credit in your account. You should use the credit score at eating places each within the U.S. and worldwide.

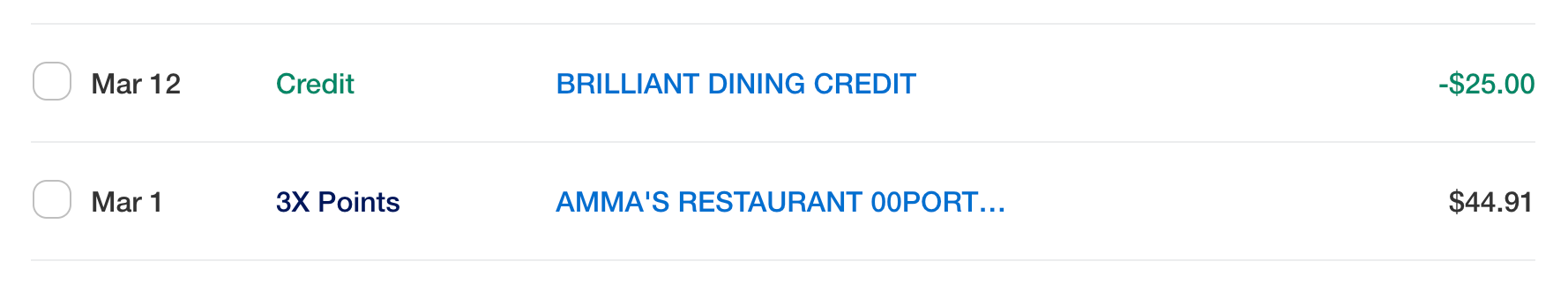

As with different American Specific assertion credit, these are likely to submit rapidly. We tried it out, and in March 2025, our credit have been posted in 11 days.

As you possibly can see, purchases that triggered the eating assertion credit nonetheless certified for incomes 3 factors per greenback at eating places worlwide.

It is also value noting that the up-to-$300 assertion credit apply solely as soon as per account.

If in case you have approved customers in your account they usually make eligible purchases, these expenses will rely towards the $300 in eating assertion credit. Nevertheless, any approved customers in your essential cardholder account don’t obtain their very own eating credit.

Associated: Is the Marriott Bonvoy Sensible Amex definitely worth the $650 annual charge?

Day by day Publication

Reward your inbox with the TPG Day by day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

How lengthy do I’ve to make use of the Marriott Bonvoy Sensible eating credit score?

The excellent news is that you need to use the as much as $300 eating credit as quickly as you open a Marriott Bonvoy Sensible Amex. These assertion credit can be found for the lifetime of your account.

The unhealthy information is that the credit require month-to-month use. Relatively than treating your self to a pleasant dinner that prices $200 in your birthday, your Bonvoy Sensible card’s eating assertion credit are solely out there as as much as $25 in assertion credit per thirty days.

When you maximize the month-to-month assertion credit for a full $25 every month, you may obtain a most of $300 of assertion credit per calendar 12 months.

Assertion credit additionally don’t roll over. Which means should you overlook to make use of your $25 in out there assertion credit this month, the credit are gone. You’ll be able to’t use $50 in eating credit subsequent month to make up for it. These credit are basically “use it or lose it” every month.

The cardboard’s phrases and situations state that the credit score might take 8-12 weeks to seem in your assertion, however it’s a lot quicker in our expertise.

Associated: 8 locations to maximise an 85,000-point Marriott Award Night time certificates

What’s not lined by the Marriott Bonvoy Sensible eating credit score?

Sadly, the phrases and situations point out:

The Eating Credit score profit isn’t legitimate for the acquisition of present playing cards or merchandise, or for purchases at non-restaurant retailers together with nightclubs, comfort shops, grocery shops, or supermarkets.

Moreover, the phrases and situations warn that you just can’t obtain the assertion credit in case your buy doesn’t code as a restaurant buy. This might occur at a restaurant positioned inside one other venue, equivalent to inside a stadium or inside a on line casino.

From these phrases, you might not obtain your month-to-month credit on the Bonvoy Sensible should you make purchases at locations that don’t code as a restaurant in your bank card assertion. The identical applies if you buy items somewhat than a meal.

Associated: Marriott Bonvoy Sensible vs. the Ritz-Carlton Card: Must you get one — or each?

The best way to maximize these credit

Almost definitely, you are pondering that going to a restaurant and spending precisely $25 is the easiest way to make use of this assertion credit score each month. You’ll be able to undoubtedly try this.

You could possibly additionally rearrange your pockets or set a reminder in your telephone to make use of your Bonvoy Sensible in your first meal at a restaurant or with a supply order every month. One other concept for utilizing the assertion credit score is setting this card because the default cost technique in a meals supply app you repeatedly use.

Sometimes, we do not suggest utilizing the credit score on the final day of the month as a result of the restaurant might doubtlessly course of the transaction the following day. In reality Amex states:

For instance, should you make an eligible buy on the final day of the month and the service provider does not course of that transaction till the following day, the transaction date will replicate the following day’s date and the assertion credit score can be utilized within the following month.

And should you overlook to make use of your assertion credit score till the final day of the month, what then? Loading the Chick-fil-A app or your Starbucks card might be an efficient means to make use of no matter remaining steadiness you have got that month.

When you’ve used $20 already at a restaurant, including $5 to your Starbucks card on the final day of the month can make sure you use the total quantity of obtainable eating assertion credit every month for the reason that steadiness won’t carry over to the following month.

Backside line

The Marriott Bonvoy Sensible American Specific Card affords as much as $300 in eating assertion credit per calendar 12 months in your account. The credit can be found as as much as $25 per thirty days in assertion credit for eligible restaurant purchases and are extremely straightforward to make use of.

For extra data, learn our full assessment of the Marriott Bonvoy Sensible card.

Apply right here: Marriott Bonvoy Sensible American Specific Card

For charges and charges of the Marriott Bonvoy Sensible Card, click on right here.