Editor’s word: It is a recurring publish, often up to date with the newest info.

Did somebody point out bringing a delegated buddy or member of the family for (virtually) free on any Southwest flight you are taking?

Incomes Southwest’s coveted Companion Cross isn’t simple — besides when it’s. The provider has been recognized to run promotions the place you possibly can earn a Companion Cross for taking a single round-trip flight, and proper now, you possibly can earn it with a single Southwest bank card welcome provide. Even with out certainly one of these promotions, Southwest bank card spending may help you fast-track your technique to the Companion Cross.

Maintain studying to search out out why the Companion Cross is so useful and how one can earn one this yr.

Associated: Southwest Speedy Rewards: Full information to incomes, redeeming and maximizing factors

What’s the Southwest Companion Cross?

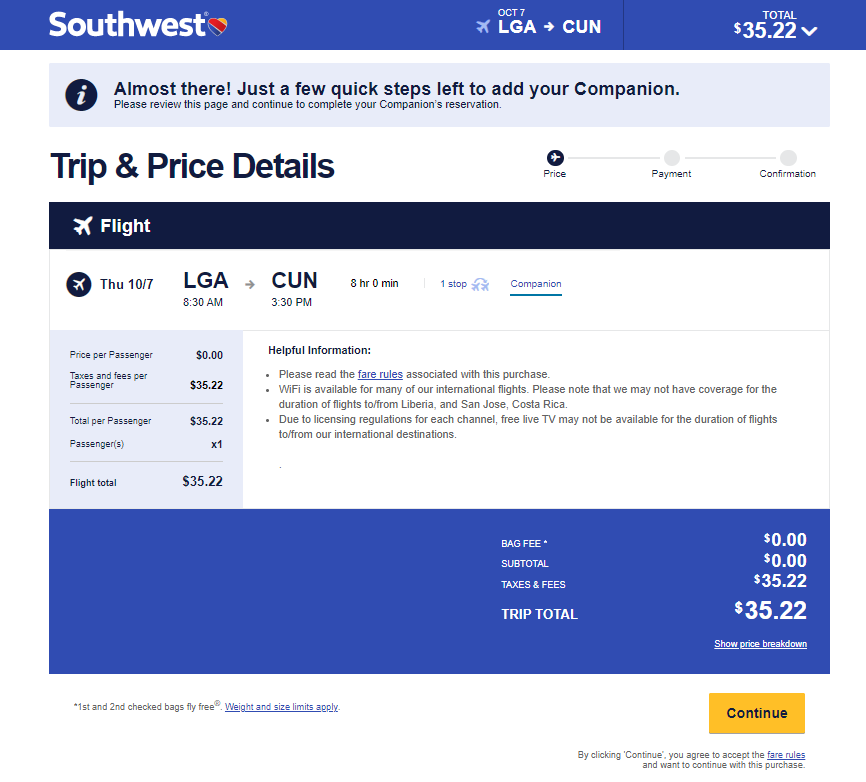

With Southwest’s Companion Cross, you possibly can convey a buddy or member of the family you designate as your companion with you on any Southwest flight. You’ll solely must pay the taxes and costs in your companion’s ticket, identical to you’ll on an award ticket. In consequence, for those who earn a Companion Cross, you’ll have over a yr of purchase one, get one (practically) free Southwest flights.

The flexibility to convey alongside a journey companion for practically free shouldn’t be distinctive to Southwest. Many bank cards provide some type of a single-use companion fare, permitting you to convey a journey companion at a closely discounted fee.

Nonetheless, the magic of the Southwest Companion Cross is that you should use it as many instances as you need till the cross expires. Even for those who have been to fly day by day of the yr, your companion might include you for simply the price of taxes and costs. It even applies to award tickets, permitting you to redeem Speedy Rewards factors for your self and produce your companion with out utilizing further factors.

TPG values Southwest factors at 1.35 cents every per our February 2025 estimates, and incomes the Companion Cross can successfully double the worth of your factors (or money) when flying with a companion on Southwest.

Bear in mind, you’re not restricted to flights inside the decrease 48 states. Over the past a number of years, Southwest has expanded to (and inside) Hawaii and added short-haul worldwide flights.

Moreover, you possibly can change your designated Southwest companion as much as 3 times per calendar yr. In different phrases, you possibly can have 4 totally different companions within the first calendar yr, then three within the second yr (for as much as seven complete throughout the lifetime of your Companion Cross). It’s value noting that even for those who swap again to a earlier companion, it nonetheless counts as certainly one of your three allotted adjustments per calendar yr.

Associated: 15 classes from 15 years of getting the Southwest Companion Cross

The best way to earn the Southwest Companion Cross

Incomes the Companion Cross requires accruing 135,000 qualifying factors or taking 100 qualifying one-way flights in a calendar yr. That feels like so much, however contemplating the mountains of factors out there from Southwest bank card provides, it’s not as troublesome as it might appear.

Plus, the Companion Cross has a powerful shelf life: It’s legitimate by way of the tip of the yr during which you earn it, in addition to the whole yr that follows. If you happen to time it appropriately, that may very well be practically two years of BOGO privileges.

So what are qualifying factors for incomes the Companion Cross? It’s necessary to notice that not all Speedy Rewards factors depend towards the 135,000-point requirement. Right here’s how Southwest defines factors that can depend:

Companion Cross qualifying factors are earned from income flights booked by way of Southwest®, factors earned on Southwest Speedy Rewards® Credit score Playing cards, and base factors earned from Speedy Rewards® companions.

As you possibly can see, all income flights booked on Southwest will depend towards incomes the Companion Cross, as will factors earned on Southwest’s cobranded bank cards. The place issues get a bit trickier is the “base factors earned from Speedy Rewards companions” verbiage. Do all companions depend?

This web page on Southwest’s web site supplies some examples of associate exercise that can depend towards qualification:

- Speedy Rewards bank cards, together with welcome bonuses

- Procuring and eating companions, reminiscent of shopping for flowers and consuming out with Speedy Rewards Eating

- Journey companions, reminiscent of associate lodge stays and automotive leases

- Residence and life-style companions, like Reliant Vitality and NRG Residence

Nonetheless, many issues don’t depend towards incomes the Companion Cross:

- Any factors transferred from Chase Final Rewards or lodge or automotive rental loyalty applications

- Bought or gifted factors

- A-Record or A-Record Most popular tier bonus factors

- Most promotional bonus factors earned on Southwest or companions (besides on Speedy Rewards bank cards and Southwest Enterprise Refer a Firm)

With that in thoughts, right here’s a rundown of three methods to earn the Southwest Companion Cross.

Associated: If you happen to like the present Southwest Airways boarding course of, you’re in luck

Southwest bank cards

Factors earned from Southwest Speedy Rewards bank cards, together with welcome bonuses, depend towards the Southwest Companion Cross. Moreover, Southwest cardholders will get pleasure from an annual increase of 10,000 factors towards Companion Cross qualification yearly. This may publish inside 30 days of opening your account after which once more by Jan. 31 of each calendar yr. This successfully reduces the variety of factors you could earn to 125,000.

Plus, three Southwest client playing cards are at present providing elevated welcome bonuses that embody a Companion Cross. The Southwest Speedy Rewards® Plus Credit score Card, Southwest Speedy Rewards® Premier Credit score Card and Southwest Speedy Rewards® Precedence Credit score Card are providing a Companion Cross good by way of Feb. 28, 2026, plus 30,000 bonus factors after you spend $4,000 on purchases within the first three months from account opening.

The data for the Southwest Premier Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or supplied by the cardboard issuer.

Now may very well be a good time so as to add one of many above to your pockets. And the earlier you earn the welcome bonus, the longer you’ll be capable to use your promotional Companion Cross.

Southwest additionally has two enterprise playing cards that may speed up your progress to the Companion Cross. You’ll be able to earn 80,000 bonus factors after you spend $5,000 on purchases within the first three months from account opening with the Southwest® Speedy Rewards® Efficiency Enterprise Credit score Card, or earn 60,000 bonus factors after you spend $3,000 on purchases within the first three months from account opening with the Southwest® Speedy Rewards® Premier Enterprise Credit score Card. Between these welcome bonuses and the ten,000-point anniversary increase, you’ll be greater than midway towards incomes the 135,000 factors wanted for a Companion Cross.

Or, for those who mix earnings from certainly one of these enterprise playing cards with these from a private Southwest card, you might qualify for a Companion Cross with none further exercise.

Associated: Do I want a enterprise to get a enterprise bank card?

Chase software restrictions

Earlier than happening an software spree, do not forget that Chase has restrictions on Southwest bank cards associated to welcome bonuses. The next verbiage seems on the applying pages for the Precedence, Premier and Plus playing cards:

This product is on the market to you for those who would not have a present Southwest Speedy Rewards Credit score Card and haven’t acquired a brand new Cardmember bonus inside the final 24 months. This doesn’t apply to Enterprise Card and Worker Credit score Card merchandise.

In consequence, you possibly can’t open a brand new Southwest private card if you have already got one or earned a welcome bonus on one inside the final 24 months. You’ll additionally need to make sure you’re aware of Chase’s normal software restrictions, together with the issuer’s notorious 5/24 rule and the overall rule that you would be able to open one private and one enterprise card each 90 days.

As of now, Southwest’s small-business bank cards would not have the identical verbiage. As an alternative, the enterprise playing cards word:

“This new Cardmember bonus provide shouldn’t be out there to both (i) present Cardmembers of this enterprise bank card, or (ii) earlier Cardmembers of this enterprise bank card who acquired a brand new Cardmember bonus for this enterprise bank card inside the final 24 months.”

If you happen to already maintain a Southwest bank card(s) and thus can’t use the welcome bonus to your benefit, all of the factors you earn from spending on these playing cards may also depend towards incomes the Companion Cross. You can theoretically earn the cross from bank card spending alone, however there are two different choices that ought to make the duty simpler.

Associated: The best way to qualify for Southwest Companion Cross with one bank card sign-up bonus

Flying with Southwest: How a lot do it’s a must to spend to get 135,000 factors?

One other easy technique to earn factors for the Companion Cross is by really flying with Southwest. If you happen to don’t have a cobranded bank card and plan to earn the Companion Cross by way of flying in 2025, you’ll must earn the complete 135,000 factors or take 100 qualifying one-way flights. This interprets to the next spending on base fares (not together with any elite standing points-earning bonus):

- $22,500 on Wanna Get Away

- $16,875 on Wanna Get Away Plus

- $13,500 on Anytime

- $11,250 on Enterprise Choose

When you have journey deliberate this yr, take into account reserving with Southwest to earn factors towards the Companion Cross. However bear in mind, this technique requires flying on many paid Southwest fares to earn sufficient Companion Cross qualifying factors.

Associated: Free luggage and open seating: Why I select Southwest each time

Use a mixture of bank cards and flying

For a lot of vacationers, the easiest way to earn the Companion Cross will probably be some mixture of flying and bank cards.

Let’s say you open the Southwest Efficiency Enterprise card and earn the complete welcome bonus in early 2025. Let’s additionally assume you spend a complete of $10,000 on the cardboard, and a part of that spending is $2,000 on Wanna Get Away base fares, all of that are on flights flown in early 2025. You’ll earn:

- Welcome bonus (for spending $5,000 within the first three months): 80,000 factors

- Flying: 12,000 factors ($2,000 x 6 factors per greenback spent on Wanna Get Away base fares)

- Southwest airfare purchases on the cardboard: 8,000 factors ($2,000 x 4 factors per greenback spent on Southwest purchases)

- Different purchases on the cardboard: 8,000 factors ($8,000 x 1 level per greenback spent)

- Bank card anniversary factors: 10,000 factors

This exercise would earn you 118,000 Companion Cross-qualifying factors, placing you simply 17,000 factors away. You can simply make up that distinction by leveraging different incomes alternatives like Speedy Rewards Procuring or automotive leases by way of Southwest.

Since these factors will all hit your Speedy Rewards account in 2025, your Companion Cross can be legitimate by way of Dec. 31, 2026. That’s numerous BOGO time.

Do not forget that your bank card factors received’t seem in your account till a couple of days after your month-to-month assertion closes, and factors earned from flights received’t publish till a couple of days after you full the journey. Once more, timing is essential to make sure you earn the Companion Cross and may use it for so long as potential.

Associated: Southwest unveils A-Record perks for brand new assigned-seating setup

Backside line

The Southwest Companion Cross could be an extremely profitable profit, particularly for those who can earn it early in a calendar yr to get pleasure from virtually two years of (practically) free companion journey. It’s not too late to plan your technique to earn the cross in 2025 — and probably for some (or all) of 2026.

For these eligible, getting a pleasant bonus from a Southwest bank card or two may help you earn a Companion Cross simply (and shortly). Whilst you can earn a Companion Cross by way of flying or bank card spending alone, a mixture is usually the simplest method.