We discuss so much about utilizing your bank card’s advantages for issues like journey delays. The peace of thoughts these perks can add to your journey when one thing goes awry is improbable.

Nevertheless, earlier than you get lulled right into a false sense of safety, bear in mind these perks should not automated. You have to take particular steps to get reimbursed for cheap bills after a prolonged (or in a single day) delay.

Listed below are 4 issues it’s essential to do if you’d like your bank card’s journey delay reimbursement to truly be just right for you.

Pay for the journey with a bank card that gives journey delay reimbursement

Whereas airways could present resort rooms and meals vouchers for in a single day delays which might be beneath their management, comparable to upkeep points, they sometimes will not present protection for issues like climate delays. Furthermore, what an airline supplies could not cowl your whole bills. That is the place journey delay reimbursement may help you.

Nevertheless, so as to be eligible, you need to pay on your journey with a card that gives this protection.

Listed below are some playing cards which might be among the many greatest for journey delay reimbursement:

*Eligibility and profit stage varies by card. Phrases, circumstances and limitations apply. Please go to americanexpress.com/benefitsguide for extra particulars. Underwritten by New Hampshire Insurance coverage Firm, an AIG Firm.

For Capital One merchandise listed on this web page, a number of the advantages could also be offered by Visa® or Mastercard® and should range by product. See the respective Information to Advantages for particulars, as phrases and exclusions apply.

Every day Publication

Reward your inbox with the TPG Every day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

It is vital to notice that the particular phrases can range from card to card (or issuer to issuer).

For instance, listed here are the phrases from Chase Sapphire Most popular Card (in accordance with the cardboard’s advantages web page):

“This profit applies to cheap bills incurred throughout Your delay not in any other case coated by Your Widespread Service, one other get together, or Your main private insurance coverage coverage. You may be refunded the surplus quantity (as much as the utmost) as soon as all different reimbursement has been exhausted as much as the restrict of legal responsibility.”

The cardboard covers “cheap bills” from the delay. Which means gadgets like a brand new toothbrush are seemingly coated, however three pairs of latest footwear most likely aren’t.

Additionally, protection is secondary, that means that it kicks in after some other insurance coverage or protection you could have (advantages from the transportation service, your individual insurance coverage protections, legal guidelines, and so forth.).

Lastly, discover out in case your card’s particular profit requires you to pay for the total quantity of the journey or simply part of it to invoke journey delay reimbursement protection. On the Chase Sapphire Reserve, you may “cost all or a portion of a standard service fare to your bank card account and/or rewards packages related together with your account.” Capital One playing cards have related terminology. Thus, an award reserving the place you paid for the taxes and charges together with your card can be enough.

Nevertheless, many American Specific playing cards wouldn’t cowl your journey delay in that scenario as a result of its phrases require you to pay the “full quantity” of the journey on the cardboard to obtain the profit.

Associated: Flight delayed or canceled? Listed below are the very best bank cards with journey delay reimbursement

Get an announcement from the service confirming the delay

As soon as your delay passes the required period of time talked about above, it is time to get it in writing. If it is not in writing, it does not exist.

The only manner to do that is to ask a workers member on the customer support desk, at your flight gate or at another airline facility. Most significantly, strive to do that whilst you’re nonetheless on the airport.

If you happen to go away the airport with out getting a delay affirmation, it is doable to request one after the very fact. Delta, for instance, has a touchdown web page to request this kind, whereas different airways deal with this by way of their respective customer support contacts. Nevertheless you get this data, be certain it consists of: your title(s), the affirmation or ticket numbers, the flight particulars (date, flight quantity, and so forth.) and the particular motive for the delay.

Confirming a flight was delayed vs. proving that the delay was on account of a coated motive are two various things. Make sure you get a type that truly helps the declare you’ll make for reimbursement together with your bank card’s journey delay protection.

The identical idea applies whether or not your journey was with an airline, bus firm or cruise.

Associated: 3 issues to do in case your flight is delayed

Save the receipts

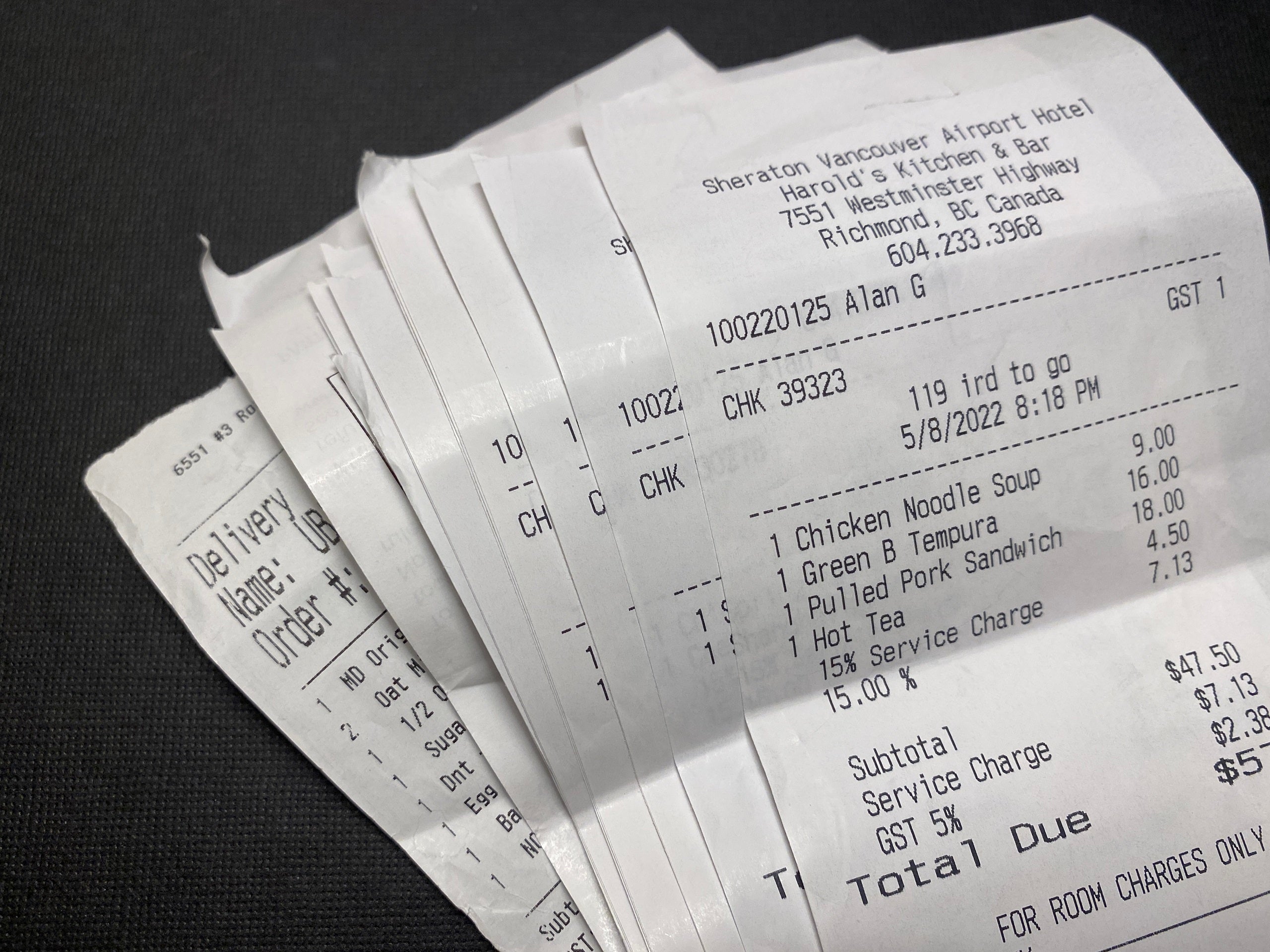

Get printed receipts for any bills you incur, and be sure you save them. In truth, you need to most likely take an image together with your telephone as quickly as you obtain them — that manner, you might have a document of the purchases, even when the bodily copies get misplaced. If you aren’t getting a receipt, you may’t submit for reimbursement together with your bank card issuer.

This does not simply apply to receipts on your purchases through the delay, as it’s essential to save the affirmation emails related to the journey. You will want that documentation to show that you simply paid for this journey with a bank card that gives journey delay reimbursement. Chances are you’ll even be requested for the month-to-month assertion with the transaction — which is what TPG senior editorial director Nick Ewen had to offer when he had an sudden in a single day layover in Lima, Peru on his manner again from Chile in 2019.

Throughout your delay, you might need to begin gathering these paperwork. Ensure you know which bank card you used to pay for the journey, and begin organizing these items for the declare you’ll make later. Doing this will even assist to keep away from surprises later.

Why? You will confirm what protection you might have based mostly on the cardboard you used — like how lengthy the delay have to be earlier than protection kicks in.

Associated: Is journey insurance coverage price it?

If that is a part of an extended journey, save the paper path

In January 2021, I submitted a declare for bills associated to a delay on a flight departing Tanzania. Previous to the flight, my spouse and I had been on the street for a number of weeks, visiting a number of different nations. The insurance coverage adjuster requested for a paper path displaying how we obtained from our dwelling deal with to Tanzania previous to the delay and our request for expense reimbursement.

Fortunately, I hold these paperwork organized in my electronic mail and on my pc and was in a position to present the tickets and affirmation numbers displaying the place we had been between leaving dwelling and attending to the incident in query.

Experiences will range, however the level is that you need to hold a paper path. Sadly, based mostly on my expertise, most insurance coverage corporations do not make it simple so that you can be reimbursed. Saving receipts on your bills and the entire transportation you took after leaving dwelling may help you help a declare when the flight is a part of an extended journey that is not essentially to or from your own home airport.

Associated: What to do when an airline loses your baggage

Backside line

Understanding that you’re coated by journey delay reimbursement in your bank card can scale back complications throughout your journey. This profit supplies peace of thoughts throughout delays, since you understand you’ll be reimbursed for any bills you incur.

Nevertheless, you will solely get that reimbursement test for those who observe the right steps. Ensure you know precisely how your card’s protection works and when it kicks in. Then be sure you have the required paperwork when submitting your declare. You will want your tickets and receipts from the acquisition, plus a affirmation of the delay motive from the frequent service and the receipts on your bills.

Associated: Do you have to get journey insurance coverage if in case you have bank card safety?

For charges and charges of the Amex Platinum card, click on right here.

For charges and charges of the Amex Bonvoy Good card, click on right here.

For charges and charges of the Delta SkyMiles Reserve Amex, click on right here.