Marriott Bonvoy Good American Categorical Card overview

*Card score relies on the opinion of TPG’s editors and isn’t influenced by the cardboard issuer.

Marriott has six cobranded playing cards out there to new cardholders at a broad vary of added advantages and annual charge ranges.

The Bonvoy Good is the costliest to carry, with its $650 annual charge (see charges and charges). However does that essentially imply it is the very best?

A credit score rating of 670 or increased is really useful to be permitted for this card.

Let’s dig deeper into the cardboard’s particulars that will help you decide if it is best for you.

Bonvoy Good Amex execs and cons

| Execs | Cons |

|---|---|

|

|

Bonvoy Good Amex welcome supply

For a restricted time, new Marriott Bonvoy Good Amex candidates can earn 185,000 bonus factors after spending $6,000 in purchases throughout the first six months of card membership.

Primarily based on TPG’s March 2025 valuations of Marriott factors at 0.7 cents every, these 185,000 factors are price $1,295.

Since this supply is available in at properly over 100,000 bonus factors, it meets our really useful threshold to use.

Day by day E-newsletter

Reward your inbox with the TPG Day by day publication

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

That is the very best welcome supply now we have seen on the Good for a easy spending requirement on the cardboard. The choice best-ever supply was for 150,000 bonus factors after spending $6,000 within the first three months of card membership, plus 50,000 bonus factors after staying six eligible paid nights with Marriott (supply not out there).

This present supply provides you double the time to fulfill the spending requirement and gives extra factors for assembly that threshold — and you will not have to finish any Marriott stays to earn the bonus.

Do not forget that Amex has restrictions limiting your capacity to gather a brand new welcome bonus in the event you’ve had related Marriott merchandise from Chase or earlier Starwood Most popular Visitor playing cards from American Categorical. Make sure you evaluate the cardboard’s supply particulars web page to make sure you’re eligible.

Associated: Is the Marriott Bonvoy Good Amex well worth the $650 annual charge?

Bonvoy Good Amex advantages

- Annual free-night award: Annually after your card renewal month, you may obtain a free night time award at collaborating inns price as much as 85,000 factors. That is way more worthwhile than the free night time certificates that include some lower-tier Marriott playing cards, that are capped at 35,000 factors. Among the greatest makes use of of the certificates embrace luxurious inns comparable to The Ritz-Carlton, Berlin and The St. Regis Langkawi, the place rooms routinely high $500 per night time — although Marriott’s dynamic pricing could affect your capacity to e-book a few of these properties. (Sure inns have resort charges.)

- Marriott Platinum Elite standing: Major cardmembers obtain complimentary computerized Marriott Platinum Elite standing, which incorporates perks like upgrades to suites, 4 p.m. late checkout (topic to availability) and lounge entry. It’s best to obtain your upgraded standing in lower than two weeks.

- As much as $300 in restaurant credit: As a cardmember, you may obtain as much as $25 in assertion credit every month while you use your card at eligible eating places worldwide, equating to a complete worth of as much as $300 every calendar yr. (A spokesperson for American Categorical has confirmed that this credit score applies to worldwide eating places, is robotically utilized and doesn’t require registration previous to utilizing this profit.)

- Property credit score of as much as $100: Once you e-book direct utilizing a particular fee for a keep of not less than two nights at Ritz-Carlton or St. Regis properties along with your card, you may obtain a credit score of as much as $100 for incidentals.

- Precedence Go lounge entry: As is fairly customary amongst premium journey rewards playing cards, the cardboard comes with a Precedence Go Choose membership, which provides you and as much as two friends limitless entry to greater than 1,700 airport lounges worldwide. Extra friends are charged the go to charge (enrollment is required). This membership doesn’t embrace entry to Precedence Go eating places.

- Utility charge credit score for World Entry or TSA PreCheck: Like many different premium playing cards, the Bonvoy Good will reimburse you through assertion credit score while you cost the applying charge for World Entry or TSA PreCheck to the cardboard as much as $120 (as much as $85 as soon as each 4½ years for TSA PreCheck or $120 as soon as each 4 years for World Entry). If you have already got World Entry or PreCheck, you should utilize this credit score to cowl a liked one’s software charge. Bear in mind, World Entry consists of TSA PreCheck, so it is sometimes the higher selection.

- Elite night time credit: Cardmembers will obtain 25 elite night time credit yearly. This profit may be stacked with the nights you earn with a Marriott small-business card. Once you mix the elite night time credit you earn on the Good with these earned on a Marriott enterprise card, you may attain 40 elite nights annually with none stays.

- Annual Earned Alternative Award: You may obtain an earned selection award after making $60,000 in eligible purchases in a calendar yr. That is separate from the Alternative Advantages you’d unlock by reaching 50 and 75 elite-qualifying nights. You’ll be able to solely earn one Earned Alternative Award per calendar yr, and you’ll select from the next: 5 Nightly Improve Awards, an 85,000-point free night time reward or $1,000 off a mattress or field spring from any Marriott Bonvoy retail model.

- Purchasing protections: Purchases made with the cardboard can stand up to at least one yr of prolonged guarantee protection* and 90 days of buy safety.*

- Journey protections: The Marriott Bonvoy Good Amex gives journey cancellation and interruption insurance coverage** and journey delay insurance coverage** for journeys delayed by greater than six hours as a result of a coated cause. To be coated, you should e-book a round-trip ticket and pay solely along with your card.

Those that can maximize the total worth of the Bonvoy Good Amex’s advantages will simply justify the cardboard’s hefty annual charge.

*Eligibility and profit ranges range by card. Phrases, situations and limitations apply. Go to americanexpress.com/benefitsguide for particulars. Insurance policies are underwritten by AMEX Assurance Firm.

**Eligibility and profit stage varies by card. Phrases, situations and limitations apply. Go to americanexpress.com/benefitsguide for particulars. Insurance policies are underwritten by New Hampshire Insurance coverage Firm, an AIG Firm.

Associated: The best way to use the Marriott Bonvoy Good’s $25 month-to-month eating credit score

Incomes factors on the Bonvoy Good Amex

Bonvoy Good Amex cardmembers earn Marriott Bonvoy factors on the following charges:

- 6 factors per greenback spent on eligible purchases at inns collaborating within the Marriott Bonvoy program

- 3 factors per greenback at eating places worldwide

- 3 factors per greenback on flights booked straight with airways

- 2 factors per greenback on different eligible purchases

The non-Marriott incomes charges are a bit low, so you may most likely wish to pair the cardboard with a number of different playing cards that supply superior bonus classes, comparable to The Platinum Card® from American Categorical for flights and the Chase Sapphire Reserve® for eating and different journey purchases.

There are additionally another nice choices to your on a regular basis spending that will make a stable pairing with the Bonvoy Good.

Associated: The very best bank card pairings

Redeeming factors on the Bonvoy Good Amex

The obvious and worthwhile technique to redeem the Marriott Rewards factors you may earn on the Bonvoy Good Amex is for stays at Marriott properties.

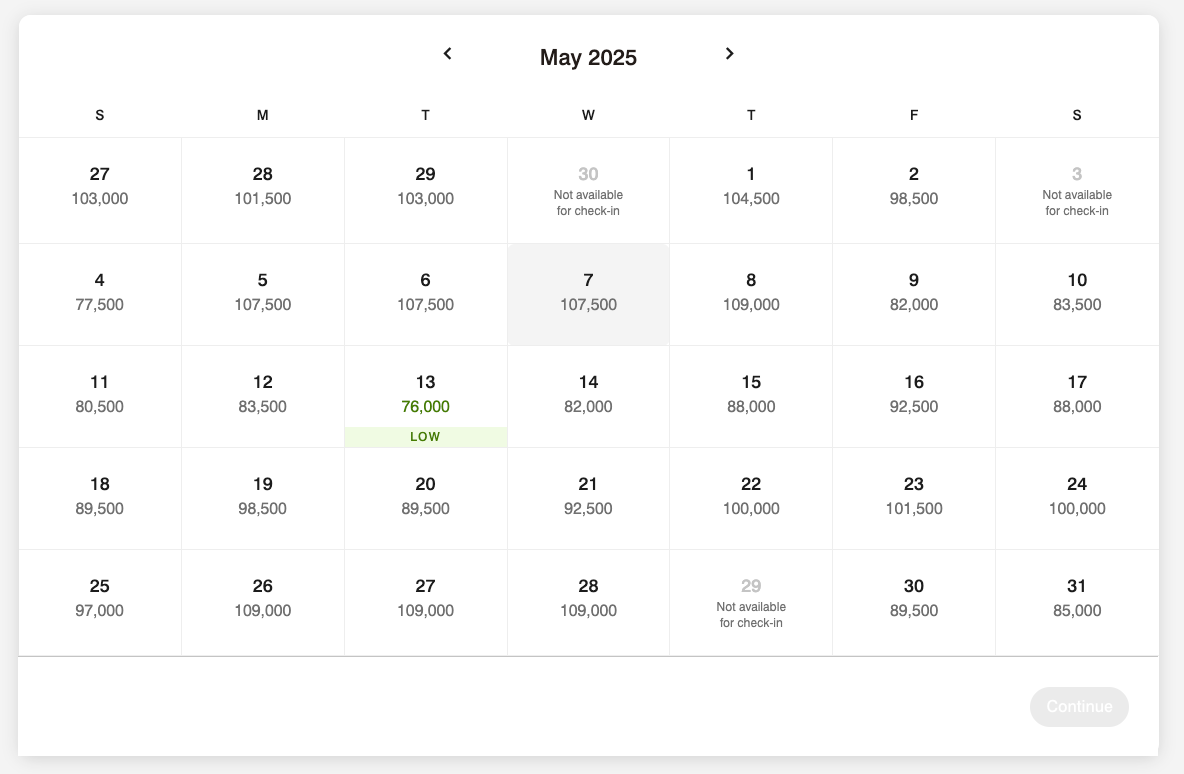

Nevertheless, what’s essential to notice with the Marriott Bonvoy program is its dynamic award pricing. Which means that the variety of factors you may must e-book rooms at any property might range month-to-month (even day-to-day) relying on demand.

As an example, in the event you’re looking for award costs on the Wailea Seashore Resort by Marriott in Might 2025, you could possibly pay as low below 80,000 factors one night time and virtually 110,000 on one other.

The speed you lock in will rely in your flexibility. It is notable that Marriott Bonvoy has additionally devalued its factors in latest months. On common, you may want extra factors to e-book rooms now than you’ll’ve earlier than these adjustments took impact.

Nevertheless, with the power to e-book 10,000 international locations throughout greater than 30 lodge manufacturers, you’ve got received lots of decisions. Marriott Bonvoy boasts many incredible inns, together with a number of the world’s most luxurious properties.

Among the extra luxurious inns and resorts you could possibly e-book with Marriott Bonvoy factors embrace plenty of Ritz-Carlton and St. Regis properties. Some are all-suite, such because the St. Regis Maldives, and others are in dreamy locations just like the Al Maha Resort within the desert exterior Dubai.

Rooms at top-tier properties like these sometimes value 100,000 factors (or much more) per night time. Which will appear to be a hefty worth in factors, however it is not a nasty worth contemplating that these room charges can attain $1,500 per night time many of the yr.

TPG bank cards author Chris Nelson acquired excellent worth by redeeming 4 nights on the JW Marriott Sao Paulo throughout peak season for 120,000 factors.

Associated: Maximizing redemptions with the Marriott Bonvoy program

Transferring factors on the Bonvoy Good Amex

Along with redeeming them for stays at Marriott Bonvoy properties, you possibly can switch your Bonvoy factors to greater than 35 airline companions.

Nevertheless, this hardly ever gives good worth, so we suggest avoiding it except you could high off an account stability for a flight redemption or must entry an airline’s loyalty foreign money.

Associated: When does it make sense to switch Marriott factors to airways?

Which playing cards compete with the Bonvoy Good Amex?

Should you’re not loyal to Marriott, there are a selection of playing cards you may take into account as a substitute of the Bonvoy Good Amex:

For added choices, take a look at our full listing of the very best lodge bank cards.

Associated: The very best premium bank cards: A side-by-side comparability

The data for the Hilton Honors Aspire Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or supplied by the cardboard issuer.

Backside line

Should you’re a Marriott loyalist in want of a cobranded bank card or need to change from a unique Marriott card, the Marriott Bonvoy Good Amex is a perfect selection.

Its incomes charges usually are not as profitable as these of a few of its opponents. Nevertheless, the dear welcome bonus coupled with spectacular built-in perks — like as much as $300 in restaurant credit every calendar yr and an annual free-night certificates of as much as 85,000 factors — make it straightforward for Marriott loyalists to get super worth out of the cardboard.

Apply right here: Marriott Bonvoy Good

Associated: Which bank card do you have to use for Marriott stays?

For charges and charges of the Marriott Bonvoy Good Amex, click on right here.

For charges and charges of the Marriott Bonvoy Bevy Amex, click on right here.