Right here at TPG, we’re all about maximizing each greenback you spend. Typically, you’ll be able to accomplish that by utilizing the most effective bank card to benefit from the highest return for a selected buy. However generally, you’ll be able to go a step additional.

Enter “double dipping,” or the follow of incomes two (or extra) various kinds of factors on a single transaction. Profiting from double-dipping alternatives will provide help to speed up your points-earning — bringing you that a lot nearer to your dream award journey.

Under, we have outlined a few of our high double-dipping alternatives that you could (and will) work into your on a regular basis factors practices.

Use on-line buying portals

One of many easiest methods to double dip is to make use of buying portals in your on-line purchases. These third-party websites companion with numerous retailers to present you factors, miles or money again once you click on by their hyperlinks. That is along with the factors and miles you earn from placing the transaction in your bank card. So, you earn one bonus from the portal and one other out of your card.

It doesn’t matter what kind of factors you are attempting to earn, there’s possible a portal on the market that may fit your wants. A number of airways and lodge chains have their very own portals, as does Chase Final Rewards. In the meantime, Rakuten lets you obtain your earnings within the type of American Categorical Membership Rewards factors as an alternative choice to its normal money again. New members can earn a one-time $30 bonus by becoming a member of Rakuten and spending $30 within the first 90 days.

Undecided which portal to make use of? Attempt utilizing a buying portal aggregator like Cashback Monitor to match incomes charges throughout quite a few portals for a given retailer.

Be part of restaurant rewards applications

Eating out generally is a profitable exercise by itself, with playing cards such because the American Categorical® Gold Card providing 4 factors per greenback on restaurant purchases worldwide (on as much as $50,000 in purchases per calendar 12 months, then 1 level per greenback). However it’s additionally a chance to double dip utilizing eating rewards applications.

When you register, collaborating eating places mechanically award you factors or miles once you pay for a meal with a linked bank card. As soon as once more, these earnings are on high of the factors or miles you internet only for buying together with your favourite bank card for eating.

There’s only one key factor to recollect: Every of your bank cards can solely be registered for one eating program, so you’ll be able to’t earn by two airline or lodge applications for a single buy.

Each day E-newsletter

Reward your inbox with the TPG Each day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Associated: Which card ought to I pay with when eating at a lodge?

Earn extra with Uber and Lyft

Whether or not you employ Uber or Lyft, you can also make your rides extra precious by linking sure rewards accounts to earn factors on each experience.

With Lyft, you will have a number of decisions with regards to incomes bonus factors or miles, although you will need to choose one of many following as your designated loyalty rewards companion:

Delta Air Traces additionally has a partnership with Lyft, however that partnership will finish April 7 when it hyperlinks up with Uber.

One other Lyft partnership ending this 12 months is with Chase. Nevertheless, by March, you should utilize an eligible card — just like the Chase Sapphire Reserve® or Chase Sapphire Most popular® Card — to earn as much as 10 factors per greenback spent on the platform.

In the meantime, with Uber, you’ll be able to hyperlink your Marriott Bonvoy account and earn the next:

- 3 factors per greenback spent on rides with Uber XL, Uber Consolation, Uber Black and Uber Black SUV

- 2 factors per greenback spent on Uber X rides once you reserve prematurely

- 2 factors per greenback spent on Uber Eats restaurant and grocery orders of $40 or extra delivered to Residence Inn, TownePlace Suites or Factor lodges

- 1 level per greenback spent on all different Uber Eats restaurant and grocery orders above $40

Be sure to’re additionally utilizing a bank card with an ideal return on journey purchases; for example, the American Categorical® Inexperienced Card, which gives 3 factors per greenback spent on journey and transit purchases, together with ride-hailing providers.

The data for the American Categorical Inexperienced Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or supplied by the cardboard issuer.

Associated: Frequent Uber or Lyft passenger? These bank cards are for you

Order with Starbucks

The Starbucks Rewards program has misplaced a few of its luster over time, however it has inked partnerships with a pair of journey manufacturers that will make your morning Starbucks run extra rewarding.

This began just a few years in the past with Delta Air Traces, although the partnership was up to date final June. Now, you may earn bonus SkyMiles once you reload $25 or extra to your Starbucks account — as much as 200 miles for a $100 reload.

Final 12 months, Starbucks and Marriott launched a brand new partnership that gives extra bonus alternatives. First, when you make three purchases at Starbucks throughout any Marriott Bonvoy Week, you’ll be able to earn 100 bonus Marriott factors. As well as, any Starbucks purchases you make whereas staying at a Marriott property earn double Stars within the Starbucks Rewards program. Lastly, you’ll be able to convert your Marriott factors to Stars at a ratio of 1,000 factors to 100 Stars.

Neither of those partnerships is value going out of your means to make use of, however when you’re a frequent Starbucks patron, you would possibly as nicely hyperlink your Delta and Marriott accounts.

Associated: The most effective bank cards to make use of at Starbucks

Hire with Airbnb or Vrbo

Make your Airbnb stays extra precious by reserving them by Delta Air Traces’ or British Airways‘ on-line portals. Select a program and click on the reserving button on its devoted Airbnb web page to rack up further miles. You may earn 1 mile per greenback spent by Delta SkyMiles and a pair of Avios per greenback spent by British Airways Govt Membership. So, costly Airbnb bookings can rapidly add as much as award flights.

Alternatively, you’ll be able to earn JetBlue TrueBlue factors in your subsequent Vrbo keep, because the pair launched a brand new partnership final 12 months. This lets members earn 1 level per greenback spent when reserving dwelling leases by Paisly, JetBlue’s web site for nonflight bookings. These purchases additionally rely towards incomes JetBlue Mosaic standing.

As with Uber and Lyft, pay with a journey bank card that earns bonus factors on trip leases to additional maximize your points-earning.

Associated: Ideas for selecting the right seaside home rental

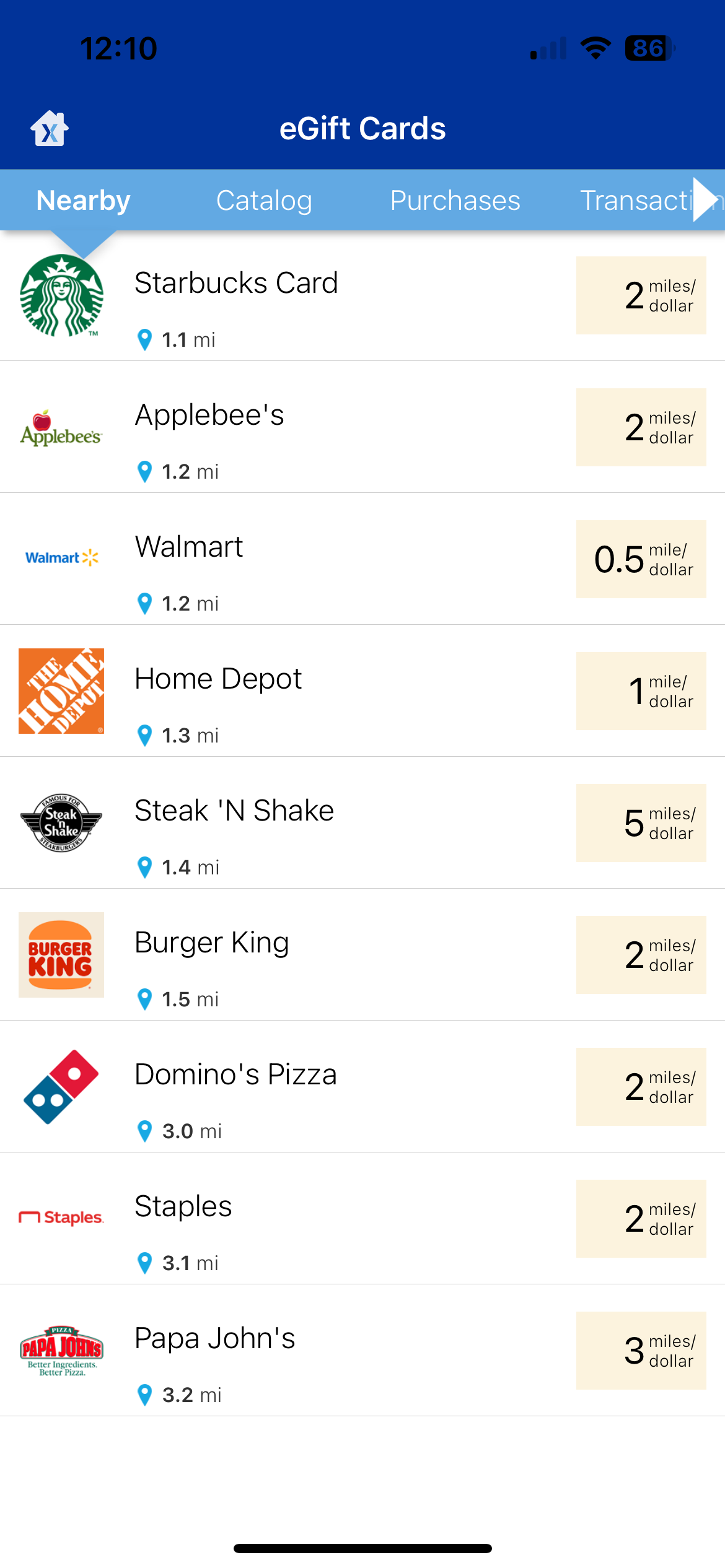

Earn bonus United miles with MileagePlus X

This app offers infinite double-dipping prospects for these trying to rack up United MileagePlus miles. It awards you bonus miles for purchasing digital reward playing cards by the app, which you’ll later use on-line or in individual at retailers and eating places. That is significantly nice for retailers not included in in style bonus classes on bank cards.

The deal is even sweeter for these with a cobranded United Airways bank card, just like the United℠ Explorer Card. If you happen to hyperlink your United card to the app, you may earn a 25% mileage bonus for each reward card you purchase, whether or not or not you employ that card to pay for the acquisition.

The most effective half? With MileagePlus X, you’ll be able to take issues to the following stage for a triple dip. Merely purchase a present card by the app — incomes factors from the app and factors for the transaction in your bank card — after which use that reward card to make a web-based buy whereas using a buying portal. Simply make sure the buying portal you employ does not exclude purchases made with a present card from incomes factors.

Associated: Here is why it issues which card you employ to pay within the United MPX app

Give RewardsPlus a go

Past the MileagePlus X app, you’ll be able to leverage the RewardsPlus program to take pleasure in elevated advantages with United and/or Marriott.

With this program, United Gold (or greater) elite members mechanically obtain Marriott Bonvoy Gold Elite standing, whereas Marriott Titanium Elite and Ambassador Elite members mechanically obtain United Premier Silver standing. After all, it is comparatively straightforward to get Marriott Gold standing with playing cards — together with The Platinum Card® from American Categorical or the Marriott Bonvoy Enterprise® American Categorical® Card. Consequently, top-tier Marriott elite members get the higher finish of this deal. Enrollment is required for choose advantages.

Along with reciprocal elite advantages, all members take pleasure in further miles when transferring Marriott factors to United, no matter standing. Whereas most (however not all) of Marriott’s switch companions provide a 5,000-mile bonus for each 60,000 Marriott factors transferred, United members get 10,000 bonus miles for transferring 60,000 factors. Which means you’ll be able to successfully convert 2 Marriott factors to 1 United mile.

Associated: When does it make sense to switch Marriott factors to airways?

Leverage retail loyalty applications

Whereas they will not get you first-class tickets or luxurious lodge stays, many sports activities retailers, eating places, workplace provide shops and pet provide shops provide loyalty applications that you could maximize when buying. Most of those applications provide you with rewards within the type of future reductions (e.g., spend $100 and get a $5 coupon) on high of the usual earnings you’d get from utilizing your bank card.

A few of the ones I take advantage of incessantly embrace Chick-fil-A One, Jersey Mike’s Shore Factors Rewards and Dunkin’ Rewards — particularly since I can obtain as much as $84 in assertion credit every year at Dunkin’ (as much as $7 monthly; solely at U.S. areas) after I make a purchase order with my Amex Gold card. Enrollment is required.

Associated: Why modifications to the Amex Gold Card made me adore it much more

Bank card gives and reductions

Making use of for a brand new bank card sometimes comes with a giant variety of factors or miles as a welcome bonus (after you meet the minimal spending requirement, in fact). Nevertheless, as soon as you have opened a card, there are a variety of different methods to earn bonus rewards or unlock reductions on on a regular basis purchases.

Many of the main issuers provide a program alongside these strains, together with:

These are focused to every particular person cardholder, and also you sometimes should activate them earlier than making a purchase order. You additionally could discover a number of obscure retailers with whom you haven’t any intention of doing enterprise. Nevertheless, by incessantly checking your on-line accounts, you could possibly discover some good alternatives for bonuses or financial savings.

Here is only a sampling of the gives that TPG staffers at present have on their playing cards:

- An Amex provide to obtain 10% again on insurance coverage purchases, as much as $20

- A Chase provide to earn 30% again on purchases with Dropbox, as much as $30

- A number of Wells Fargo gives to earn 10% again once you spend $100 with a number of Marriott manufacturers — together with AC Inns, Autograph Assortment and Renaissance Inns

- A Citi provide to earn 5% again on Lyft rides

You may as well stack these with most of the different “dips” on this record to create a double dip or triple dip. For instance, you could possibly stack an Amex Supply at a close-by restaurant with a eating rewards program or a web-based buy with a buying portal.

Backside line

There are many nice methods to rack up factors and miles rapidly, however on a regular basis spending typically will get ignored as considered one of them. There are lots of concrete issues you can begin doing immediately that may unlock a world of rewards for tomorrow.

Make these double-dipping efforts part of your general technique, and you will construct your account balances and get a lot nearer to your subsequent award journey.

For charges and costs of the Bilt Mastercard, click on right here.

For rewards and advantages of the Bilt Mastercard, click on right here.