The Chase Sapphire Most popular® Card (see charges and costs) was my first journey bank card. Since I signed up for it in 2016, I’ve flown to locations like London, Istanbul, Mexico Metropolis and Tbilisi, Georgia — all on factors. It is protected to say that my first welcome bonus is lengthy gone.

Once I not too long ago transferred my final 36,000 Chase Final Rewards factors out of my account to e-book two nights on the Hyatt Regency Vancouver earlier than an Alaska cruise this summer season, I felt relatively points-poor.

It might take some time to construct my stability again to “enterprise class to Europe” ranges — even with beneficiant incomes classes like 5 factors per greenback spent on all journey bought via Chase Journey℠, 2 factors per greenback spent on all different journey, 3 factors per greenback spent on eating, choose streaming, on-line groceries and 1 level per greenback on all different purchases.

However then Chase introduced it was elevating the bonus on this card to a record-high 100,000 factors after spending $5,000 on purchases within the first three months of account opening.

I knew I needed to take motion.

Associated: Do not cancel: Find out how to downgrade a Chase bank card

my first step

I had already thought of signing up for the no-annual charge Chase Freedom Limitless® (see charges and costs) since I’ve a number of excessive spending classes (vet payments, ugh) that do not match into any bonus classes for the present playing cards in my pockets.

Along with incomes 3% money again on drugstore purchases and restaurant eating in addition to 5% money again on journey bought via Chase Journey, the Chase Freedom Limitless provides 1.5% money again on all different purchases.

Once I heard concerning the 100,000 bonus, I downgraded my current Chase Sapphire Most popular to the Freedom Limitless as an alternative of signing up for a brand new card. That approach, I might be eligible for a brand new Chase Sapphire Most popular and will earn this historic bonus; in contrast to Amex playing cards, it’s attainable to earn a bonus greater than as soon as on Chase Sapphire playing cards.

Each day E-newsletter

Reward your inbox with the TPG Each day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Take into account that downgrading to the no-annual-fee Chase Sapphire Card (not open to new purposes) would nonetheless disqualify you.

You may have to comply with just a few essential guidelines. This is the step-by-step course of I adopted to downgrade my Chase Sapphire Most popular and join a brand new one for the possibility to earn 100,000 bonus factors.

The data for the Chase Sapphire Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or supplied by the cardboard issuer.

Associated: Playing cards providing welcome bonuses of 100,000 factors or extra

Test which month your earlier bonus hit

In response to Chase’s 48-month rule, you may’t earn a bonus on a Chase card for those who at present maintain that card in your pockets or for those who’ve earned a bonus on that card within the final 48 months. (It is also necessary to know that Chase will not allow you to downgrade a card if you have not held it for no less than 12 months.)

Should you’re questioning, 48 months in the past was Might 2021, proper across the time I used to be getting the primary COVID-19 vaccine.

I’ve solely had one Chase Sapphire Most popular account — which I opened in 2016, lengthy earlier than the pandemic — so I knew I used to be effectively exterior the 48-month rule.

However to double-check, you may scroll again via your statements to see precisely which month your final bonus landed in your account.

Be sure to’re underneath the 5/24 rule

Subsequent up was the 5/24 rule: To ensure that Chase to approve me for a brand new card, I needed to examine that I hadn’t opened 5 or extra private bank cards throughout all banks within the final 24 months.

I used to be assured I used to be effectively underneath the 5/24 rule, however to double-check, I logged into my Experian account to examine my credit score historical past and make sure I had solely utilized for 2 new playing cards up to now two years.

Unfreeze your credit score if frozen

Should you’ve frozen your credit score to stop anybody else from opening up new credit score traces in your title, you have to unfreeze your credit score earlier than making use of for a brand new bank card.

Whereas in my Experian account, I shortly unfroze my credit score in order that after I reapplied, Chase may entry my credit score file. (Chase sometimes makes use of Experian to tug credit score stories, so I did not hassle additionally unfreezing my credit score stories at TransUnion and Equifax, the opposite two credit score bureaus.)

Associated: Find out how to freeze your credit score

Name a Chase agent to downgrade

As soon as I had checked every thing was so as, I referred to as the quantity on the again of my Chase card and requested the agent to downgrade my Chase Sapphire Most popular to the no-annual-fee Chase Freedom Limitless.

The primary time I referred to as round 7 p.m. on a weeknight, there was a 15-minute wait to speak to an agent. Once I referred to as again the subsequent day round midday, an agent answered after just a few rings.

The complete name took six minutes. Along with downgrading me to the Chase Freedom Limitless, the agent confirmed that my Chase Sapphire Most popular annual charge, which I had simply paid in February, could be prorated. Inside a day or so, Chase credited $71.28 again to my account.

The ready sport

Inside moments, my Chase app confirmed the Chase Freedom Limitless card artwork subsequent to my authentic card quantity. Regardless that every thing had transitioned and I not had a Chase Sapphire account inside the app, I made a decision to attend till my new Chase Freedom Limitless card arrived to reapply for a brand new Chase Sapphire Most popular account.

Nonetheless, since it is a limited-time supply ending quickly, I might act on this as quickly as attainable.

Signing up once more

On Friday, April 25, I made a decision I had waited lengthy sufficient and utilized for a brand new Chase Sapphire Most popular. After filling out the brand new card utility, Chase accredited me instantly, and my new card quantity immediately appeared in my Chase app.

Although my new card hasn’t arrived within the mail but, I used to be in a position so as to add it to my Apple Pockets so I may begin charging my subway rides to my new account ASAP and begin incomes 2 factors per greenback spent on journey purchases.

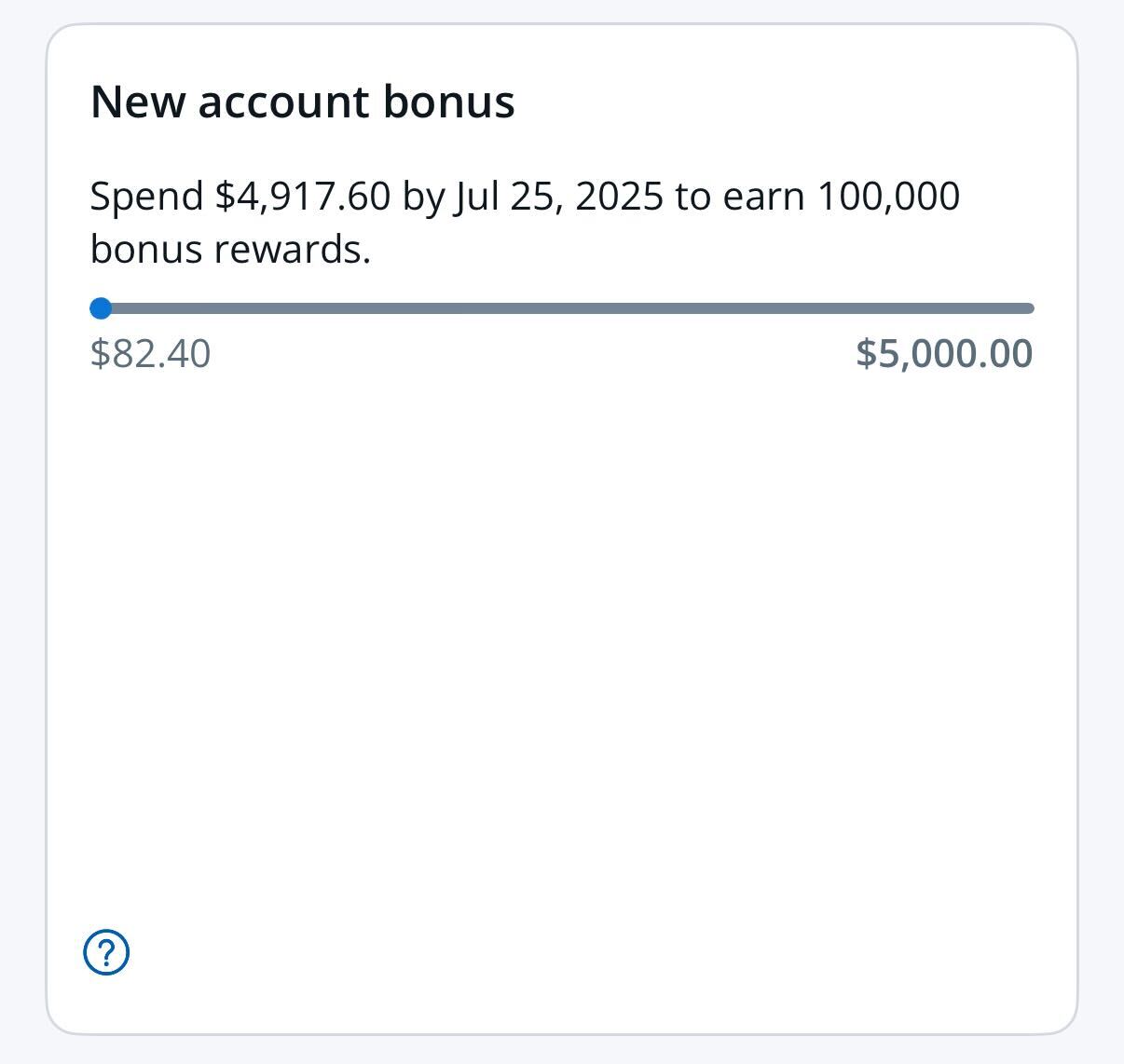

Because of the useful tracker Chase added to my account beneath my new Chase Sapphire Most popular, I can see what I’ve spent towards the $5,000 I have to earn the 100,000 level bonus by July 25.

Backside line

Should you’re desirous to replenish your Chase Final Rewards stability with one other 100,000 factors, it could possibly be value downgrading your Chase Sapphire Most popular to a no-annual-fee card just like the Chase Freedom Limitless so you may reapply for a brand new Chase Sapphire Most popular account and earn the limited-time bonus.

Simply make certain you have not earned a Chase Sapphire Most popular bonus inside the final 48 months and have signed up for fewer than 5 new bank cards with any financial institution within the final 24 months.

Associated:

Apply now: Chase Sapphire Most popular