Traditionally, you may solely redeem Capital One miles at a hard and fast worth. However in 2018, Capital One added switch companions as a further redemption choice for a few of its playing cards. Capital One has since added further switch companions, together with the current readdition of JetBlue TrueBlue.

On this information, we’ll introduce the Capital One switch companions, describe earn Capital One miles after which stroll by means of every of the lodge and airline switch companions so you may determine which of them to be taught extra about.

Capital One switch companions overview

Here is every of the Capital One switch companions and the ratio at which you’ll switch Capital One miles to every associate:

- Aeromexico Rewards: 1:1 switch ratio

- Air Canada Aeroplan: 1:1 switch ratio

- Air France-KLM Flying Blue: 1:1 switch ratio

- Accor Dwell Limitless: 2:1 switch ratio

- Avianca LifeMiles: 1:1 switch ratio

- British Airways Govt Membership: 1:1 switch ratio

- Cathay Asia Miles: 1:1 switch ratio

- Selection Privileges (solely U.S.-based accounts): 1:1 switch ratio

- Emirates Skywards: 1:1 switch ratio

- Etihad Visitor: 1:1 switch ratio

- EVA Airways Infinity MileageLands: 4:3 switch ratio

- Finnair Plus: 1:1 switch ratio

- JetBlue TrueBlue: 5:3 switch ratio

- Qantas Frequent Flyer: 1:1 switch ratio

- Singapore Airways KrisFlyer: 1:1 switch ratio

- TAP Air Portugal Miles&Go: 1:1 switch ratio

- Turkish Airways Miles&Smiles: 1:1 switch ratio

- Virgin Pink: 1:1 switch ratio

- Wyndham Rewards: 1:1 switch ratio

Associated: Cashing in Capital One miles? Easy methods to get the utmost worth when redeeming miles

Easy methods to earn Capital One miles

Some, however not all, Capital One bank cards earn Capital One miles. Here is a abstract of some at present out there playing cards that earn transferable Capital One miles:

| Card | Welcome provide | Incomes charges | Annual charge |

|---|---|---|---|

| Capital One Enterprise Rewards Credit score Card | Take pleasure in $250 to make use of on Capital One Journey in your first cardholder 12 months, plus earn 75,000 bonus miles when you spend $4,000 on purchases inside the first three months from account opening (limited-time provide) | 5 miles per greenback on accommodations, trip leases and rental automobiles booked by means of Capital One Journey

2 miles per greenback on each different buy |

$95 |

| Capital One Enterprise X Rewards Credit score Card | Earn 75,000 bonus miles when you spend $4,000 on purchases inside the first three months from account opening. | 10 miles per greenback on accommodations and rental automobiles booked by means of Capital One Journey

5 miles per greenback on flights and trip leases booked by means of Capital One Journey 2 miles per greenback on all different purchases |

$395 |

| Capital One VentureOne Rewards Credit score Card | Earn 20,000 bonus miles when you spend $500 on purchases inside the first three months from account opening | 5 miles per greenback on accommodations and rental automobiles booked by means of Capital One Journey

1.25 miles per greenback on each different buy |

$0 |

| Capital One VentureOne Rewards for Good Credit score | None | 5 miles per greenback on accommodations and rental automobiles booked by means of Capital One Journey

1.25 miles per greenback on each buy |

$0 |

| Capital One Enterprise X Enterprise | Earn 150,000 bonus miles whenever you spend $30,000 within the first three months from account opening. | 10 miles per greenback on accommodations and rental automobiles booked by means of Capital One Journey

5 miles per greenback on flights booked by means of Capital One Journey 2 miles per greenback on each different buy |

$395 |

| Capital One Spark Miles for Enterprise | Earn 50,000 bonus miles when you spend $4,500 on purchases inside the first three months of account opening | 5 miles per greenback on accommodations and rental automobiles booked by means of Capital One Journey

2 miles per greenback on each different buy for what you are promoting |

$0 introductory annual charge for the primary 12 months, then $95 after |

After getting a card incomes transferable Capital One miles, you may convert money again out of your different Capital One playing cards into transferable miles. So, when you’re seeking to increase your stash of Capital One miles, it is perhaps price pairing one of many above playing cards with a few of our favourite Capital One cash-back playing cards, such because the Capital One Savor Money Rewards Credit score Card.

Associated: The most effective time to use for these standard Capital One bank cards based mostly on provide historical past

Finest Capital One switch companions

Each day E-newsletter

Reward your inbox with the TPG Each day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Air Canada Aeroplan

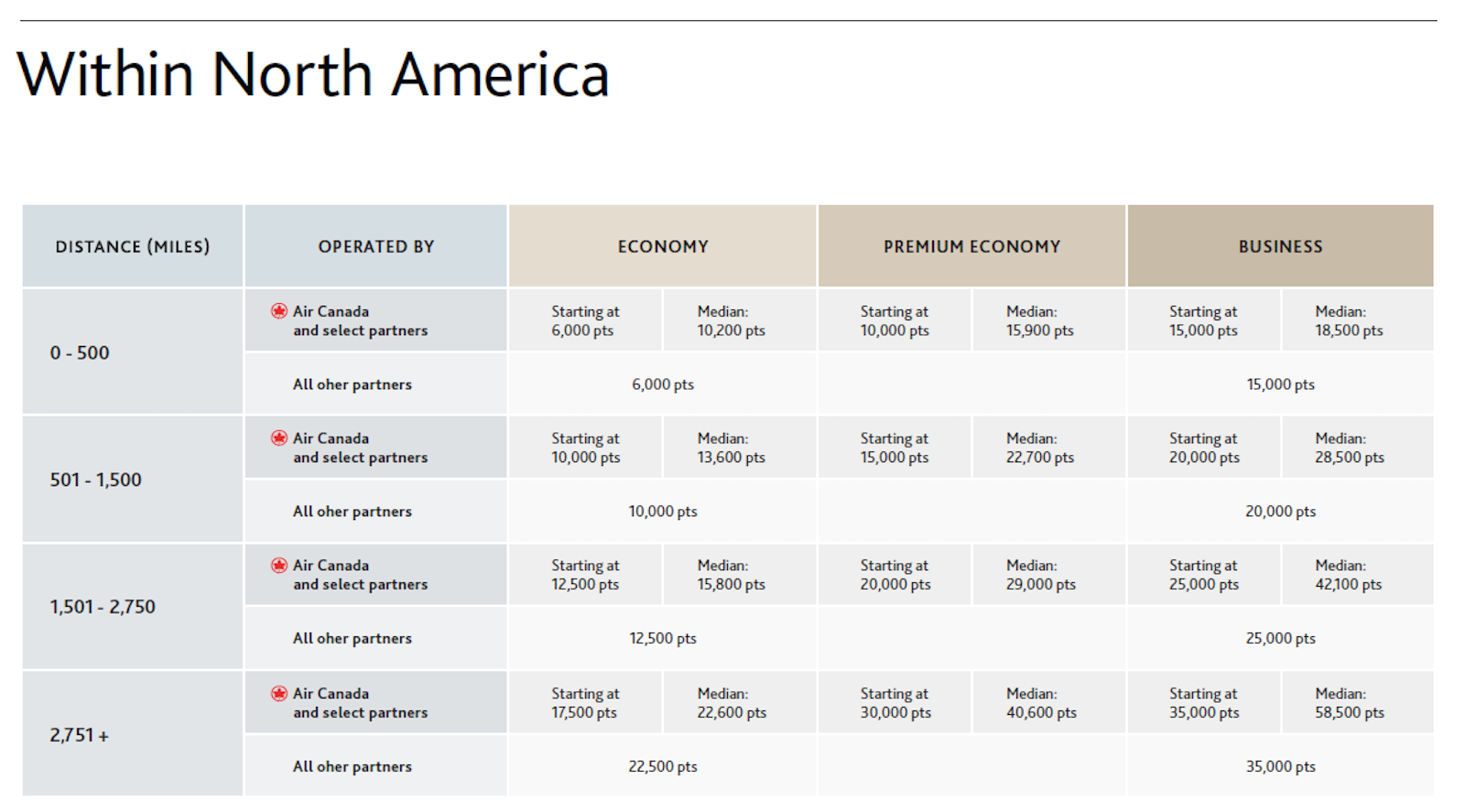

The Air Canada Aeroplan loyalty program noticed vital modifications in 2020. Since then, the Aeroplan award chart has listed award ranges for Air Canada flights and glued charges for many associate awards. Nevertheless, beginning March 25, Aeroplan will use a brand new award chart displaying solely beginning charges for award flights operated by Air Canada and choose companions, together with United Airways, Emirates and Etihad Airways.

Though dynamic award pricing might be constructive in some circumstances, it is more likely to be unfavourable for a lot of vacationers on this case. Nevertheless, we cannot know precisely how unhealthy dynamic pricing for choose companions will likely be till Aeroplan implements it on March 25. You should still discover cases the place a dynamically priced award gives respectable — however doubtless not outsize — worth.

Nevertheless, we’re nonetheless itemizing Aeroplan as a prime switch choice since you should still discover candy spots with Aeroplan companions that use mounted award pricing. Plus, Aeroplan does not move on carrier-imposed surcharges, that means you should utilize this system to ebook Star Alliance award tickets with comparatively low taxes and costs. And based mostly on the Aeroplan stopover coverage, you may ebook a stopover on a one-way award for simply 5,000 factors. However you may have to pay a associate reserving charge of 39 Canadian {dollars} (about $27) per ticket for awards with partner-operated segments.

Associated: You may as soon as once more share Aeroplan factors with as much as 7 relations — this is how

Avianca LifeMiles

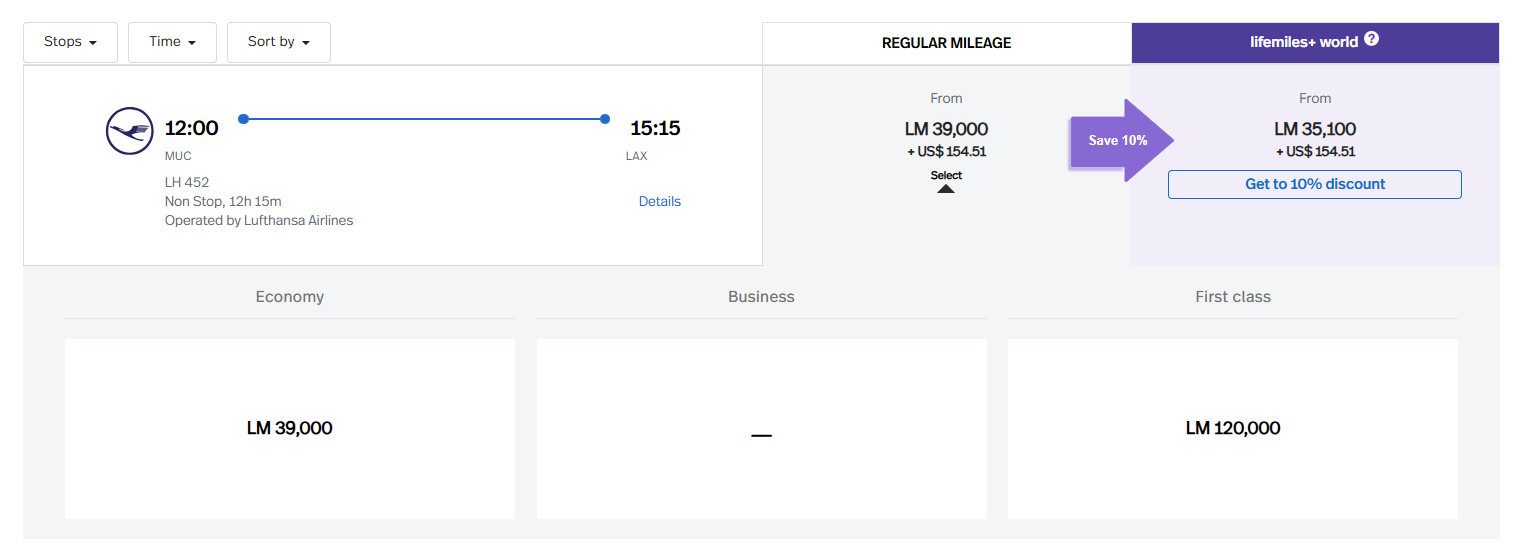

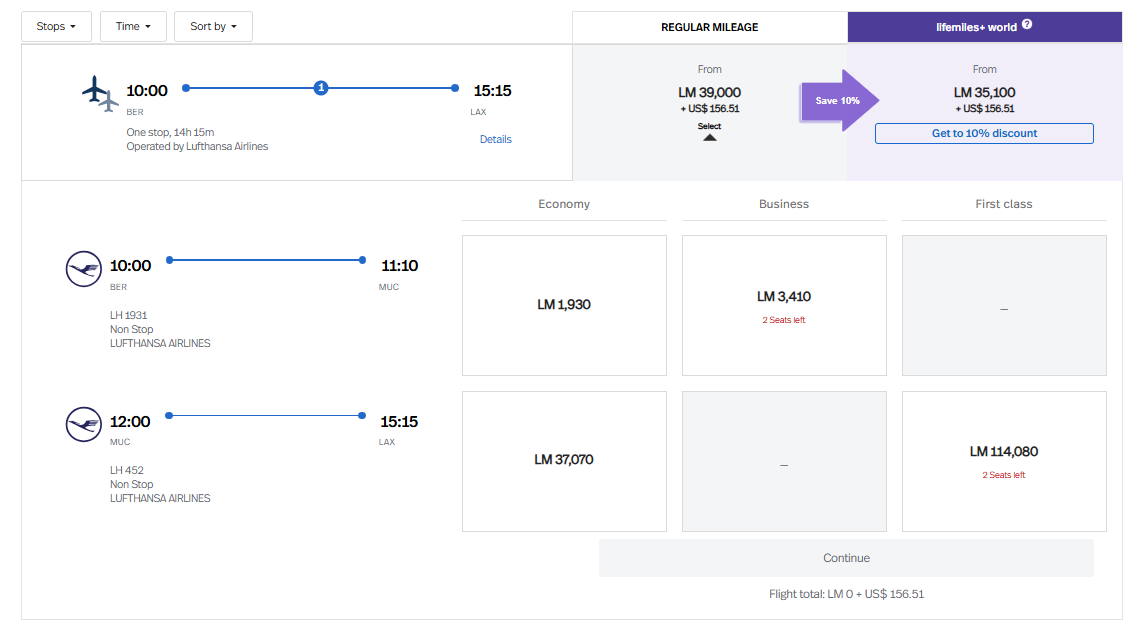

Avianca LifeMiles is thought for providing low-cost redemption charges on Star Alliance associate flights and never passing on gas surcharges on associate awards.

Nevertheless, a number of award pricing will increase during the last 12 months and an rising lack of associate award availability have made the LifeMiles program much less broadly helpful. In August 2024, LifeMiles elevated award costs in all cabins between North America and Europe and in firstclass between North America and Asia. Then in February 2025, LifeMiles elevated costs on many awards — together with one other improve for economic system and business-class awards between North America and Europe.

Avianca LifeMiles can nonetheless be helpful for some awards, similar to flying Lufthansa firstclass. Nevertheless, discovering Lufthansa first-class award house on a particular flight might be tough, so you may normally have to ebook inside a couple of days of departure and be versatile relating to your route and actual journey date.

Due to a beneficiant pricing construction for mixed-cabin awards, you may have the ability to drop that worth even additional. In case you’re flying in long-haul firstclass and connecting to or from one other vacation spot, your connection will doubtless be in a decrease class of service. Avianca refunds you the distinction, that means including a connection could make your flight cheaper.

Avianca LifeMiles may nonetheless be helpful for home journey on United. If yow will discover availability, economic system awards inside the U.S. normally price between 7,500 and 15,000 LifeMiles every means, plus taxes and costs.

Associated: Is an Avianca LifeMiles+ subscription price it?

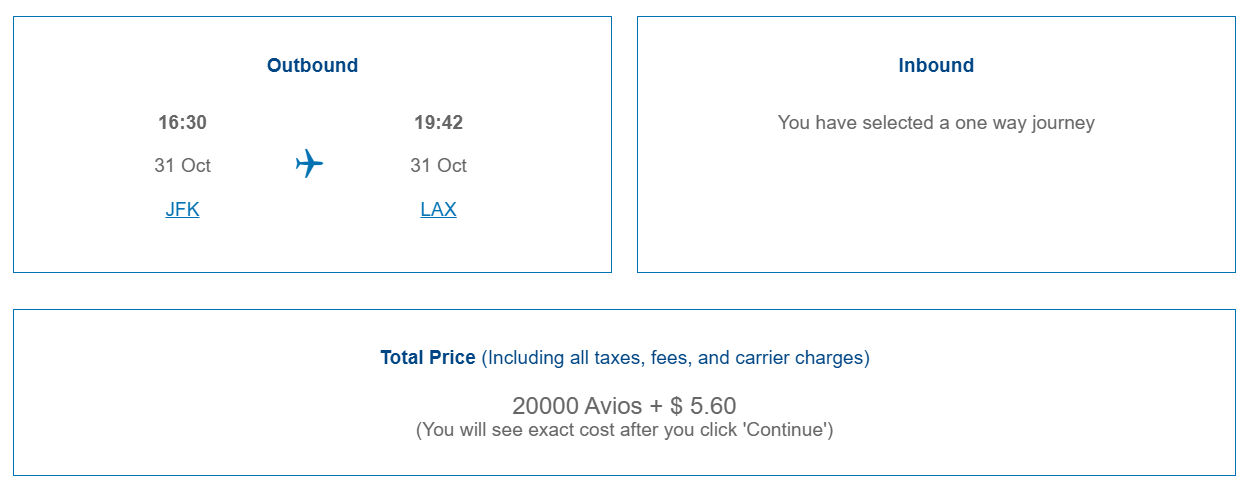

British Airways Govt Membership

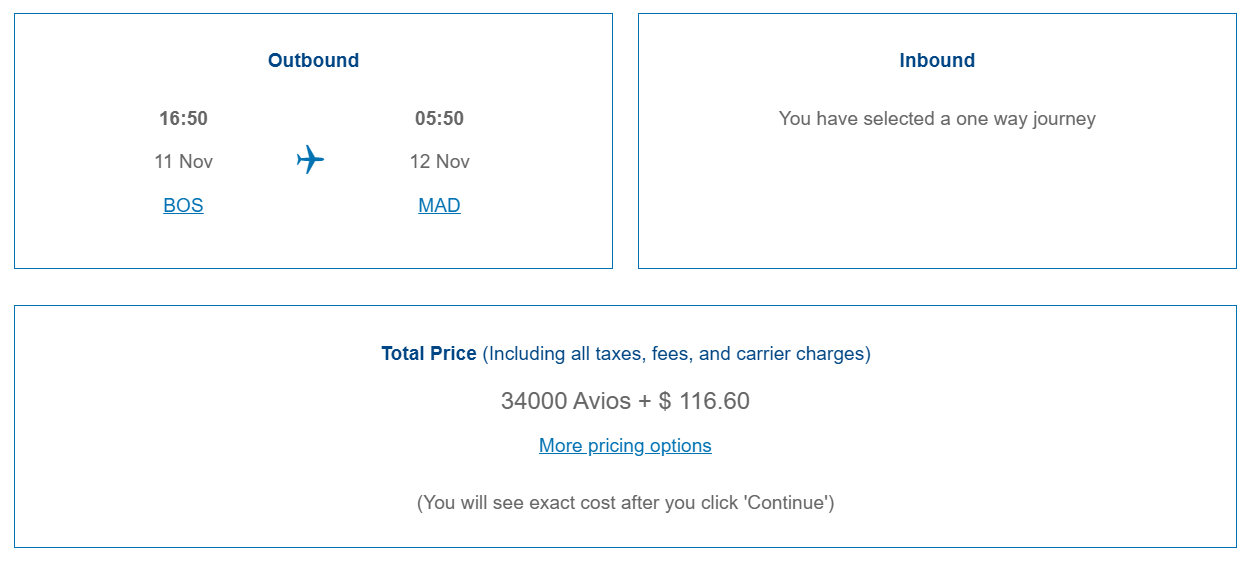

There are numerous the reason why it’s best to care about British Airways Avios. One main motive is the British Airways distance-based award chart. For instance, you may ebook off-peak business-class flights from choose U.S. cities to Madrid or Barcelona for 34,000 Avios plus $117 in taxes and costs one-way.

You too can redeem Avios for American Airways and Alaska Airways award flights. Award charges are a lot greater after a no-notice devaluation in July 2024, however they might nonetheless make sense for some flights.

You too can switch British Airways Avios to Qatar Airways Privilege Membership, Finnair Plus, Iberia Plus and Aer Lingus AerClub, most of which have candy spots you may get pleasure from.

Associated: With 5 airline loyalty applications utilizing Avios, this is why I give attention to British Airways Govt Membership

Turkish Airways Miles&Smiles

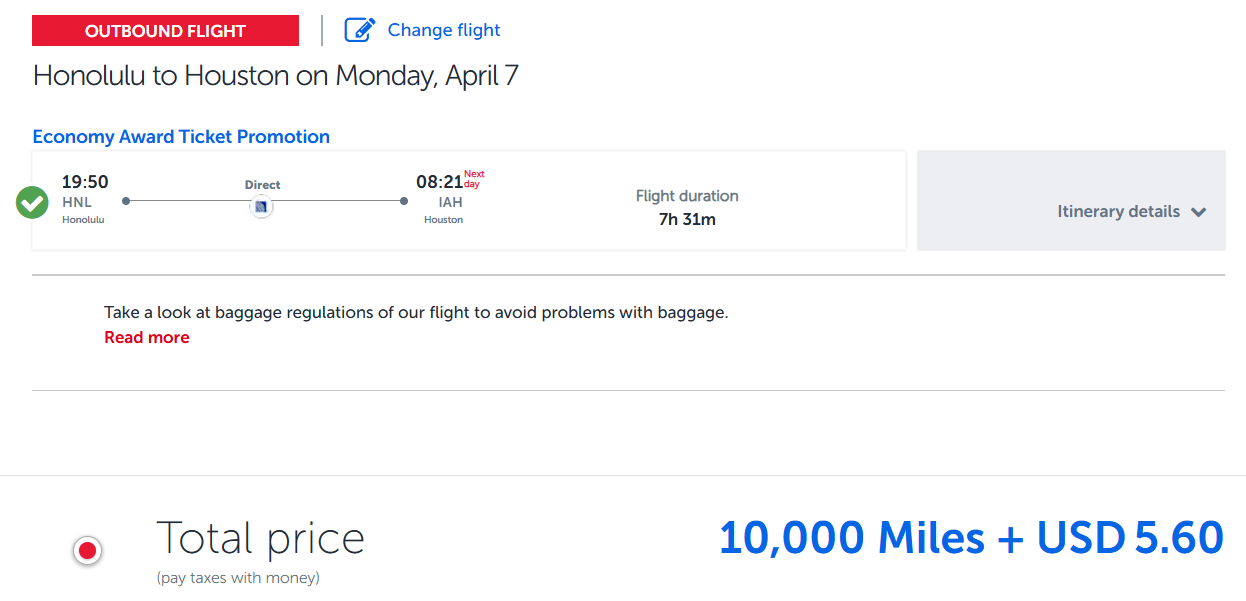

Turkish Airways Miles&Smiles has a lot to like about it. This system nonetheless makes use of award charts and gives an elusive however interesting candy spot: United-operated flights between the U.S. and Hawaii for simply 10,000 miles one-way in economic system.

Gasoline surcharges might be problematic if you wish to fly choose Star Alliance carriers. However you will not be charged gas surcharges on United-operated flights, and gas surcharges are considerably affordable on Turkish-operated flights. You too can typically get good worth when redeeming for Turkish-operated promotional award flights.

Associated: 5 Turkish Airways Miles&Smiles candy spots you should utilize to maximise your transferable rewards

Virgin Pink

Virgin Pink is the loyalty program for the Virgin household of manufacturers. Amongst different issues, you should utilize Virgin factors to ebook flights by means of the Virgin Atlantic Flying Membership program and cruises with Virgin Voyages.

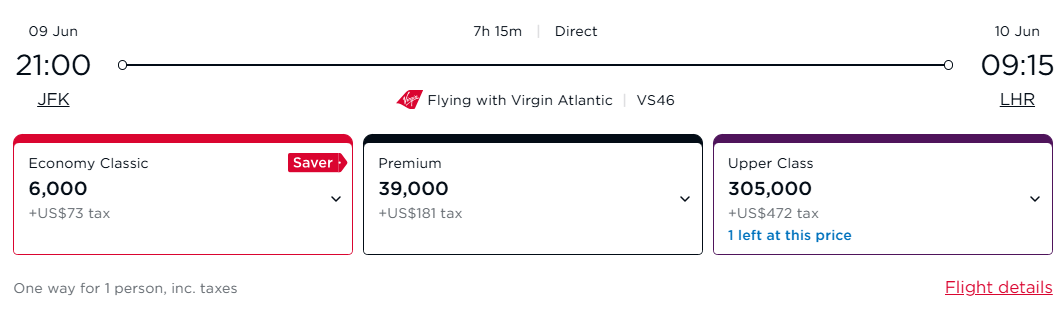

Virgin Atlantic switched to dynamic award pricing for its flights in October 2024, however many vacationers had been proud of the modifications. Flying one-way from the U.S. to Europe in economic system from 6,000 factors plus $73 is fairly superb.

You may nonetheless get good worth when utilizing Flying Membership to ebook partner-operated awards. For instance, you may fly from the U.S. West Coast to Japan in All Nippon Airways enterprise class for 52,500 factors one-way (plus taxes and costs), though you may have to name to ebook. And you may nonetheless get stable worth on some Delta Air Traces-operated awards with Virgin Atlantic Flying Membership.

Associated: Is the Virgin Pink Rewards Mastercard price it?

Mid-tier Capital One switch companions

A number of of Capital One’s switch companions fall into what we’ll name the mid-tier group. These applications can provide stable worth in the best context, however it’s in no way a assure. Run the numbers to your bookings earlier than transferring Capital One miles to those applications.

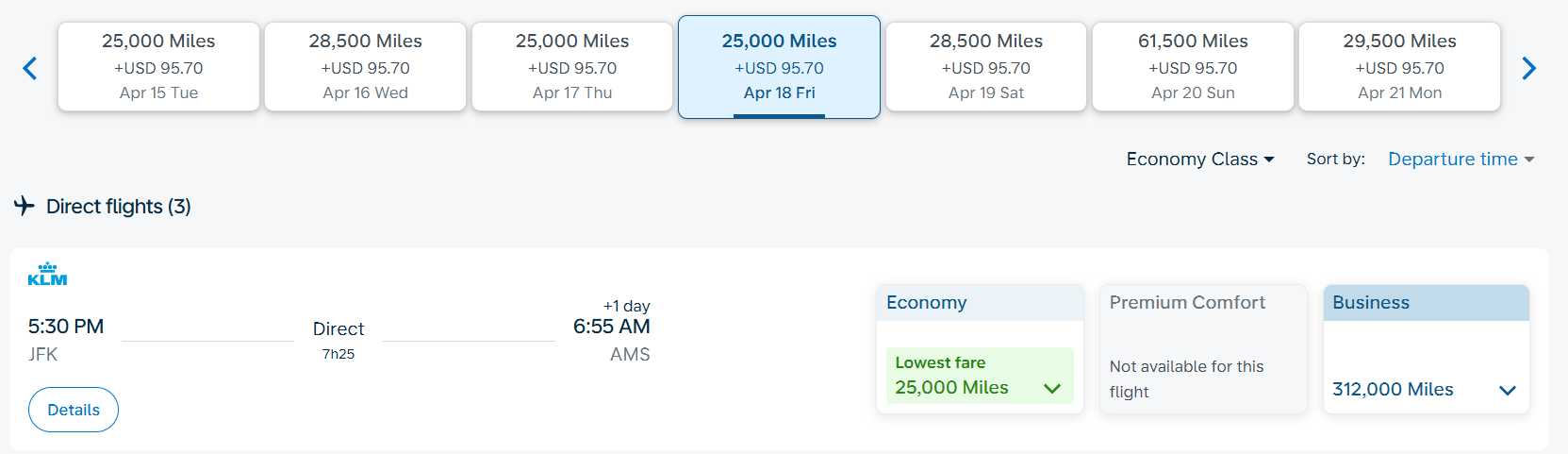

Air France-KLM Flying Blue

Even after the will increase, you should utilize Flying Blue to fly from the U.S. to Europe in economic system beginning at 25,000 miles one-way.

Flying Blue additionally presents month-to-month Promo Rewards that allow you to ebook choose award flights at a reduction.

Associated: Flying Blue stopovers: Lengthen your journey and ebook a further flight at no additional price

Accor Dwell Limitless

Resort chain Accor makes use of a fixed-value redemption scheme in its Accor Dwell Limitless program. So, transferring miles from Capital One will all the time symbolize a stable — although in no way aspirational — worth. Accor Dwell Limitless lets you redeem 2,000 factors for 40 euros (about $42) off of a keep.

Given the two:1 switch ratio, you’d have to switch 4,000 Capital One miles to get $42 off your keep. In the meantime, you may get $40 from the identical 4,000 Capital One miles when you redeemed your miles for current journey purchases utilizing Capital One’s fixed-rate redemption choice. Whereas it is solely a $2 distinction, you may get a barely higher worth by transferring your miles to Accor if you wish to keep at an Accor property.

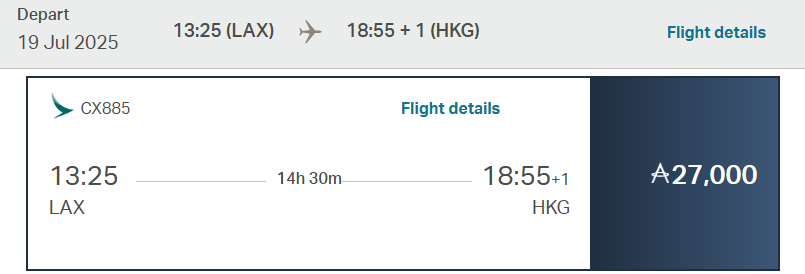

Cathay Pacific Asia Miles

As a result of Cathay Pacific Asia Miles makes use of distance-based award charts, this program might be costly if you wish to fly Cathay Pacific to or from the U.S.

Nevertheless, though the Asia Miles modifications in late 2023 induced many premium-cabin award charges to extend for Cathay Pacific flights, some economic system charges dropped. For instance, you may fly one-way in economic system from Los Angeles to Hong Kong for 27,000 Asia Miles plus 977 Hong Kong {dollars} (about $132) in taxes and costs.

Reserving British Airways flights with Asia Miles might allow you to pay decrease carrier-imposed surcharges. The Asia Miles program may also be helpful if you wish to check out Cathay Pacific firstclass, as Asia Miles typically has entry to extra Cathay Pacific award house than associate applications. Nevertheless, Cathay Pacific first-class award house between the U.S. and Hong Kong is extraordinarily tough to search out proper now.

Associated: 9 superb first-class seats you may ebook with factors and miles

Emirates Skywards

Emirates Skywards might be helpful if you wish to ebook one of many provider’s premium cabins. The award charges aren’t low-cost, particularly after a number of devaluations. However Emirates Skywards is without doubt one of the greatest methods to ebook or improve to Emirates firstclass.

Emirates Skywards additionally companions with a number of different airways, that means you may redeem Emirates miles for flights on choose associate airways.

Finnair Plus

Finnair Plus makes use of Avios as its award foreign money. Nevertheless, not like different Avios applications (which use distance-based charts), Finnair Plus makes use of a zone-based chart. This zone-based chart creates some Finnair Avios candy spots. Plus, you may typically keep away from paying as many surcharges whenever you ebook by means of Finnair as a substitute of British Airways.

Associated: Switch Avios to and from the Finnair Plus loyalty program

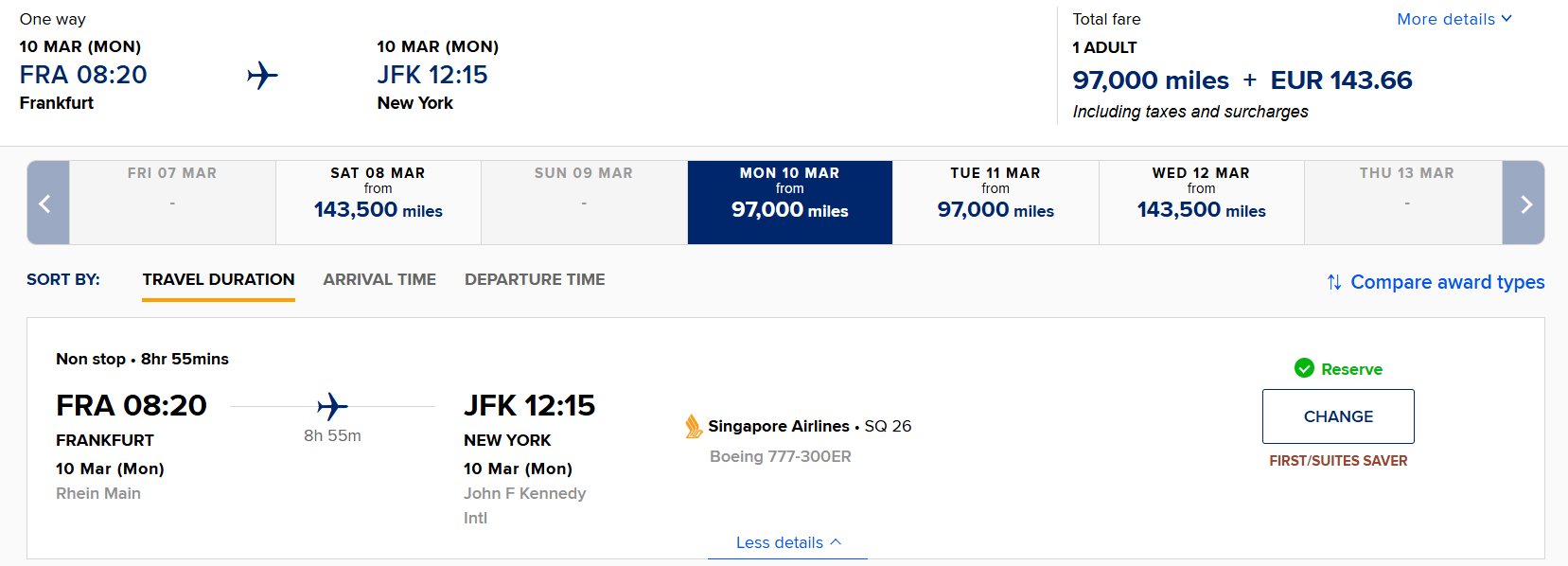

Singapore Airways KrisFlyer

A number of devaluations have marred Singapore KrisFlyer over the previous couple of years. However if you wish to ebook Singapore Suites or firstclass, you may wish to use Singapore KrisFlyer.

You might also usually discover good worth whenever you redeem KrisFlyer miles for Singapore Airways’ Spontaneous Escapes.

Associated: How does Singapore Airways’ KrisFlyer waitlist work for award flights?

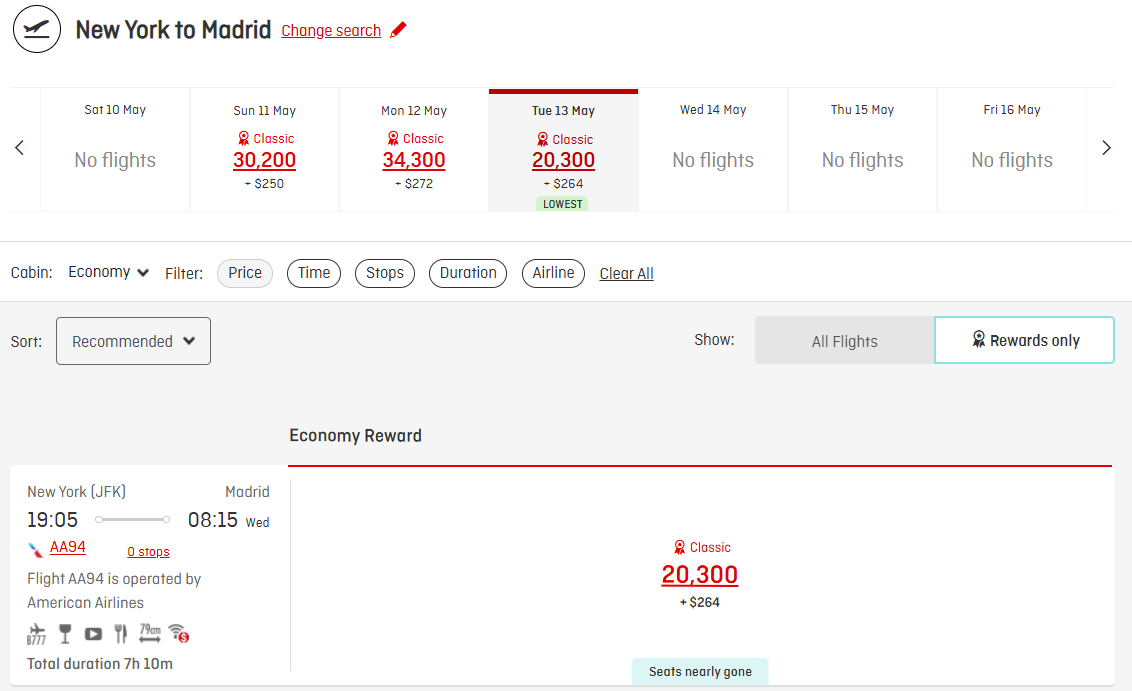

Qantas Frequent Flyer

Qantas Frequent Flyer presents dynamically priced Traditional Plus Rewards for flights it operates. However you may normally get higher worth reserving Traditional Flight Rewards that use distance-based charts.

These distance-based charts imply long-haul flights from the U.S. to Australia are normally prohibitively costly. However you may journey from the East Coast to Europe in economic system for as little as 20,300 factors plus taxes and costs. Nevertheless, the excessive taxes and costs make this feature not very compelling.

The Qantas Frequent Flyer program will endure sweeping modifications on Aug. 5. At that time, we’ll see whether or not this system turns into roughly beneficial.

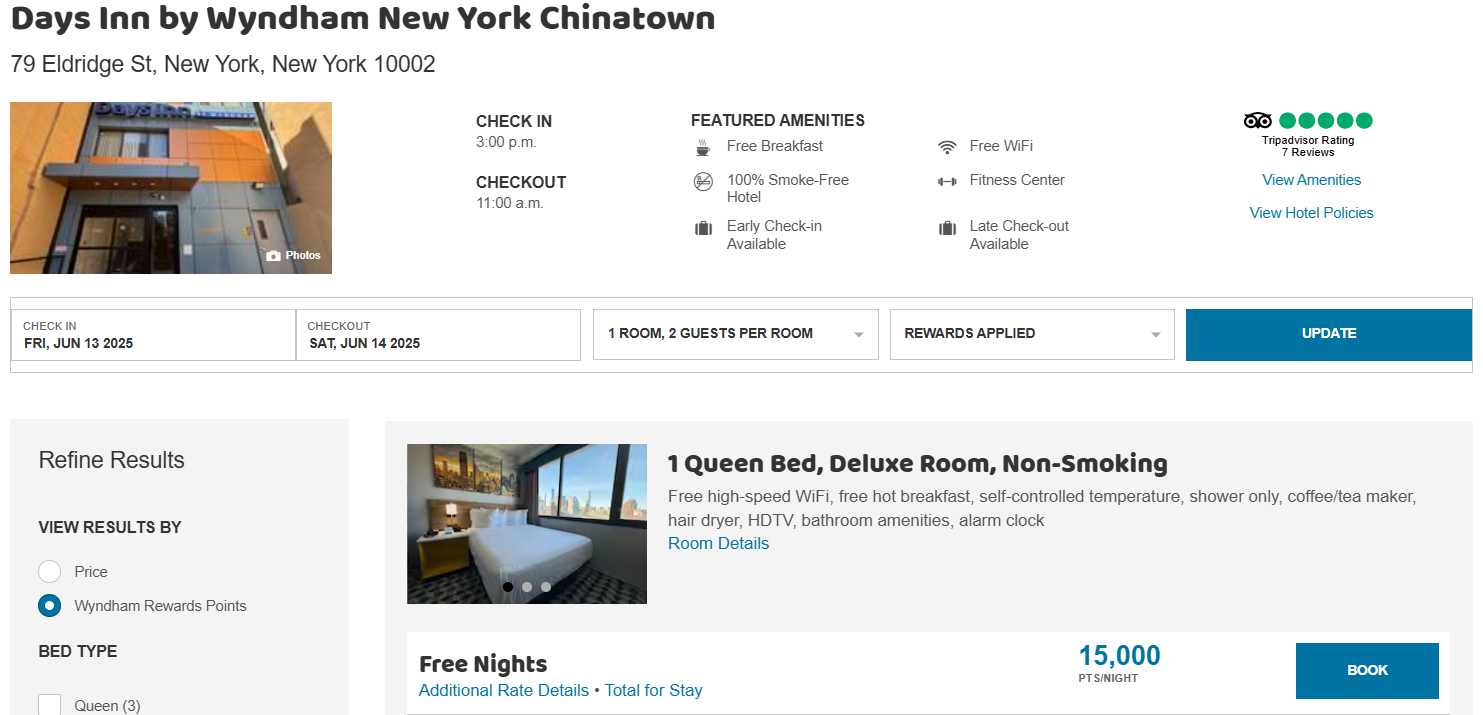

Wyndham Rewards

TPG’s March 2025 valuations solely peg Wyndham Rewards factors at 1.1 cents every. Nevertheless it’s definitely doable to get extra worth when redeeming Wyndham factors.

Utilizing the three-tier Wyndham Rewards award chart for costly nights may provide excessive worth. One instance is the Days Inn by Wyndham New York Chinatown, the place you may ebook a deluxe room with a queen mattress for 15,000 factors per evening.

In case you had paid money for the above evening, the speed would have been $403.97, together with taxes and costs. So, when you booked an award keep on this evening, you’d get a redemption fee of two.69 cents per level. You probably have an eligible Wyndham bank card, you may even get a ten% factors low cost on redemptions free of charge nights.

Associated: The 12 greatest Wyndham accommodations on the earth

Capital One switch companions to keep away from

Between costly award charts, unhealthy switch ratios, hidden charges and applications which are tough to navigate, you may doubtless wish to keep away from a few of the Capital One switch companions. Nevertheless, simply because we do not normally suggest transferring Capital One miles to those applications does not imply they haven’t any redeeming qualities.

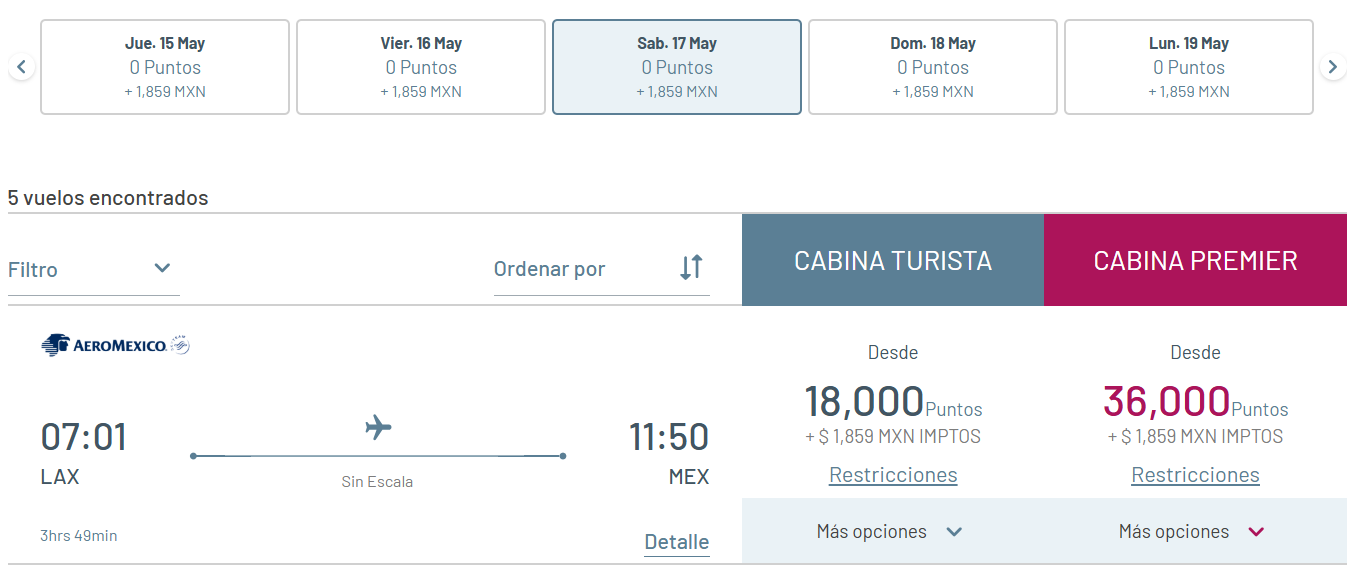

Aeromexico Rewards

Nevertheless, when you seek for award flights on-line, you may usually solely discover Aeromexico-operated flights. Particularly when you take into account the taxes and costs and the reserving charge (even when reserving by means of the web site), the Aeromexico Rewards program usually will not be your only option.

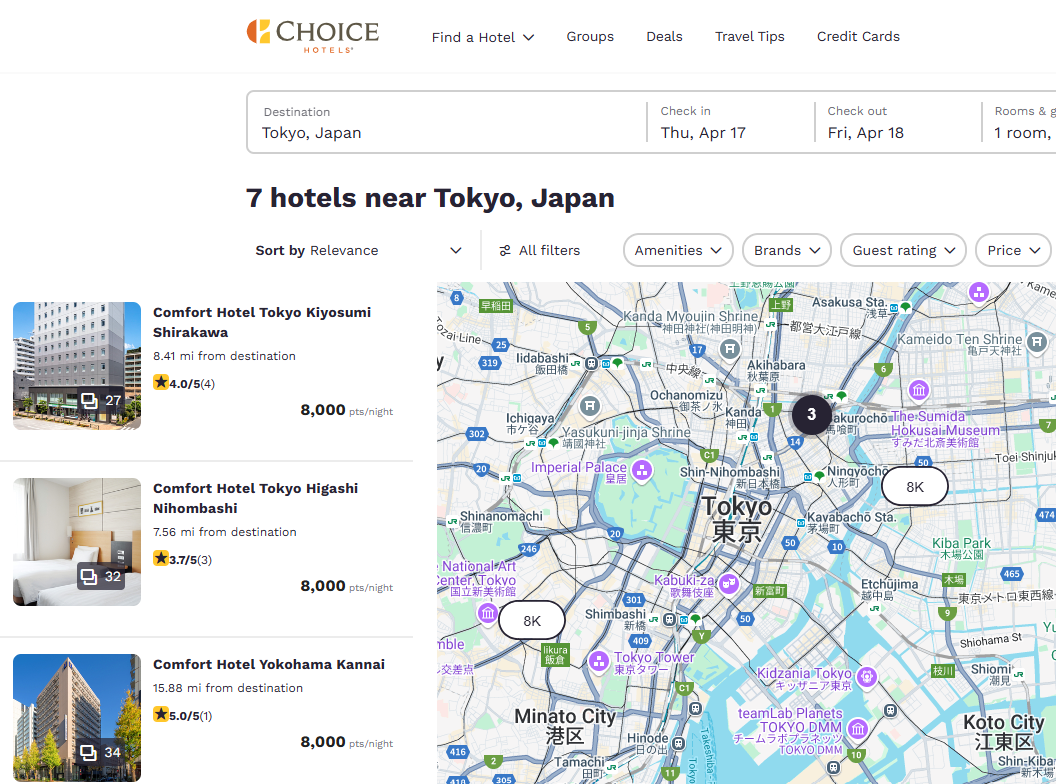

Selection Privileges

You’ll find lots of worth within the Selection Privileges program. For instance, you may ebook nights for 8,000 factors in Tokyo.

However, since TPG’s March 2025 valuations peg the worth of Selection factors at 0.6 cents per level, transferring Capital One miles to Selection Privileges at a 1:1 ratio normally will not make sense. As an alternative, take into account shopping for Selection factors throughout a sale or signing up for a Selection Privileges bank card to earn Selection factors.

Associated: Distinctive methods to redeem Selection Privileges factors

Etihad Visitor

Regardless of not being a member of any main alliances, Etihad Visitor has many companions, together with American Airways and Air Canada. So it will possibly typically be tempting to ebook awards by means of Etihad Visitor.

Nevertheless, Etihad Visitor made some unfavourable modifications in June 2024. And two of those modifications would hold me from transferring Capital One miles to Etihad Visitor. First, Etihad Visitor miles expire after 18 months except you are taking a flight operated by Etihad or a associate airline. Second, award cancellation fees are punitive, with a 25% mileage penalty when you cancel greater than 21 days earlier than departure and a 75% penalty inside seven days of departure.

EVA Air Infinity MileageLands

Capital One already companions with a number of different Star Alliance applications — Avianca LifeMiles and Air Canada Aeroplan — which are normally higher for reserving awards, so there’s hardly ever a motive to trouble with EVA. EVA’s award chart is normally dearer, and this system is commonly tough to navigate.

JetBlue TrueBlue

Capital One not too long ago restored JetBlue as a switch associate. This new switch choice would usually be welcome information, however the 5:3 switch ratio makes JetBlue TrueBlue a poor choice for transferring your Capital One miles.

TPG’s March 2025 valuations peg the worth of JetBlue factors at 1.35 cents every. So, with the 5:3 switch ratio, our valuations estimate you’d solely get 0.81 cents per Capital One mile transferred to JetBlue.

Associated: JetBlue now permits Blue Primary award redemptions — and tickets are as little as 700 factors

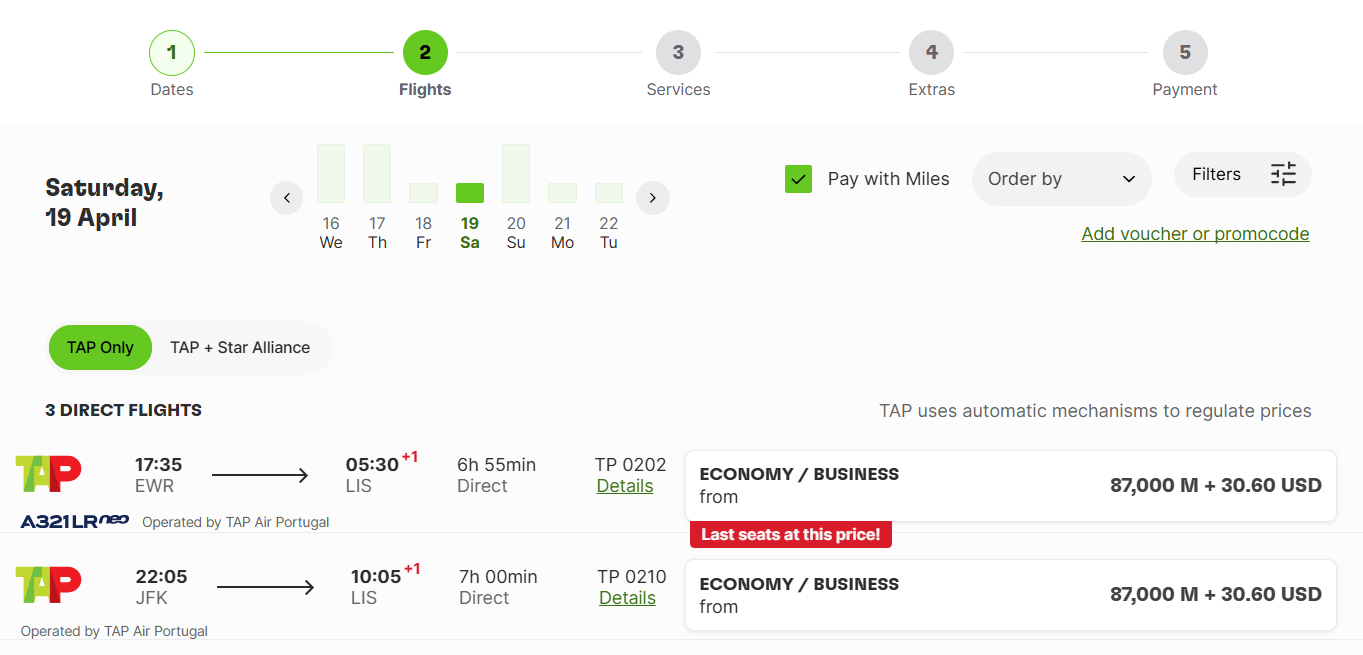

TAP Air Portugal Miles&Go

TAP Miles&Go has award charts. However in observe, you may see different (usually greater) charges whenever you do an award search. For instance, this is the bottom fare for a one-way economic system award flight from New York to Lisbon on a randomly chosen date:

You may sometimes purchase TAP miles for below 1 cent per mile throughout gross sales. So, even if you wish to ebook an award flight utilizing TAP miles, transferring Capital One miles doubtless will not be your only option for incomes TAP miles.

Backside line

Some wonderful Capital One switch companions can virtually single-handedly carry the worth of Capital One miles.

Nevertheless, not each switch associate will present outsize worth, so keep in mind to match the money worth of your ticket or lodge keep earlier than transferring Capital One miles. Generally, shopping for a paid ticket (or keep) after which redeeming Capital One miles at a hard and fast worth to cowl your current journey buy will yield higher worth.