I have been concerned on this planet of factors and miles for over a decade, and never as soon as have I utilized for a cobranded resort bank card. Though this would possibly come as a shock to most individuals, my journey habits simply have not required me to wish one.

Though I journey round 100,000 aeronautical miles a 12 months, I do not keep on with a single resort model and have been very open with the manufacturers I select to remain at. After I e-book a resort, I deal with worth, location and the distinctiveness of the property. This makes me open to all manufacturers, however I have a tendency to finish up at ones and not using a loyalty program.

Listed below are my prime explanation why I have not wanted a cobranded resort bank card, and the way I’ve managed to make it work with the present bank cards in my pockets.

I am not loyal to 1 model

When most individuals consider resort manufacturers, they have an inclination to deal with the three main ones: Marriott, Hilton and Hyatt. These manufacturers have a number of sorts of motels of their portfolios, from finances to extended-stay to high-end properties.

When reserving properties for home or worldwide journeys, I think about numerous components, together with worth, scores, location and facilities.

Sometimes, I am going to find yourself at a Marriott property because it has the most important resort portfolio. However 75% of the time, Marriott motels should not in my location of selection (or on the proper worth level).

An enormous motive why I do not see a necessity for a cobranded resort bank card is that almost all of the properties I keep at don’t have any loyalty ecosystem. These properties embrace 4 Seasons, Mandarin Oriental, Rosewood, Aman and One&Solely.

Fairly frankly, I journey particularly to sure locations as a result of the manufacturers talked about above are likely to have distinctive and splendid properties. These properties present a stage of service, facilities, personalization and high quality that’s arduous to beat, even when staying at top-tier properties with manufacturers that provide cobranded bank cards.

For instance, 4 Seasons has a few of the comfiest mattresses within the trade, a lot in order that it even sells them. I journey with my household usually, and every time these manufacturers see a small baby on the reservation, they virtually at all times present facilities and particular items.

Every day Publication

Reward your inbox with the TPG Every day publication

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

As a result of the resort model I keep at varies, it is extra useful for me to make use of my Chase Sapphire Reserve® (see charges and costs) to earn 3 factors per greenback spent on purchases coded as journey, together with motels. I am going to later redeem these factors for airfare by transferring to one among Chase’s 11 airline companions.

Better of all, the Sapphire Reserve gives a versatile $300 annual journey credit score to use to something that codes as journey, in accordance with Chase, so this credit score can mechanically be utilized to any resort buy. Up to now, I’ve referred to as motels after my $300 credit score has reset and requested the property to cost my Sapphire Reserve $300, immediately utilizing my credit score.

Associated: Chase Sapphire Reserve bank card overview: Luxurious perks and worthwhile rewards

I fear about program devaluations

This will likely come as a shock, however I at the moment maintain Platinum Elite standing within the Marriott Bonvoy program. I earn it organically by paid stays and maximizing Marriott promotions for double elite evening credit or bonus nights after eligible stays.

Marriott persistently runs a double-night promotion from February to April yearly, the place every paid evening earns you a bonus elite evening credit score. With a purpose to earn Marriott Bonvoy® Platinum Elite standing, it’s essential keep 50 nights inside a calendar 12 months. Throughout the double-night promotion, I keep about 15 to twenty nights, which earns me between 30 to 40 nights proper off the bat.

However like airline frequent flyer applications, resort loyalty applications are topic to devaluations. Earlier this 12 months, TPG calculated a drop in worth for Marriott Bonvoy factors towards stays throughout numerous properties worldwide.

By opening a cobranded resort bank card, I’m investing in this system for the long term. I’m tying myself to the resort program by staying virtually solely with that model and utilizing the model’s card for purchases that can give me bonus factors.

The factors earned on a cobranded resort bank card are additionally valued fairly low. For instance, based mostly on TPG’s Might 2025 valuations, Marriott Bonvoy factors are value 0.7 cents every. On the flip aspect, transferable factors from applications like Chase Final Rewards and American Categorical Membership Rewards are value 2.05 and a pair of cents apiece, respectively.

After I first began gathering factors and miles a decade in the past, Marriott had a hard and fast award chart that made it simple to maximise redemptions. The Ritz-Carlton, Dubai Worldwide Monetary Centre, for example, value me simply 200,000 Bonvoy factors for 4 nights over New Yr’s in 2019, thanks, partly, to the fifth evening being free. The identical property this 12 months throughout New Yr’s Eve will run greater than 400,000 factors, a staggering 200% improve in value.

In my expertise, resort program devaluations are far worse than airline program devaluations.

Associated: Marriott Bonvoy has considerably elevated some award prices

Dynamic pricing

At the moment, Marriott and Hilton supply dynamic pricing for redemptions, whereas Hyatt has a set award chart with off-peak, commonplace and peak charges.

Though Hyatt lately shifted motels inside classes for a lot of properties, it’s nonetheless a prime favourite amongst TPG staffers and factors fanatics due to the printed award chart. You may redeem an evening for as little as 3,500 factors (off-peak) or splurge on a Class 8 property for wherever between 35,000 and 45,000 factors an evening. The one draw back is that its international footprint shouldn’t be as giant as different resort manufacturers.

Hilton and Marriott are a completely totally different story. Because of the sheer variety of factors required for stays with these manufacturers, saving up factors for aspirational stays can take fairly a while.

I’ve virtually 800,000 Bonvoy factors from a number of years of resort stays throughout Marriott manufacturers. Each time I’ve considered redeeming them, there was both a change in resort classes or better-priced money charges that have been arduous to move up.

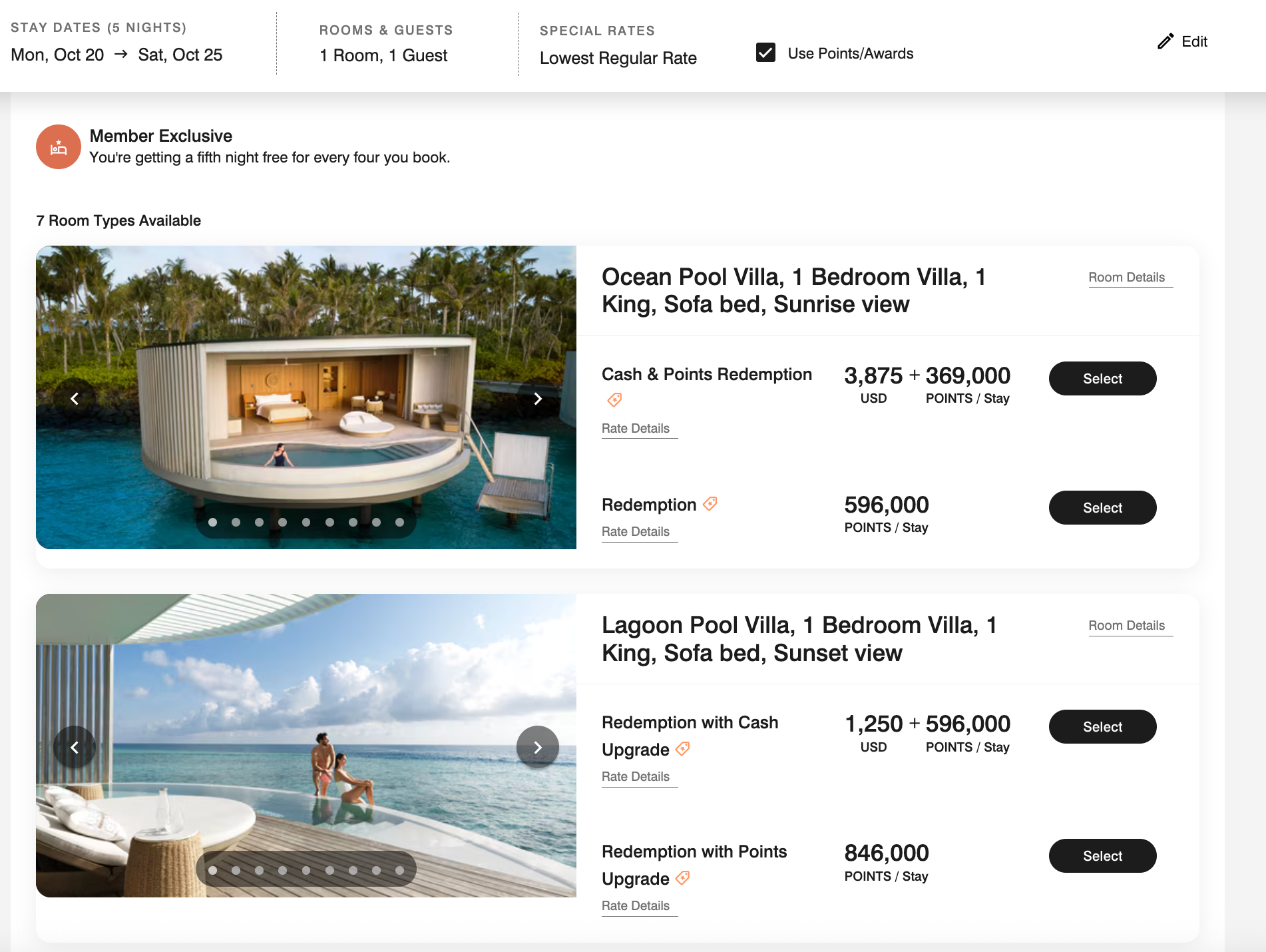

For instance, I have been eyeing The Ritz-Carlton Maldives, Fari Islands for a while now. A five-night keep in an ocean pool villa would value 596,000 factors, whereas an identical keep in a lagoon pool villa would set you again 846,000 factors. Each choices nonetheless require a money copay of over $2,000 for seaplane transfers and a few taxes.

The money price for a similar keep in an ocean pool villa can be $11,675, giving us about 1.95 cents a degree in worth, virtually 3 times what Marriott factors are value based mostly on TPG’s Might 2025 valuations. A lagoon pool villa will set you again $13,206, providing you with about 1.56 cents per level in worth, in accordance with TPG’s Might 2025 valuations. Though these are good offers, it may take some time for Marriott cardholders to amass that many factors.

If I had a Marriott Bonvoy Sensible® American Categorical® Card and was making an attempt to gather factors solely by resort spending, I might need to accrue $28,380 value of bills at Marriott properties to make the redemption within the Maldives come to life. I got here to that value based mostly on incomes 6 factors per greenback spent on Marriott purchases and incomes a further 15 factors per greenback spent at most properties due to having Platinum Elite standing.

This might give me sufficient factors for the redemption I am on the lookout for, however that is fairly a little bit of spending (effectively above what the room would value cash-wise). To not point out, you may be hit with one other devaluation.

Associated: Keep at these wonderful Ritz-Carltons the world over

I desire incomes transferable rewards

Given how widespread resort program devaluations are, I desire incomes transferable rewards versus factors with a particular model by a cobranded resort card.

My go-to journey bank card is my Sapphire Reserve as a result of it earns 3 factors per greenback spent on purchases that code as journey, together with motels. In response to TPG’s Might 2025 valuations, Chase Final Rewards factors are value 2.05 cents apiece.

Chase Final Rewards factors switch to 11 airline and three resort applications, giving me flexibility when utilizing my factors. I haven’t got to fret about Chase factors being devalued, and barely does an issuer sever ties with a switch companion.

By incomes transferable factors, I can simply switch my factors to airways to expertise merchandise like Qatar Airways Qsuite, Etihad first-class Flats (through Air Canada Aeroplan) or All Nippon Airways’ The Suite.

Not too long ago, Chris Nelson, a bank cards author at TPG, offered a compelling case as to why he by no means pays for his resort stays utilizing a cobranded bank card, and I agree with him.

Due to my Platinum Elite standing, I earn 15 factors per greenback spent at most Marriott properties, giving me a ten.5% return on purchases. Whereas which will look like quite a bit, take into account that in accordance with TPG’s Might 2025 valuations, Marriott Bonvoy factors are value 0.7 cents apiece, which is a couple of third of the worth of Chase Final Rewards factors.

I’ve different methods to get pleasure from elitelike perks

The most important good thing about a cobranded resort bank card is the flexibility to have on the spot elite standing or a pathway to incomes it.

The knowledge for the Hilton Honors American Categorical Aspire card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or supplied by the cardboard issuer.

Some would argue that on the spot top-tier elite standing makes a card value it, however I might argue that the variety of elite members with resort applications makes essentially the most fascinating perks like room upgrades robust to come back by.

I can use elitelike perks with out having a cobranded resort bank card, due to applications similar to American Categorical Effective Inns + Resorts and The Edit by Chase Journey℠. When reserving eligible properties, these applications present breakfast for as much as two visitors, room upgrades, property credit score, early check-in, late checkout and welcome facilities.

One other approach I earn elitelike perks is by utilizing specialty journey companies. These journey companies are a part of distinctive applications with prime manufacturers that provide comparable or higher perks than Amex Effective Inns + Resorts and The Edit and predate these applications.

If a journey company is a 4 Seasons Most well-liked Companion, a Rosewood Elite companion, an Aman companion or affiliated with one other comparable companion program, then you possibly can anticipate distinctive charges, gives and elitelike perks when reserving by it.

On a current journey to Tokyo, I used to be upgraded to a set on the 4 Seasons Resort Tokyo at Otemachi, given a property credit score of $200 and supplied with each early check-in and late checkout. In my expertise, these applications are much more constant at offering perks than resort elite standing.

Associated: 4 Seasons Resort Tokyo at Otemachi: An ultramodern resort in a historic neighborhood

Backside line

It has been almost a decade since I started utilizing factors and miles, and I’m nonetheless and not using a cobranded resort bank card. My want to earn transferable factors and to have flexibility with the manufacturers I select to remain at, plus the excessive factors prices free of charge nights, have saved me from needing one.

General, my journey type and rising curiosity in searching for out manufacturers with out loyalty applications (suppose: 4 Seasons, Mandarin Oriental and Rosewood, amongst others) are the primary drivers for me not getting a resort bank card. Factors-wise, I profit extra from incomes transferable factors, as I have a tendency to make use of them to e-book premium cabin airfare.

Regardless of not having a resort bank card, I nonetheless earn standing with Marriott by paid stays and obtain elitelike advantages by standing or reserving by particular applications with journey brokers. Until there are main unfavourable modifications that come to my transferable rewards bank card, I’ll proceed to be and not using a resort bank card.

Associated: Greatest journey rewards bank cards