The Ritz-Carlton Credit score Card overview

Should you’re after an elevated resort expertise, particularly at Ritz-Carlton motels, the Ritz-Carlton™ Credit score Card is right here to supply Gold Elite standing, an annual free evening reward, club-level room improve certificates and extra. The one technique to get this card is to product change from an current Marriott card, however it’s fairly a course of. Should you’re devoted to finishing up the steps wanted, the cardboard generally is a worthwhile funding. Card score*: ⭐⭐⭐⭐

*Card score relies on the opinion of TPG’s editors and isn’t influenced by the cardboard issuer.

Marriott is the world’s largest resort model, and it has an in depth household of bank cards throughout two issuers, Chase and American Categorical.

Nevertheless, arguably its finest card and the most effective journey rewards playing cards total, the Ritz-Carlton Credit score Card, shouldn’t be out there to new candidates. Regardless of that, there’s nonetheless a manner you may get your arms on it.

This card has a steep annual price of $450, however many advantages may also help offset that price.

To get this card, you need to maintain an eligible Chase Marriott bank card for no less than 12 months. The really helpful credit score rating for the Marriott-Chase household of playing cards is 670, however getting authorised with a decrease rating shouldn’t be unusual.

Let’s leap into whether or not you need to add the Ritz-Carlton card to your pockets.

The data for the Ritz-Carlton Credit score Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

Ritz-Carlton Credit score Card execs and cons

| Execs | Cons |

|---|---|

|

|

Ritz-Carlton Credit score Card welcome provide

The cardboard is closed to new candidates, so there is not any welcome provide.

Every day E-newsletter

Reward your inbox with the TPG Every day publication

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

It is essential to notice that you simply will not be eligible to open the Marriott Bonvoy Sensible® American Categorical® Card if you happen to’ve held the Ritz-Carlton card previously 30 days. Earlier than requesting a change to the Ritz-Carlton card, you may need to take into account opening the Marriott Bonvoy Sensible.

As a part of their bank card technique, a number of TPG staffers carry each playing cards of their wallets.

Eligible playing cards that may be transformed into the Ritz-Carlton card after 12 months of being a cardholder embody the Marriott Bonvoy Daring® Credit score Card (see charges and costs), Marriott Bonvoy Boundless® Credit score Card (see charges and costs) and Marriott Bonvoy Bountiful® Credit score Card. You have to contact Chase to request a product change.

The data for the Marriott Bonvoy Bountiful card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

Because the Ritz-Carlton card is a Visa Infinite card, the Marriott bank card you might be product altering from will need to have a minimal credit score restrict of no less than $10,000. Better of all, since you are not making use of for a brand new card and as an alternative doing a product change, you should not have to fret about Chase’s 5/24 rule or getting a tough pull in your credit score report.

Associated: Are you eligible for a brand new Marriott Bonvoy card? This chart tells you sure or no

Ritz-Carlton Credit score Card advantages

The Ritz-Carlton card has a plethora of advantages that may offer you substantial worth and assist offset the annual price. Its Marriott-focused advantages embody:

- 15 elite evening credit per yr: You may obtain 15 elite evening credit each calendar yr, making it simpler to achieve the next elite standing with Marriott Bonvoy.

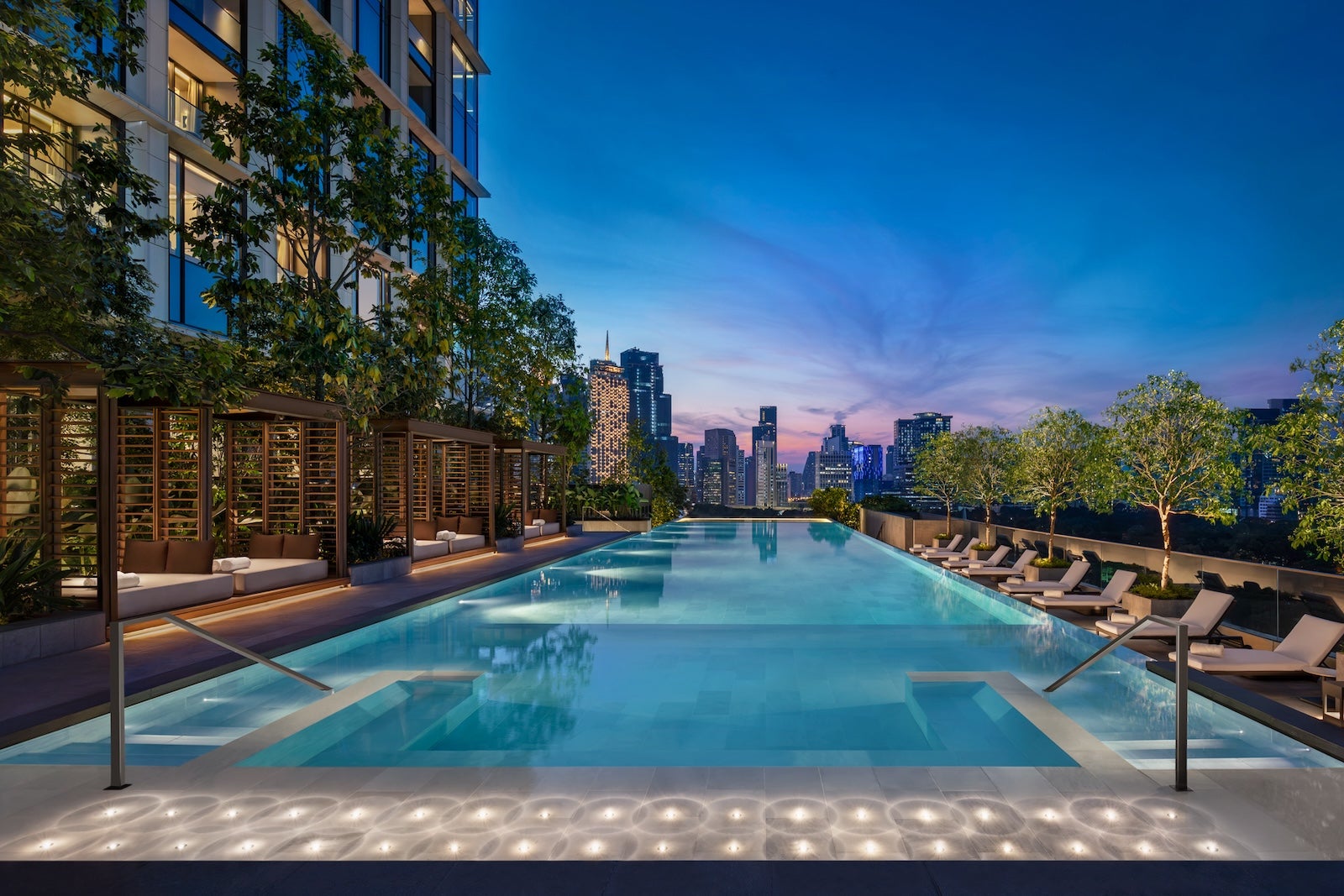

- Annual free evening award: You may obtain an annual free evening award every anniversary yr, price as much as 85,000 factors. Based on TPG’s Might 2025 valuations, 85,000 Marriott Bonvoy factors are price $595, primarily overlaying the annual price. The free evening award could be topped up with an additional 15,000 Bonvoy factors out of your Marriott account. You may get distinctive worth from these awards if you happen to redeem them at luxurious properties in Southeast Asia, like Malaysia’s The Ritz-Carlton, Langkawi.

- Automated Marriott Bonvoy elite standing: You may obtain complimentary Gold Elite standing. Perks embody 25% bonus earnings, 2 p.m. late checkout (when out there), room upgrades (primarily based on availability) and a welcome present upon arrival. You may fast-track your technique to Platinum Elite standing by spending $75,000 on the cardboard on purchases yearly.

- Ritz-Carlton club-level improve certificates: You may obtain three certificates every calendar yr for upgrades to club-level rooms. Every certificates is legitimate for a club-level improve on an eligible paid keep of as much as seven nights. Not all Ritz-Carlton properties have a membership degree. Make sure you examine the Ritz-Carlton web site to see eligible properties.

These are first rate advantages for a cobranded resort bank card, however nothing spectacular. The Marriott Bonvoy Sensible is perhaps a better option, because it supplies Platinum Elite standing and a few elevated advantages, like 25 elite evening credit and the flexibility to earn an Earned Alternative Award every calendar yr.

The Ritz-Carlton card additionally supplies a number of travel-oriented perks that assist scale back journey prices and make your holidays extra gratifying. These advantages embody:

- $300 annual airline credit score: You may obtain an annual $300 airline credit score. The credit score is broadly outlined and can be utilized on purchases like checked baggage charges, inflight Wi-Fi, seat upgrades and lounge entry. This isn’t an automated credit score, and you need to name the quantity on the again of your card and ask Chase to use it to eligible purchases.

- Lounge entry: You may get Precedence Cross Choose membership, which supplies you limitless entry to greater than 1,700 airport lounges worldwide. Distinctive to the cardboard is the flexibility to convey limitless company to lounges. You may even have limitless entry to Chase Sapphire Lounges with limitless visitor privileges. Approved customers additionally obtain a Precedence Cross membership.

- TSA PreCheck/World Entry credit score: You may obtain a $120 assertion credit score for TSA PreCheck or World Entry software charges each 4 years.

- Automotive rental standing, upgrades and reductions: Since this can be a Visa Infinite card, you may obtain Avis Most popular Plus and Nationwide Emerald Membership Government standing. This perk additionally supplies reductions and upgrades when reserving rental automobiles with Avis and Nationwide.

As a Chase Sapphire Reserve® (see charges and costs) cardholder, I discover the Ritz-Carlton card’s lounge entry, automobile rental elite standing and TSA PreCheck/World Entry credit score to be fairly much like what the Sapphire Reserve already provides.

The principle distinction is that the Sapphire Reserve supplies a versatile $300 credit score that can be utilized towards something that codes as a journey buy. It is a enormous perk for me, because it permits me to make use of the credit score on quite a lot of journey purchases.

Better of all, as a Visa Infinite card, the Ritz-Carlton card comes with the next journey protections:

- Major automobile rental insurance coverage: You are eligible for major collision insurance coverage that gives reimbursement of as much as $75,000 for theft and injury to rental automobiles within the U.S. and overseas.

- Misplaced baggage reimbursement: Should you or an instantaneous member of the family examine or stick with it baggage that’s broken or misplaced by the airline, you are lined for as much as $3,000 per passenger.

- Journey delay reimbursement: In case your widespread provider journey is delayed greater than six hours or requires an in a single day keep, you and your loved ones are lined for unreimbursed bills, equivalent to meals and lodging, as much as $500 per ticket.

- Journey cancellation/interruption insurance coverage: In case your journey is canceled or lower brief because of sickness, extreme climate or different eligible lined conditions, you could be reimbursed for as much as $10,000 per particular person and as much as $20,000 per journey in your eligible journey bills.

- Baggage delay insurance coverage: In case your baggage is delayed over six hours, you’ll be able to obtain as much as $100 a day for as much as 5 days for important purchases like toiletries and clothes.

Further advantages for you embody entry to J.P. Morgan Premier Concierge, no international transaction charges and the flexibility so as to add approved customers for no extra price. The journey protections are equivalent to these of the Sapphire Reserve, however the upside of the Ritz-Carlton card is the choice so as to add approved customers for no extra price.

Associated: Greatest Marriott motels on this planet

Incomes factors on the Ritz-Carlton Credit score Card

Ritz-Carlton cardholders earn 6 factors per greenback spent on Marriott purchases; 3 factors per greenback spent on eating at eating places, automobile leases and airfare booked immediately with an airline; and a couple of factors per greenback on all different purchases.

Plus, due to the cardboard’s automated Marriott Gold Elite standing, you may earn 12.5 factors per greenback spent on Marriott stays, for a complete of 18.5 factors per greenback spent on Marriott stays. You may earn much more in case you have the next elite standing.

Based mostly on TPG’s Might 2025 valuations, this equates to a return on spending of no less than 12.9% on Marriott purchases; 2.1% on eating, automobile leases and airfare; and 1.4% on all different purchases.

Though the Ritz-Carlton card’s incomes potential appears pretty excessive, the low worth of Marriott Bonvoy factors performs an enormous issue. Based on our valuations, Marriott Bonvoy factors are price 0.7 cents every. That is almost thrice lower than Chase Final Rewards factors, for instance, that are price 2.05 cents apiece (in accordance with our valuations) and switch to Marriott at a 1:1 ratio.

In comparison with the Ritz-Carlton card’s 2.1% return on eating purchases, the Sapphire Reserve provides you a 6.1% return, for instance.

Provided that, it is price contemplating whether or not making eating purchases and reserving automobile leases and airfare on the Ritz-Carlton bank card is the easiest way to construct your factors stability. If Chase is not your most well-liked issuer, playing cards just like the American Categorical® Gold Card and the Bilt Mastercard® (see charges and costs)* provide higher returns in your spending for sure bonus classes than this card. They, too, earn factors that switch to Marriott at a 1:1 ratio.

That mentioned, it may very well be price it to place Marriott purchases on the Ritz-Carlton card to maximise earnings in that class.

*TPG’s Brian Kelly is a Bilt adviser and investor.

Associated: Your full information to incomes Marriott Bonvoy factors

Redeeming factors on the Ritz-Carlton Credit score Card

There are a number of methods to redeem Bonvoy factors on the Ritz-Carlton card. You may redeem them for resort stays, airline tickets, automobile leases, cruises, present playing cards and merchandise.

Redeeming your factors for resort stays usually supplies the very best worth. Marriott has greater than 9,000 properties in 142 international locations unfold among the many 30-plus manufacturers in its portfolio.

I’ve discovered that Marriott factors provide the very best worth for redemptions in locations just like the Center East or Asia. Just lately, TPG bank cards author Chris Nelson redeemed 47,000 Bonvoy factors an evening for a keep on the JW Marriott Lodge Beijing.

You can too use Marriott’s Keep for five, Pay for 4 perk, which lets you get your fifth evening free when redeeming factors for 5 consecutive nights on a single reservation on the identical resort.

This profit provides you the most cost effective award evening free of charge for each 5 consecutive nights. That is robotically utilized when reserving, so it requires no additional effort and is an effective excuse to increase any resort keep by one extra day.

Associated: 8 locations to maximise an 85,000-point Marriott award evening certificates

Transferring factors on the Ritz-Carlton Credit score Card

Marriott Bonvoy factors earned through the Ritz-Carlton card could be transferred to Marriott’s 39 airline companions, equivalent to United Airways MileagePlus, American Airways AAdvantage and Southwest Airways Speedy Rewards.

Whereas that is usually not the easiest way to redeem Marriott Bonvoy factors, there are occasions when transferring Bonvoy factors to airline companions might make sense.

Most companions enable transfers at a 3:1 ratio and provide 5,000 bonus factors for each 60,000 Bonvoy factors you switch. Because of Marriott’s most well-liked partnership with United Airways, you may obtain a bonus 10,000 miles for each 60,000 Bonvoy factors you switch whenever you’re a United MileagePlus member.

I’ve amassed almost 800,000 Bonvoy factors, and transferring them to an airline is one thing I am considering. The motels and journey dates I have been eyeing have me second-guessing whether or not utilizing my Bonvoy factors for motels is a worthwhile redemption.

It is essential to notice that transfers can take three to 4 days, so if you happen to’re trying to e-book an award flight with a associate airline, make sure that there’s loads of availability.

Associated: Marriott Bonvoy: Find out how to earn and redeem factors, elite standing and extra

Which playing cards compete with the Ritz-Carlton Credit score Card?

Should you’re not a Marriott loyalist, there are another playing cards you may need to take into account as an alternative of the Ritz-Carlton card.

- Should you want Hilton: The Hilton Honors American Categorical Aspire Card is Hilton’s prime card; it has a $550 annual price and provides many related advantages to the Ritz-Carlton card, together with varied assertion credit, an annual free evening reward and automated elite standing. This card additionally has higher returns on bonus class spending. To be taught extra, learn our full overview of the Hilton Amex Aspire.

- If you wish to earn transferable factors: The Chase Sapphire Reserve comes with a $550 annual price and provides related advantages to the Ritz-Carlton card. It earns Chase Final Rewards factors as an alternative of Marriott Bonvoy factors and has entry to Chase’s spectacular roster of switch companions, together with Marriott. It has strong incomes charges on eating and journey and comes with advantages like lounge entry, an annual journey credit score, a TSA PreCheck/World Entry credit score and quite a few journey protections. To be taught extra, learn our full overview of the Sapphire Reserve.

- If you need a lower-annual-fee Marriott card: The Marriott Bonvoy Boundless has a $95 annual price and comes with a free evening award and Silver Elite standing, making this card straightforward to maintain yr after yr. Nevertheless, it lacks lots of the premium advantages discovered on the Ritz-Carlton card. To be taught extra, learn our full overview of the Bonvoy Boundless.

The data for the Hilton Honors Aspire card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

For added choices, take a look at our full listing of the very best resort bank cards and the very best Marriott bank cards.

Associated: Is the Chase Sapphire Reserve well worth the annual price?

Is the Ritz-Carlton Credit score Card price it?

Should you’re like me and keep at Ritz-Carltons or different Marriott properties, then this card is unquestionably price having in your pockets. The annual free evening award, on-property advantages, elite standing advantages and varied credit give it strong worth. However if you happen to don’t remain at Marriott properties usually or want incomes transferable factors for extra versatile redemptions, then I say this card shouldn’t be the precise match for you.

Backside line

The Ritz-Carlton card could be a wonderful addition to your pockets. With nice perks like a free evening award, $300 journey credit score and Ritz-Carlton club-level improve certificates, its $450 annual price generally is a worthwhile funding.

Though I’ve Marriott Platinum Elite standing via paid stays, I am unsure how a lot worth I can get from this card aside from the elite evening credit. My foremost journey card, the Sapphire Reserve, supplies many overlapping advantages. If in case you have a premium card just like the Sapphire Reserve, make sure that to match advantages to see how a lot worth the Ritz-Carlton card actually brings to your pockets.

If in case you have your eyes set on Marriott elite standing and at the moment haven’t got a card that gives lounge entry or journey assertion credit, the Ritz-Carlton card is an effective choice. Remember you can solely make a product change to this card if you happen to’ve held an eligible Marriott Bonvoy card for no less than 12 months.

Associated: How to decide on a resort bank card

For charges and costs of the Bilt Mastercard, click on right here.

For rewards and advantages of the Bilt Mastercard, click on right here.