Whereas it is fantastic to redeem your factors and miles for journey preparations, resembling lodging and flights, there may be many different bills concerned in planning a visit, resembling automotive leases, prepare tickets, fuel and campsite charges. Fortunately, utilizing cash-back rewards together along with your factors and miles can prevent much more cash in your subsequent trip.

With that in thoughts, let’s study the often-overlooked Financial institution of America Most popular Rewards® program. On high of the straightforward banking advantages members can count on, consolidating your funds with Financial institution of America may enhance your money again earnings with a few of the greatest Financial institution of America bank cards.

That is as a result of Financial institution of America designed its Most popular Rewards program to incentivize shoppers to maneuver their checking, financial savings, funding and retirement accounts to Financial institution of America and Merrill. The upper your stability of complete belongings with the financial institution, the extra perks you may unlock, together with with its bank cards. Relying in your holdings and the kind of rewards you are seeking to accumulate, it is likely to be time to cease ignoring Financial institution of America Most popular Rewards.

Associated: 5 causes to get the Financial institution of America Premium Rewards bank card

Financial institution of America Most popular Rewards Program overview

To begin, this is a normal overview of this system:

Learn how to qualify for Financial institution of America’s Most popular Rewards Program

To qualify for the Financial institution of America Most popular Rewards program, you should have each of the next:

- An energetic, eligible Financial institution of America checking account

- A 3-month mixed common every day stability of $20,000 or extra in qualifying Financial institution of America deposit accounts and/or Merrill funding accounts

There are 5 Most popular Rewards tiers. You will qualify for every based mostly in your mixed common every day stability:

- Gold: $20,000 or extra in complete belongings

- Platinum: $50,000 or extra in complete belongings

- Platinum Honors: $100,000 or extra in complete belongings

- Diamond: $1,000,000 or extra in complete belongings

- Diamond Honors: $10,000,000 or extra in complete belongings

Every day Publication

Reward your inbox with the TPG Every day e-newsletter

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Whereas not exorbitant, even the bottom degree requires some fairly excessive figures. However do not throw within the towel right away. When you have an emergency fund, a vacation account, a financial savings account and a checking account, combining all these balances might qualify you for a Most popular Rewards tier. When you add in funding accounts, resembling IRAs, chances are you’ll even discover that the Platinum or Platinum Honors tiers are inside attain.

Your stability would not have to originate with Merrill or Financial institution of America to depend towards every threshold. You’ll be able to roll present IRAs and funding accounts over to Merrill or Financial institution of America and instantly use these balances to start establishing a three-month common to spice up your tier. In fact, you will have to think about different issues like account administration charges and out there funding choices to resolve whether or not doing so is an effective choice.

Associated: Learn how to maximize your incomes with the Financial institution of America Premium Rewards card

Learn how to transfer amongst Most popular Rewards tiers

You’ll be able to rise from one rung to the following any month after your common every day stability for the three earlier months reaches the brink for the next tier. When you attain a selected standing degree, you will not have to maintain all of your money within the Financial institution of America basket.

As a substitute, you will keep your Most popular Rewards tier standing for a full yr. For those who not meet the qualification necessities after that yr, you’ve a three-month grace interval to take action. For those who nonetheless do not meet the factors after the three-month grace interval, you will both be moved to a decrease tier or fully lose your Most popular Rewards advantages.

Associated: Is the Financial institution of America Premium Rewards Card definitely worth the $95 annual payment?

Advantages of Financial institution of America’s Most popular Rewards Program

Here is a chart of the 5 Most popular Rewards tiers, together with the related advantages of every:

| Profit | Gold | Platinum | Platinum Honors | Diamond | Diamond Honors |

|---|---|---|---|---|---|

| Bank card rewards bonus | 25% | 50% | 75% | 75% | 75% |

| Financial savings rate of interest booster | 5% | 10% | 20% | 20% | 20% |

| Mortgage perks | $200 origination payment discount | $400 origination payment discount | $600 origination payment discount | 0.250% rate of interest discount (when PayPlan is established) | 0.375% rate of interest discount (when PayPlan is established) |

| Auto mortgage rate of interest low cost | 0.25% | 0.35% | 0.50% | 0.50% | 0.50% |

| House fairness rate of interest low cost | 0.125% | 0.250% | 0.375% | 0.625% | 0.750% |

| No-fee banking providers | Included | Included | Included | Included | Included |

| Free non-Financial institution of America ATM transactions | N/A | 12 per yr | Limitless within the U.S. | Limitless within the U.S. and internationally | Limitless within the U.S. and internationally |

| Merrill Guided Investing payment low cost | 0.05% | 0.10% | 0.15% | 0.15% | 0.15% |

| Overseas forex trade charge low cost (for cellular and on-line orders solely, contains free customary delivery) | 1% | 1.5% | 2% | 2% | 2% |

| Entry to unique way of life advantages | N/A | N/A | N/A | Sure | Sure |

Now, let’s take a better have a look at every of those advantages.

Financial savings Curiosity Charge Booster

That you must have a Financial institution of America Benefit Financial savings account and be an enrolled Most popular Rewards member to take pleasure in this profit. When you have an present financial savings account, it is not going to routinely convert to a Financial institution of America Benefit Financial savings account once you enroll in Most popular Rewards. Be sure you request the conversion when becoming a member of Most popular Rewards.

At Gold, the rate of interest enhance is 5%. That seemingly sounds higher than it’s. In case your rate of interest is 1.00%, a 5% charge booster would improve it to 1.05%.

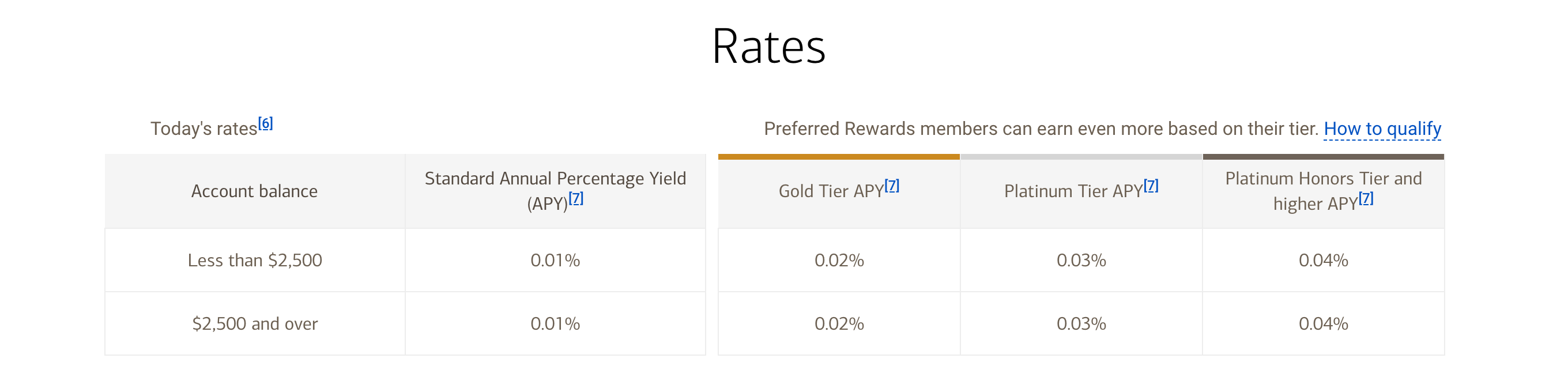

Here is the annual share yield on a Financial institution of America Benefit Financial savings account as of January 2025 to offer you some perspective:

You’ll be able to verify how this enhance would have an effect on the present annual share yield on a Financial institution of America Benefit Financial savings account in your area right here.

Associated: The most effective methods to economize & earn journey rewards for youths

Bank card rewards bonus

Most popular Rewards members earn a 25%, 50% or 75% rewards bonus on choose Financial institution of America playing cards. For bank cards that earn factors or money rewards, you’ll obtain a rewards bonus on each buy.

Your incomes charge is predicated in your Most popular Rewards tier when the acquisition is posted to your account. We’ll get into how this performs out with particular playing cards beneath.

You’ll be able to earn the Most popular Rewards bonus on most Financial institution of America consumer-branded bank cards, together with the Financial institution of America® Premium Rewards® bank card, the Financial institution of America® Journey Rewards bank card, the Financial institution of America® Limitless Money Rewards bank card and the Financial institution of America® Custom-made Money Rewards bank card, amongst others.

Associated: Chase Sapphire Most popular vs. Financial institution of America Journey Rewards — which ought to newbie vacationers get?

Mortgage origination payment discount

Any time you may minimize down on charges for getting or refinancing a house, it’s best to. Most popular Rewards members are eligible to obtain a set discount in one among two methods, relying in your membership tier:

- A greenback quantity off of your origination payment (to not exceed its worth)

- A share off your mortgage APR

The Most popular Rewards payment discount is not transferable. And chances are you’ll not have the ability to mix this payment discount with different reductions.

Associated: Bank card methods for mortgage and residential mortgage candidates

Auto mortgage rate of interest low cost

You will need to full an auto buy finance or refinancing mortgage by way of Financial institution of America to qualify for a charge low cost. This profit isn’t transferable, so solely the Most popular Rewards member can make the most of this perk.

In fact, you will have to make it possible for Financial institution of America provides essentially the most aggressive charge after the low cost. In any other case, it won’t be price pursuing. Even 1 / 4 of a p.c might save or price you 1000’s of {dollars} over the lifetime of the mortgage.

Associated: What is an effective credit score rating?

House fairness rate of interest low cost

You may get a house fairness line of credit score rate of interest low cost of as much as 0.75%, relying in your Most popular Rewards standing degree.

This profit is non-transferable, however you could possibly mix this perk with different dwelling fairness rate of interest reductions. And even co-borrowers are eligible so long as not less than one applicant is enrolled or eligible to enroll.

Associated: Bank card vs. line of credit score: What is the distinction?

No-fee banking providers

Most popular Rewards members additionally take pleasure in a number of banking providers for no payment.

These providers embody:

- ATM/Debit card rush charges

- ATM worldwide transaction payment

- Month-to-month upkeep charges on as much as 4 eligible checking and 4 financial savings accounts from Financial institution of America

- Non-Financial institution of America ATM charges for withdrawals, transfers or stability inquiries

- One overdraft safety switch payment waived per billing cycle

Moreover, Platinum and above incur no charges for incoming worldwide wire transfers and may open a small protected deposit field without cost at a Financial institution of America department.

Associated: Learn how to keep away from ATM charges

Free non-Financial institution of America ATM transactions

Within the U.S. and U.S. territories, Platinum and Platinum Honors members:

- Will not be charged non-Financial institution of America ATM charges

- Will obtain a refund of the ATM operator or community payment for withdrawals, stability inquiries and stability transfers

Platinum members obtain one free transaction per assertion cycle (as much as 12 yearly), and Platinum Honors members don’t have any cap. In the meantime, Diamond and Diamond Honors members have limitless no-fee transactions each within the U.S. and internationally.

Associated: 7 methods to save lots of on abroad ATM withdrawals

Merrill Guided Investing payment low cost

Most popular Rewards members take pleasure in a payment low cost when using Merrill Guided Investing providers. You may get began with as little as $1,000 for Merrill Guided Investing or $20,000 for Merrill Guided Investing with an adviser.

Merrill Guided Investing usually expenses a payment of 0.45% of belongings below administration, and Merrill Guided Investing with an advisor usually expenses a payment of 0.85% of belongings below administration.

Whereas these charges might sound small, they add up over time. As such, these expenses can turn into a compound drain in your investments as they improve. So, it could be greatest to search for a monetary advisor that expenses a set payment as an alternative of a share of your belongings.

Associated: The most effective apps for cash administration

Overseas forex trade charge low cost

All Most popular Rewards members will get some type of low cost for international forex orders by way of on-line banking or the cellular banking app.

Relying in your standing tier, you will obtain a reduction between 1% and a pair of%.

Associated: Every part it is advisable to learn about international transaction charges

Entry to unique way of life advantages

High-tier Diamond and Diamond Honors members will take pleasure in custom-made and distinctive way of life experiences, resembling journey, wellness, occasions, foods and drinks or different private providers. You’ll be able to preview a few of these curated provides right here.

Associated: The most effective bank cards out there now

Learn how to maximize money reward earnings with Financial institution of America bank cards and Most popular Rewards

To maximise the Financial institution of America Most popular Rewards program, you will wish to qualify for not less than Platinum Honors and be eligible for the 75% bonus in your bank card rewards.

In fact, it is not an awesome concept to make huge funding and banking choices based mostly fully on bank card bonuses. Nonetheless, it could be worthwhile should you already plan to put money into Merrill and have an present banking relationship with Financial institution of America. For those who do, listed below are a few of the financial institution’s rewards playing cards to think about and how one can maximize your cash-back earnings.

Associated: How to decide on the very best bank card for you

Financial institution of America Premium Rewards bank card

The Financial institution of America Premium Rewards bank card is a wonderful rewards bank card in its personal proper. But it surely will get much more aggressive once you add within the bonuses from the Most popular Rewards program.

The cardboard expenses a $95 annual payment and provides a modest choice of advantages. For instance, cardholders get an up-to-$100 annual airline incidental payment assertion credit score, a World Entry or TSA PreCheck software payment credit score each 4 years (as much as $100) and a few respectable journey protections.

Nonetheless, this card shines with its incomes charges on on a regular basis spending in addition to journey and eating purchases. Here is how the incomes charges stack up when you think about the Most popular Rewards bank card rewards bonus:

| Spending classes | Common cardholder | Most popular Rewards Gold (25% bonus) | Most popular Rewards Platinum (50% bonus) | Most popular Rewards Platinum Honors, Diamond and Diamond Honors (75% bonus) |

|---|---|---|---|---|

| Journey and eating | 2 factors per greenback spent | 2.5 factors per greenback spent | 3 factors per greenback spent | 3.5 factors per greenback spent |

| Every part else | 1.5 factors per greenback spent | 1.875 factors per greenback spent | 2.25 factors per greenback spent | 2.625 factors per greenback spent |

The flexibility to get not less than 2.625% on all purchases with this card (for high-tier Most popular Rewards members) is unbelievable. This return makes the Financial institution of America Premium Rewards bank card probably the greatest bank cards for on a regular basis spending.

Associated: Financial institution of America Premium Rewards bank card full evaluate

Financial institution of America Journey Rewards bank card

If you wish to keep away from paying bank card annual charges, you possibly can go for the Financial institution of America Journey Rewards bank card. The cardboard earns 1.5 factors per greenback spent on all purchases. Factors may be redeemed to cowl journey bills at a charge of 1 cent per level.

By incomes 1.5 factors per greenback spent on every thing plus a 75% Most popular Rewards bonus as a Platinum Honors (or increased) Most popular Rewards member, you successfully earn 2.625% money rewards towards journey purchases made with the cardboard. That is a improbable money reward charge to earn on all spending — particularly for a card with no annual payment.

Associated: Financial institution of America Journey Rewards card full evaluate

Financial institution of America Limitless Money Rewards bank card

The Financial institution of America Limitless Money Rewards bank card is nice for folk who do not wish to maintain observe of a number of bonus classes however who nonetheless wish to earn at a robust fastened charge on all their purchases. This no-annual-fee bank card earns limitless 1.5% money rewards on all purchases with no restrict.

Platinum Honors and better members would get again 2.625% on all of your purchases — probably the greatest rewards charges any card provides for nonbonus on a regular basis purchases.

Associated: The most effective Financial institution of America playing cards

Financial institution of America Custom-made Money Rewards bank card

One other no-annual-fee card is the Financial institution of America Custom-made Money Rewards bank card. It earns 3% in one of many following classes of your alternative every calendar month:

- Eating

- Drugstores and pharmacies

- Gasoline and electrical car charging stations

- House enchancment and furnishings

- On-line buying (together with cable, streaming, web and telephone providers)

- Journey

It additionally earns 2% again at grocery shops and wholesale golf equipment and 1% again on every thing else. Simply word which you could solely earn 3% and a pair of% on as much as $2,500 in mixed purchases every quarter (then 1%).

So, should you’re not less than a Platinum Honors member, you will earn as much as a whopping 5.25% again in your 3% class. You’d additionally earn as much as 3.5% again at grocery shops and wholesale golf equipment and 1.75% again on all different purchases. That is fairly phenomenal for a no-annual-fee money rewards card.

Associated: Financial institution of America Custom-made Money Rewards full evaluate

Learn how to convert your Financial institution of America factors to money

A number of Financial institution of America bank cards earn straight-up money. However some earn “factors,” which you’ll be able to commerce for money.

To redeem your Financial institution of America factors with a card such because the Premium Rewards card, you will discover a “money” choice inside your on-line account. This lets you request a press release credit score or a money deposit into your Financial institution of America checking or financial savings account (or eligible Merrill Edge and Merrill Lynch accounts) at a charge of 1 cent per level. Word which you could additionally redeem right into a 529 Faculty Financial savings Plan.

Moreover, the Journey Rewards card earns a barely totally different rewards forex. You’ll be able to redeem them as a direct deposit into your Financial institution of America checking or financial savings account or as a credit score into an eligible Merrill Money Administration Account — however you will normally get a paltry worth of 0.6 cents per level. You will solely obtain a price of 1 cent per level when offsetting a travel-related transaction in your card.

Associated: Learn how to redeem factors utilizing the Financial institution of America Premium Rewards card

Backside line

The Financial institution of America Most popular Rewards program might be not price pursuing except you qualify for not less than Platinum Honors to maximise the 75% bonus on bank card earnings.

That mentioned, this system’s perks imply that should you already do enterprise with Financial institution of America or Merrill, it’s best to think about consolidating your banking and investing to spice up your rewards and advantages.

It would even be price switching to Financial institution of America if doing so will not price you something additional. In any case, the Most popular Rewards program can tip the size on a few of Financial institution of America’s high card choices and reward you with important reductions on different banking providers like mortgage and auto loans.

Associated: The last word information to bank card software restrictions