Have you considered paying to your taxes with a bank card however weren’t certain if that was a wise transfer or not? On one aspect, charging your taxes to a rewards bank card might imply you earn money again, factors or miles towards journey. On the opposite aspect, you may incur hefty service charges relying on the quantity of taxes you are charging to a card.

There are many causes you may need to pay your taxes with a bank card, but in addition a number of caveats. Here is what it’s essential know as you take into account your choices.

The top-of-year This fall tax funds from final 12 months had been due by January 15. Subsequently, your subsequent estimated tax funds by means of the remainder of the 12 months sometimes seem like this:

- Tax funds for Jan. 1 by means of March 31 are due April 15

- Tax funds for April 1 by means of Might 31 are due by June 15

- Tax funds for June 1 to Aug. 31 are due by Sept. 15

Though you will often get dinged with service expenses and different charges for utilizing a bank card to pay your taxes, it might nonetheless be worthwhile for just a few causes.

As an illustration, you may have to hit a minimum-spending threshold to earn the welcome bonus on a brand new card or to attain a spending-based perk like elite qualifying miles with an airline card or a free evening award with a lodge card.

Or possibly you’ve gotten a card providing a 0% annual proportion fee on purchases for a sure interval, so you’ve gotten some respiration room to repay your tab.

One of the best bank cards for paying your taxes

The data on the Uncover it Miles and PayPal Cashback Mastercard have been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or authorized by the issuer.

Each day E-newsletter

Reward your inbox with the TPG Each day publication

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Comparability of the most effective bank cards for tax funds

Under, you will discover the final incomes charges for the highest bank cards you may pay your taxes with, together with TPG’s January 2025 valuations of what worth your earned rewards are value.

Remember that the potential return can be primarily based on maximizing the earnings by means of the tactic talked about within the “Caveat” column — although it would not embody the worth of any welcome provide you may earn. We additionally assume a 1.75% charge for paying by bank card (extra on that beneath).

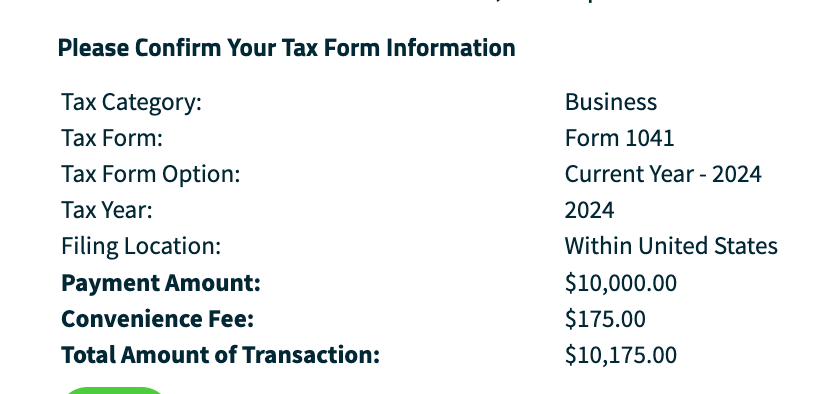

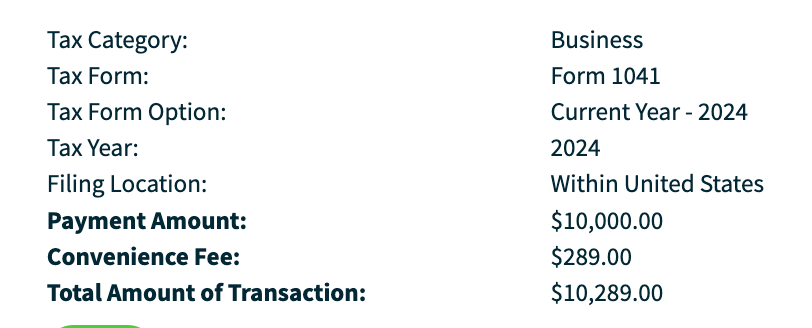

If you happen to can declare your comfort charges as a tax deduction on your small business (converse along with your tax adviser about this chance), your good points can be even better.

Other ways to pay your taxes

If you happen to owe taxes to the IRS, you may select from a number of cost strategies. Most individuals go for one of many following:

- You may make a direct cost out of your checking account, and the IRS will not cost any further charges for such a cost.

- You possibly can wire the cash from a checking account, though this feature often incurs a charge.

- You possibly can mail a examine or cash order to the IRS with none charges except for postage and probably the cash order (relying on the place you get it).

If you happen to want extra time to pay your taxes, you may file for an extension with the IRS or arrange an installment settlement with a cost plan. You’ll, nevertheless, be anticipated to pay penalties and curiosity on that cost plan.

You can even pay your taxes with a debit card. Whereas the charge is minimal, you typically will not earn beneficial journey rewards or money again except you’ve gotten a product just like the Amex Rewards Checking debit card, which earns 1 level for each $2 spent on eligible debit card purchases.

That spending fee plus different situations may imply it is higher to make use of one other Amex Membership Rewards-earning card.

The data on the Amex Rewards Checking debit card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or authorized by the issuer.

Thankfully, the IRS allows you to pay your tax invoice with a bank card by means of a number of third-party cost processors. However be warned: These firms can — and often do — tack on their very own charges to your funds. You possibly can see an inventory of those firms and their comfort charges on the IRS web site.

The price of paying taxes with a bank card

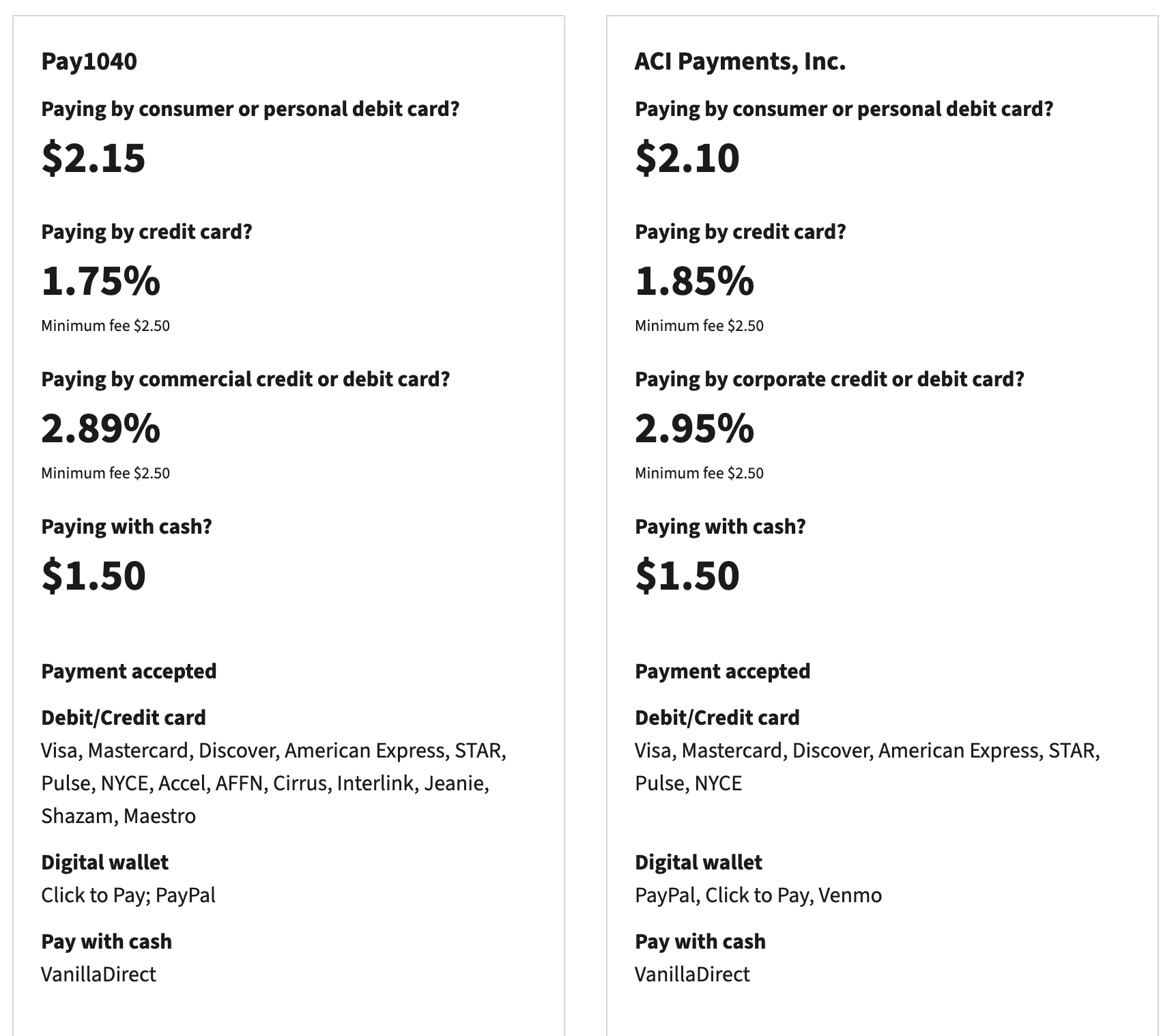

While you use a bank card to pay your taxes, the charge is calculated as a proportion of the quantity paid. There are two cost processors the IRS makes use of for taking bank card funds: Pay1040 and ACI Funds, Inc.

At the moment, these charges vary from 1.75% to 2.89%. So, should you owe $10,000 and need to pay by way of bank card, you will be on the hook for an additional $185 to $289 in charges, relying on the service you employ.

*Regardless of Pay1040 displaying a 1.75% charge on the IRS.gov web site, some TPG and Frequent Miler readers have reported being charged larger charges when utilizing playing cards from some issuers like American Specific. It seems that the 1.75% processing charge applies to client Visa and Mastercard funds. If you happen to use a enterprise bank card or a private or enterprise Amex card, you can be charged 2.89%. TPG bank cards author Chris Nelson examined this along with his Chase Sapphire Most well-liked Card and was proven a 1.75% processing charge. When he tried utilizing his Enterprise Platinum Card from American Specific in addition to his American Specific® Gold Card, he was proven a 2.89% charge.

Moreover, some TPG readers have reported that ACI Funds, Inc. doesn’t settle for enterprise playing cards once they’re used to pay private taxes.

If you wish to pay with a enterprise bank card or Amex card, it is best to make use of ACI Funds Inc, as you can be charged a processing charge of 1.85%.

Causes to pay your taxes with a bank card

Regardless of these surcharges, there are many the reason why paying your taxes with a bank card could make sense.

First, doing so may also help you earn beneficial rewards and provide you with extra time to repay a excessive tax invoice if in case you have a 0% APR provide on a brand new card or are focused for a no-fee, pay-over-time plan. Nevertheless, in case your buy is topic to regular bank card rates of interest, it is best to strongly take into account different choices, as paying your buy off over time could possibly be exceedingly dear.

Listed here are among the instances it is smart to make use of a bank card to your taxes.

Incomes an enormous bank card welcome bonus

Many rewards playing cards lengthen welcome affords value lots of (and typically over $1,000) in money again or tens of hundreds of factors should you spend a certain quantity in your new card inside a particular timeframe.

The one most vital cause to make use of a bank card when paying a large tax invoice is which you could earn a factors windfall out of your preliminary spending with a brand new card. That is as a result of the worth of the factors you earn may also help offset the price of charges for utilizing your card to your taxes.

Some journey rewards playing cards have particularly excessive minimal spending necessities for incomes a bonus, so a tax cost may be simply the factor to place you over that threshold.

You often solely come out forward utilizing a card to pay taxes once you’re making an attempt to qualify for a big welcome provide concurrently you’re incomes rewards at on a regular basis charges. And should you can in any other case hit the minimal spending requirement with out paying taxes with the cardboard (and incurring these charges), it is higher to chop a examine to the IRS.

Earlier than you select to pay your taxes with a bank card, be sure to will pay your card steadiness off in full since, should you do not, you may get hit with curiosity expenses and late charges that rapidly wipe out the worth of any rewards you may earn. Accruing 20% to 25% curiosity in your bank card invoice will simply negate a 3% to 4% return on spending by means of the factors you earn.

Meet a bank card spending threshold

Many bank cards provide advantages that set off after you attain a specific spending threshold. These may be primarily based on the calendar 12 months or your cardmember anniversary, however in both case, making massive tax funds might assist you to earn these rewards when that quantity of spending may be out of vary in any other case. For instance:

With perks like this, placing your taxes on the suitable bank card may also help you earn beneficial extras like a lift towards elite standing, free evening awards and extra.

Spend towards elite standing

A number of bank cards will let you enhance your elite standing — or earn standing outright — by means of spending on a bank card. Placing a big tax cost on considered one of these bank cards might assist you to, similar to the next:

Use a number of playing cards to maximise earnings

When you have a big tax invoice, you do not have to spend all the quantity on one bank card.

The IRS web page explaining bank card funds says you may solely use debit or bank cards to make as much as two funds per tax interval (12 months, quarter or month, relying on the kind of taxes you are paying), however meaning you may use two completely different playing cards to make two completely different funds.

For instance, say that you’ve got a $28,000 tax cost due. You may apply for each The Enterprise Platinum Card from American Specific and the Ink Enterprise Most well-liked® Credit score Card. By placing $20,000 inside three months of approval on the Amex Enterprise Platinum Card, you’d have spent sufficient to earn the 150,000-point welcome provide.

Plus, for the reason that buy is greater than $5,000, you may earn 1.5 factors per greenback spent (as much as $2 million of those purchases per calendar 12 months, then 1 level per greenback thereafter), which suggests you’d earn 30,000 factors on the acquisition itself. Then, you may cost the extra $8,000 steadiness due (inside three months of approval) on the Ink Enterprise Most well-liked and earn its 90,000-point welcome bonus and an extra 8,000 factors for the spending itself (1 level per greenback spent on on a regular basis purchases).

On this state of affairs, you’d find yourself with greater than $6,000 in journey rewards, in line with TPG’s January 2025 valuations. (These figures do not keep in mind the factors you’d earn on the charges you’re charged for paying your taxes with these playing cards.)

Purchase some further time to pay your taxes

One in all TPG’s 10 commandments for incomes bank card rewards is rarely to pay curiosity expenses. It is paramount that you just by no means chunk off greater than you may chew.

When paying your taxes with a bank card, observe when the primary day of your new assertion interval begins on the cardboard you need to use. This manner, you’ll have as much as 30 days till your assertion closes and almost 60 days till you could repay your steadiness in full.

Some bank cards even provide 0% APR for an introductory interval on new purchases, which may present 12 to 18 months of interest-free funds in your tax invoice. You could repay all the steadiness in full earlier than the promotional interval ends or threat exorbitant curiosity expenses.

Lastly, make sure to examine your eligibility for a pay-over-time installment plan, as issuers typically present introductory affords.

For instance, TPG senior editorial director Nick Ewen was focused two years in the past for a no-fee My Chase Plan on his Chase Sapphire Reserve®. For any buy over $100, he might’ve created his first plan by Sept. 30, 2023, and paid no charges and no curiosity over the lifetime of the plan (typically between six and 18 months) — all whereas nonetheless incomes rewards.

This could possibly be a good way to finance a big tax invoice over time with out incurring huge curiosity expenses.

Learn extra: A comparability of the highest ‘purchase now, pay later’ providers — and what to be careful for

The draw back of utilizing a bank card to pay your taxes

Regardless of the advantages listed above, utilizing a bank card to pay your taxes is usually a reckless technique, because the rate of interest on most rewards bank cards can severely damage your funds ought to it’s important to pay it.

If you do not have a no-fee, 0% APR choice and can’t pay your assertion steadiness in full after charging your taxes to a bank card, it is best to rethink utilizing a bank card to pay your taxes.

As a substitute, seek the advice of your tax skilled about your choices. The IRS affords cost plans with decrease rates of interest than most bank cards would lengthen.

Backside line

Paying your taxes with a bank card is usually a profitable technique to earn factors and miles as half of a giant welcome provide. Having a 0% APR card may additionally provide you with extra time to repay the next tax steadiness with out worrying about excessive bank card rates of interest, however be sure to do your individual math to make sure the advantages you obtain are value the associated fee.

The very last thing you need is to be caught paying again your taxes on high of sky-high bank card curiosity.

Associated: One of the best bank card welcome affords obtainable this month

For charges and costs of the Blue Enterprise Plus Credit score Card from American Specific, click on right here.