The Enterprise Platinum Card from American Categorical overview

* Card ranking relies on the opinion of TPG’s editors and isn’t influenced by the cardboard issuer.

With premium playing cards within the mainstream lately, many individuals are comfy paying annual charges of over $400. The Enterprise Platinum Card from American Categorical stands out above even that, although, with a $695 annual price (see charges and costs) — though its annual assertion credit and advantages go above and past to offset that yearly price.

Between its excessive annual price and a handful of business-focused perks, this card actually will not be appropriate for each small enterprise — particularly ones that do not log main journey bills or ones with main spending areas extra in step with the bonus classes provided by different enterprise playing cards. Nonetheless, it has some worthwhile perks, making it a robust alternative for a lot of companies.

We suggest candidates have a credit score rating of 670 or above to extend their probabilities of getting accredited.

Let’s dive into the cardboard particulars so you may resolve if it is a good match for your small business.

Associated: Easy methods to get a enterprise bank card

Amex Enterprise Platinum execs and cons

| Professionals | Cons |

|---|---|

|

|

*Enrollment required for choose advantages. Phrases apply

Amex Enterprise Platinum welcome supply

Proper now, new Amex Enterprise Platinum candidates can earn:

Each day Publication

Reward your inbox with the TPG Each day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

- 150,000 factors after spending $20,000 on eligible purchases within the first three months of card membership; plus

- A $500 assertion credit score after spending $2,500 on qualifying flights booked straight with airways or by means of American Categorical Journey inside the first three months of card membership.

To earn the $500 assertion credit score, you should purchase flights throughout any variety of airways (it would not should be only one). The bookings might be made both straight with the airline or by means of Amex Journey. Be aware that it’s essential to meet the $2,500 minimal spending requirement for airfare purchases inside three months of being accredited for the cardboard.

Our April 2025 valuations peg the Membership Rewards factors this card earns at 2 cents apiece. So, if you happen to can handle the excessive spending requirement on this tiered supply, you may obtain as much as $3,500 in worth. This beats the most effective welcome supply we have now seen on this card, because of the addition of the assertion credit score for airfare purchases.

Whereas $20,000 in three months may not be laborious for companies with a whole lot of money stream, in case your enterprise is smaller, you possibly can take into account prepaying as many bills as you may afford throughout your first three months to assist earn your welcome supply.

As a cardmember, you may get extra worth from the $500 assertion credit score by stacking it with an Amex Provide. After making use of for the cardboard and being accredited, search for Amex Gives offering money again or bonus Membership Rewards factors for airfare purchases.

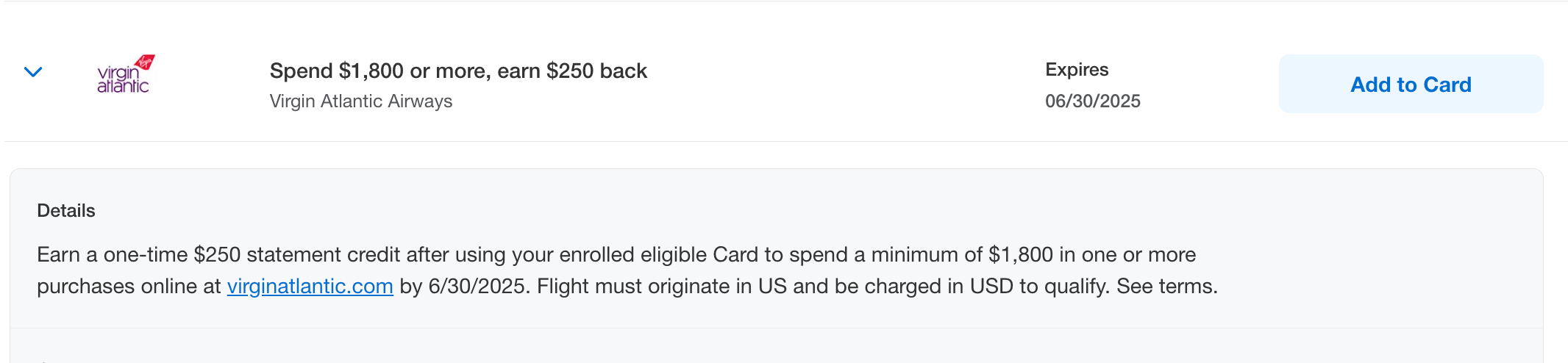

For instance, an Amex Provide out there to TPG bank card author Danyal Ahmed is a $250 assertion credit score after spending $1,800 or extra with Virgin Atlantic. By stacking this with the welcome supply, a cardmember might rise up to $750 in assertion credit score on Virgin Atlantic flights.

Alternatively, if this kind of spending is out of your league, one other enterprise card with a decrease bonus threshold, a smaller annual price and extra focused incomes classes may be a greater match for you in the long term.

Associated: Easy methods to obtain the Amex Enterprise Platinum’s spending requirement to earn 150,000 factors

Amex Enterprise Platinum advantages

Amex’s bevy of assertion credit, simply totaling over $1,500 in annual advantages, will help cardmembers probably offset the preliminary shock of that top annual price. This is a detailed take a look at all of them (enrollment is required for choose advantages, phrases apply):

| Assertion credit score | Annual quantity | The way it works |

|---|---|---|

| Dell† | As much as $400 per calendar yr | Assertion credit score on U.S. Dell purchases as much as $200 semiannually |

| Certainly | As much as $360 per calendar yr | Assertion credit score on Certainly hiring and recruiting services to submit open positions and discover expertise, as much as $90 per quarter |

| Adobe† | As much as $150 per calendar yr | Assertion credit score on choose annual purchases (topic to auto-renewal), together with Adobe Artistic Cloud and Acrobat Professional DC |

| Hilton | As much as $200 per calendar yr | Assertion credit score as much as $50 per quarter on eligible purchases made straight with a property within the Hilton portfolio. Hilton for Enterprise program membership is required. |

| Wi-fi phone providers | As much as $120 per calendar yr | Assertion credit for purchases made straight from any U.S. wi-fi phone supplier, as much as $10 per thirty days |

| Clear Plus | As much as $199 per calendar yr | Assertion credit score towards an annual Clear Plus membership for expedited airport safety (topic to auto-renewal) |

| Airline price | As much as $200 per calendar yr | Annual airline price credit score of as much as $200 on expenses by the airline you choose every calendar yr |

| International Entry or TSA PreCheck | As much as $120 | Assertion credit score for International Entry ($120) or TSA PreCheck (as much as $85) each 4 years (4.5 years for PreCheck) |

Alongside the plethora of assertion credit you might (or might not) be capable to use, the Amex Enterprise Platinum shines by means of with its different journey perks.

Except for entry to Amex’s Centurion Lounges, your card will open the door to the in depth American Categorical International Lounge Assortment (entry is proscribed to eligible cardmembers). It’s comprised of greater than 1,700 lounges worldwide, together with Delta Sky Golf equipment you can enter when you might have an eligible same-day flight on that airline, Precedence Go lounge entry (enrollment required; excluding restaurant areas), Escape Lounges and Lufthansa Lounges when you might have a same-day flight on that airline.

Nevertheless, it is price noting that you just’re restricted to 10 whole Delta Sky Membership visits per yr — until you spend $75,000 in a calendar yr to unlock limitless entry.

As for advantages that come in useful when you attain your vacation spot, this card lets you register for complimentary Gold standing with Hilton Honors and Marriott Bonvoy, which offer greater earnings and elevated advantages throughout stays with these two manufacturers.

Cardmembers additionally get pleasure from complimentary elite automotive rental standing with a number of packages, together with Avis Most well-liked, Hertz Gold Plus Rewards and Nationwide Emerald Membership. (Enrollment required for these advantages.)

As you may think, the Amex Enterprise Platinum Card can be nice for enterprise purchases. It options prolonged guarantee safety‡ that prolongs eligible U.S. producer warranties of 5 years or much less by a further yr, saving enterprise house owners money and time if one thing occurs to an merchandise they purchase.

Moreover, the cardboard’s buy safety covers unintended injury or theft for as much as 90 days after buy, as much as $10,000 per lined buy and $50,000 per cardmember account per calendar yr, so it is an ideal alternative for costly objects.‡

Except for these two particular advantages, the cardboard’s different notable perks embrace:

- Cellphone safety, for a most of $800 per declare with a restrict of two accredited claims per 12-month interval. Protection for a stolen or broken eligible cellphone is topic to the phrases, circumstances, exclusions and limits of legal responsibility of this profit.§

- Entry to the Cruise Privileges Program and the Worldwide Airline Program

- A 35% rebate while you use Pay with Factors to cowl a first- or business-class ticket on any airline or an economic system ticket on one airline of your alternative (as much as 1 million factors again per calendar yr)

‡Eligibility and profit stage varies by card. Phrases, circumstances and limitations Apply. Please go to americanexpress.com/benefitsguide for extra particulars. Underwritten by AMEX Assurance Firm.

§Eligibility and profit stage varies by card. Phrases, circumstances and limitations Apply. Please go to americanexpress.com/benefitsguide for extra particulars. Underwritten by New Hampshire Insurance coverage Firm, an AIG Firm.

Associated: Is the Amex Enterprise Platinum definitely worth the annual price?

Incomes factors on the Amex Enterprise Platinum

Amex Enterprise Platinum cardholders will earn 1.5 Membership Rewards factors per greenback spent on as much as $2 million in eligible purchases within the U.S. per calendar yr within the following classes:

- Eligible purchases of $5,000 or extra

- U.S. cloud service suppliers

- U.S. development supplies and {hardware} provides

- U.S. digital items retailers

- U.S. transport suppliers

- U.S. software program

Cardmembers earn 5 factors per greenback spent on airfare and pay as you go lodge purchases with American Categorical Journey (together with Amex Wonderful Resorts + Resorts).

All different purchases earn 1 level per greenback spent.

Associated: All the pieces it’s good to find out about Amex Membership Rewards

Redeeming factors on the Amex Enterprise Platinum

We suggest transferring your Membership Rewards factors to any of Amex’s lodge and airline companions for optimum worth.

You may as well redeem your factors for service provider reward playing cards or to cowl expenses in your invoice. Nevertheless, these choices considerably devalue your rewards to 1 cent per level or much less, so we do not suggest utilizing your factors this fashion.

The best redemption choice that also affords respectable worth is American Categorical Journey’s Pay with Factors characteristic, which lets you obtain a 35% bonus while you use factors towards first- and business-class flights on any airline, in addition to economy-class flights on a particular airline. This boosts your redemption worth for these purchases from 1 cent to 1.54 cents per level.

Simply observe that the 35% rebate is capped at 1 million factors again per calendar yr, and it’s essential to have the total variety of factors for the usual redemption in your account on the time of reserving. You may then obtain the rebate inside two billing cycles.

Transferring factors on the Amex Enterprise Platinum

You’ll be able to unlock much more worth out of your earnings by transferring your Membership Rewards factors to any of Amex’s 21 airline or lodge companions. Most transfers happen at a ratio of 1:1 and are processed immediately.

Going this route might take a little bit of analysis, however slightly work will help enhance the worth of your factors considerably above the TPG valuation.

You may additionally need to look ahead to Amex’s common switch bonuses, which might additional enhance the worth of your factors.

TPG bank cards author Chris Nelson regularly receives outsize worth by using Amex’s beneficiant switch bonuses to Avianca LifeMiles, to e-book lie-flat seats on Star Alliance companions, equivalent to United Polaris business-class flights to Europe.

Associated: The perfect methods to make use of Amex Membership Rewards factors

Which playing cards compete with the Amex Enterprise Platinum?

If you happen to really feel that your small business may not be capable to get the total worth out of the Enterprise Platinum Card, you would possibly need to take into account different choices:

For added choices, take a look at our full listing of the finest enterprise bank cards.

Learn extra: Ink Enterprise Most well-liked vs. Amex Enterprise Platinum: Practicality vs. luxurious

Backside line

With a plethora of journey advantages, the Amex Enterprise Platinum is a must have card for enterprise house owners trying to elevate their travels.

Apply right here: Amex Enterprise Platinum

For charges and costs of the Amex Enterprise Platinum, click on right here.

For charges and costs of the Amex Enterprise Gold, click on right here.