With lower than 2 months left till Feb. 28, 2025, when all American Airways Loyalty Factors balances reset, the race to earn AAdvantage elite standing in artistic methods is alive and nicely.

Loyalty Factors are the only metric utilized in qualifying for American standing. From bank card spending to purchasing flowers by way of the AAdvantage Procuring Portal, quite a few artistic methods exist to earn Loyalty Factors. Individuals would possibly say: “A mile earned, a Loyalty Level earned.” However there are many exceptions to that rule.

Simply as vital as realizing what earns Loyalty Factors is familiarizing your self with what will not earn Loyalty Factors. In spite of everything, we do not need you miscalculating your award steadiness and subsequently not attaining standing.

Listed here are 9 AAdvantage actions that will not accrue Loyalty Factors.

Shopping for, gifting or transferring miles

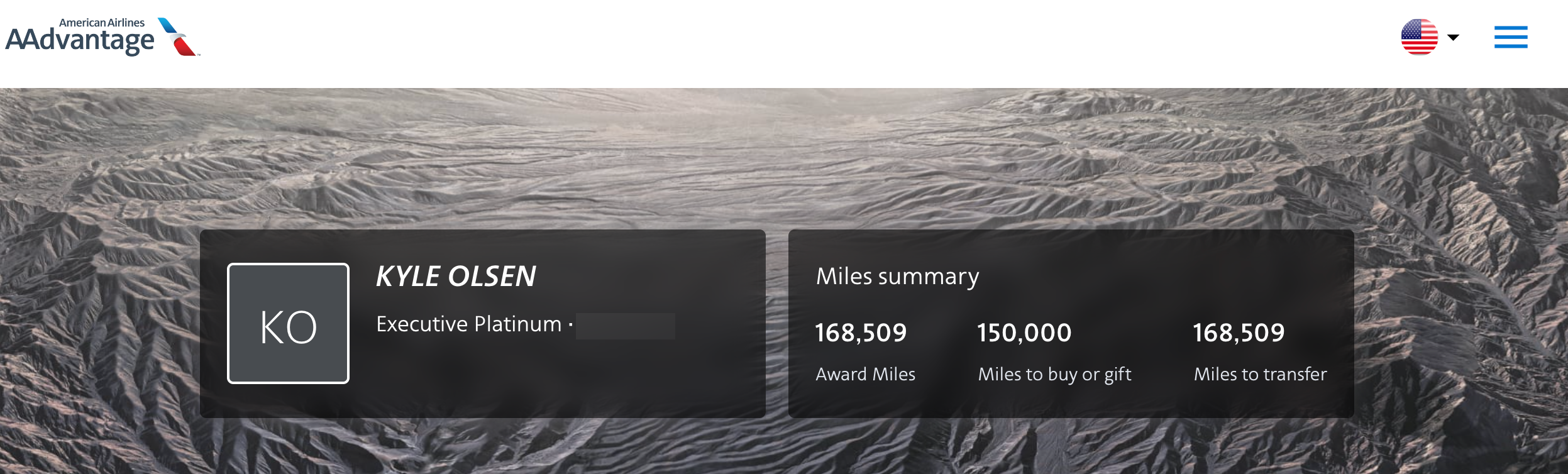

You will not earn Loyalty Factors if you purchase, present or switch miles. For instance, you should purchase 150,000 AAdvantage miles at a 35% low cost for $3,668.44. However you may earn 0 Loyalty Factors on that transaction.

Equally, in the event you switch or present AAdvantage miles to another person, neither you nor they may earn Loyalty Factors.

Associated: Present promotions for getting factors and miles

Redeeming AAdvantage miles

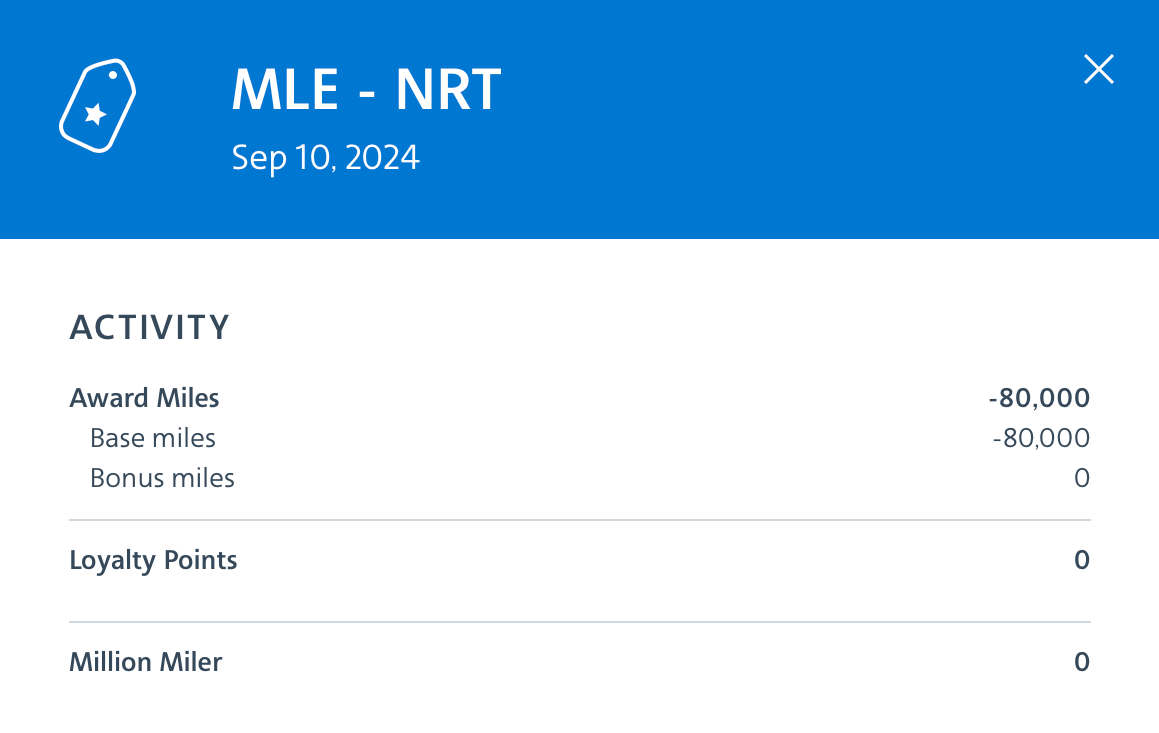

You additionally will not earn Loyalty Factors if you redeem AAdvantage miles.

For instance, I booked the above flight from Velana Worldwide Airport (MLE) within the Maldives to Tokyo Narita Worldwide Airport (NRT) by way of Kuala Lumpur Worldwide Airport (KUL) in Malaysian Airways and Japan Airways enterprise class for 40,000 AAdvantage miles per passenger. As you possibly can see, I accrued no Loyalty Factors.

Day by day E-newsletter

Reward your inbox with the TPG Day by day publication

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Associated: How you can redeem miles with the American Airways AAdvantage program

Welcome gives, spending bonuses and particular promotions

“Enroll and earn 50,000 bonus miles.” “Guide now and luxuriate in 5,000 bonus miles.”

We have all heard these gives on flights, in airports and when calling American. Sadly, you will not earn Loyalty Factors for welcome gives, spending bonuses and particular promotions, even when it is a sign-up bonus on an AAdvantage cobranded bank card. This exclusion additionally applies to bonuses on the AAdvantage Procuring Portal, AAdvantage Eating, AAdvantage Vehicles, AAdvantage Cruises, AAdvantage Resorts and AAdvantage Holidays.

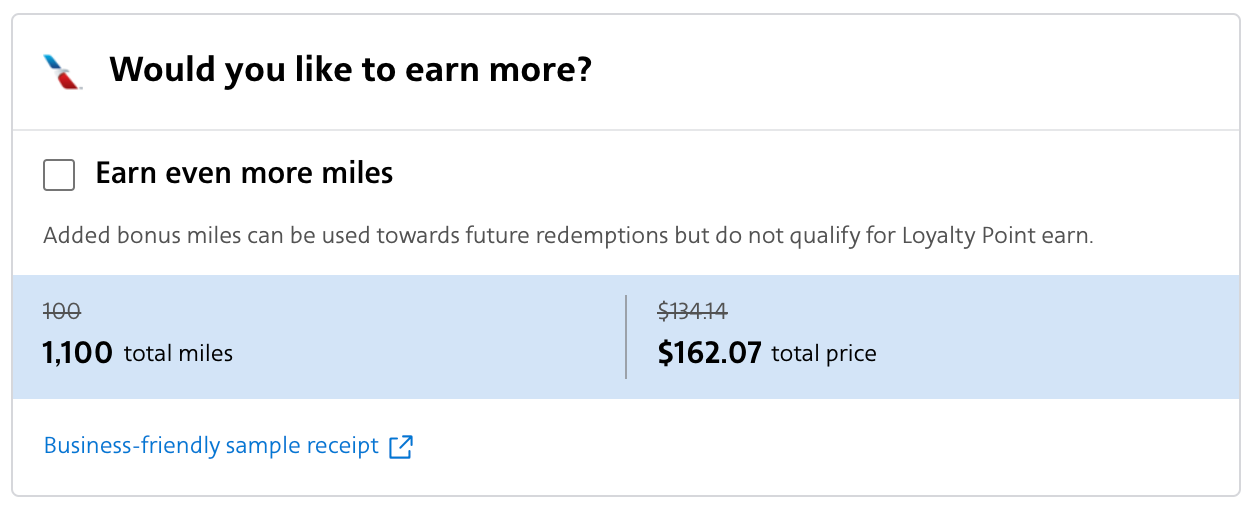

Equally, AAdvantage Resorts does not award Loyalty Factors on the extra miles you possibly can add at checkout.

In fact, you may proceed incomes Loyalty Factors on customary purchases by way of these platforms, simply not bonuses or promotions.

As an illustration, on the time of writing, Viator purchases earn 6 miles per greenback if you click on by way of the AAdvantage Procuring Portal. On this case, you may earn 6 Loyalty Factors per greenback you spend on Viator excursions. Nonetheless, if a promotion by way of AA Procuring enables you to earn 2,000 bonus miles for spending $500, you will not accrue one other 2,000 Loyalty Factors even in the event you earn the two,000 bonus miles.

Associated: The freshmen information to airline purchasing portals: How you can earn bonus factors and miles

Bank card bonus classes

You may earn a flat 1 Loyalty Level per greenback spent on purchases made together with your cobranded AAdvantage card, even when the cardboard earns greater than 1 mile per greenback on sure classes. Take the Citi® / AAdvantage Enterprise™ World Elite Mastercard® (see charges and costs), for instance. Though this card earns 2 miles per greenback on eligible American Airways purchases, at fuel stations and on different bonus classes, you may solely earn 1 Loyalty Level per greenback spent no matter the place you spend.

Nonetheless, in the event you’re a enterprise proprietor with excessive bank card spending, charging $200,000 to the cardboard would provide you with 200,000 Loyalty Factors, sufficient for top-tier Government Platinum standing with out ever setting foot on an American aircraft.

As well as, there are two methods to earn bonus Loyalty Factors with bank cards. Vacationers with an AAdvantage® Aviator® World Elite Silver Mastercard® earn 5,000 Loyalty Factors after they spend $20,000 in a standing yr. Plus, they will earn one other 5,000 Loyalty Factors after they attain $40,000 and $50,000 spent on the cardboard, for a most of 15,000 bonus Loyalty Factors per standing yr.

The knowledge for the AAdvantage Aviator Silver card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

Then again, the Citi® / AAdvantage® Government World Elite Mastercard® (see charges and costs) awards 10,000 Loyalty Factors after you accrue 50,000 Loyalty Factors in a standing qualification yr and one other 10,000 after reaching 90,000 Loyalty Factors in the identical standing qualification yr.

Associated: Finest bank cards for American Airways flyers

Bask Financial institution financial savings accounts

You are in all probability conversant in CD (certificates of deposit) financial institution accounts: Deposit a sure amount of cash for a set interval with out withdrawing it, and you may earn curiosity.

AAdvantage has utilized this mannequin to an association with Bask Financial institution: AAdvantage members can deposit cash right into a Bask Financial institution Mileage Financial savings Account for 12 months and earn AAdvantage miles as a substitute of money curiosity. For each $1 that you simply deposit for 12 months, you earn 2 AAdvantage miles. You’ll be able to deposit as much as $200,000 and earn 500,000 miles; mileage curiosity is paid month-to-month.

As well as, Bask Financial institution sometimes gives promotions for further miles. For instance, new Bask Financial institution Mileage Financial savings Account clients can at the moment earn 10,000 bonus miles after opening a brand new account by Feb. 28, 2025, funding the account inside 15 days and sustaining a minimal every day account steadiness of $50,000 for 180 consecutive days out of the primary 210 days following the preliminary account opening.

Sadly, none of those AAdvantage miles rely as Loyalty Factors — except a limited-time promotion explicitly awards Loyalty Factors (like we noticed in 2022).

Associated: 10 methods you might be incomes airline miles apart from bank cards

Donations to combat most cancers

American awards 10 miles per greenback if you donate greater than $25 to Stand Up To Most cancers. We have additionally seen promotions providing as much as 50 miles per greenback for a restricted time. That is a improbable return for supporting a fantastic trigger.

When you earn miles from these donations, you will not earn Loyalty Factors.

Associated: Giving Tuesday: The 7 finest bank cards to maximise your charitable donation

Transferring rewards from one other foreign money to AAdvantage

Associated: When does it make sense to switch Marriott factors to airways?

The price of your ticket outdoors the bottom fare and carrier-imposed charges

While you’re flying American, you earn miles and Loyalty Factors relying in your standing:

| Standing | Earnings on primary economic system fares | Earnings on all different fares |

|---|---|---|

| Basic member | 2 miles and LPs per greenback | 5 miles and LPs per greenback |

| Gold | 2.8 miles and LPs per greenback | 7 miles and LPs per greenback |

| Platinum | 3.2 miles and LPs per greenback | 8 miles and LPs per greenback |

| Platinum Professional | 3.6 miles and LPs per greenback | 9 miles and LPs per greenback |

| Government Platinum | 4.4 miles and LPs per greenback | 11 miles and LPs per greenback |

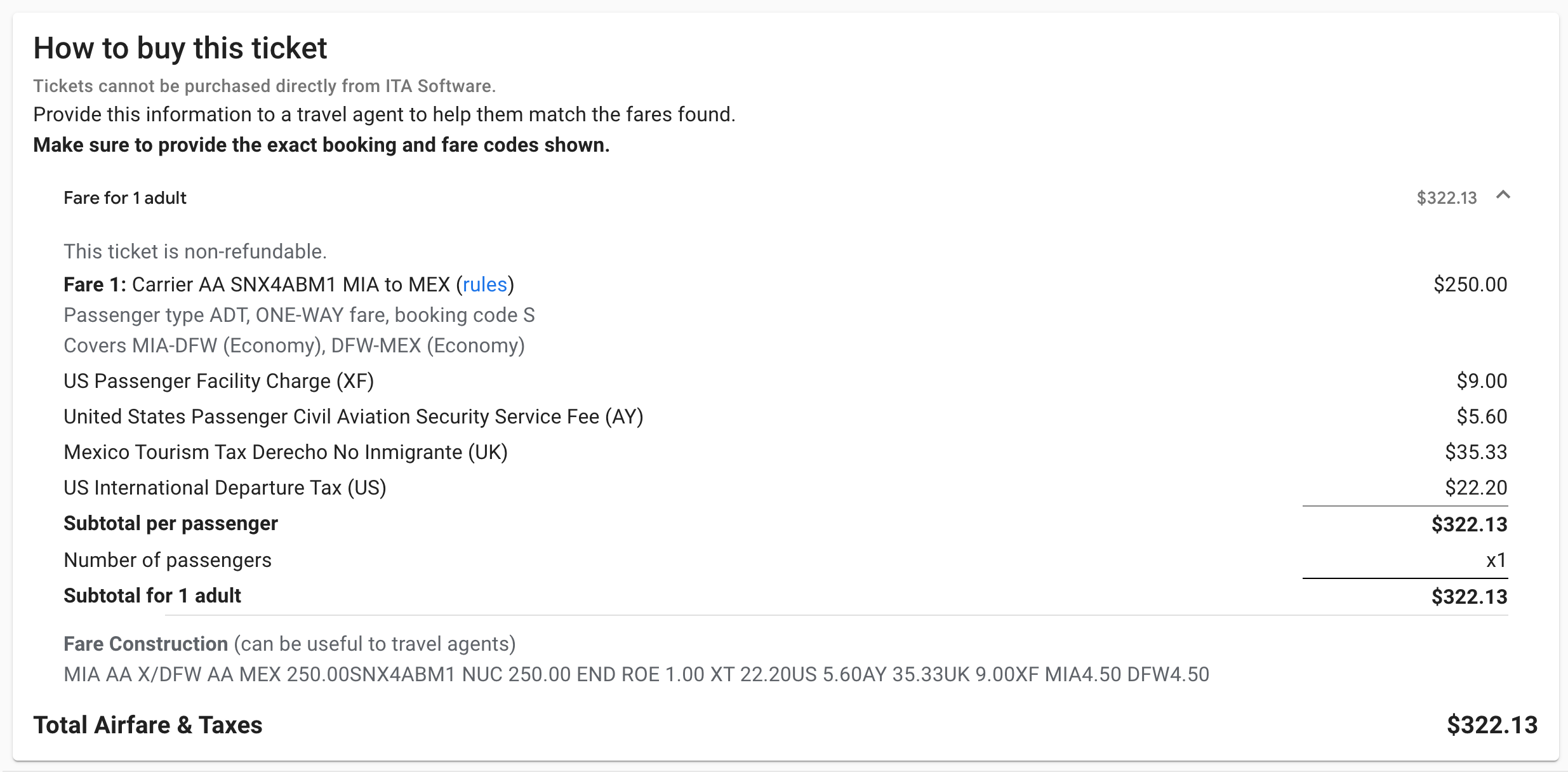

Nonetheless, you solely earn miles and Loyalty Factors on the bottom fare and carrier-imposed charges. Authorities-imposed taxes and costs, such because the U.S.’s obligatory $5.60 safety price on each ticket, are ineligible for mileage and Loyalty Level credit score. Add-ons like seat choice and baggage charges do not earn miles or Loyalty Factors, both.

You’ll be able to name American and make sure what number of miles and Loyalty Factors your reservation will earn. Alternatively, you possibly can pull up your itinerary on ITA Matrix and check with the fare breakdown. Subtract all government-imposed taxes and costs, and you may see how a lot spending earns AAdvantage miles and Loyalty Factors.

For instance, this economic system flight from Miami Worldwide Airport (MIA) to Mexico Metropolis Worldwide Airport (MEX) prices $322.13. Nonetheless, solely $250 of that is eligible for incomes AAdvantage miles and Loyalty Factors. As you possibly can see within the fare breakdown, the remainder of the associated fee includes taxes and costs imposed by the U.S. and Mexico.

This implies an AAdvantage member with out elite standing would earn 1,250 AAdvantage miles and Loyalty Factors, whereas a top-tier Government Platinum member would earn 2,750 miles and Loyalty Factors.

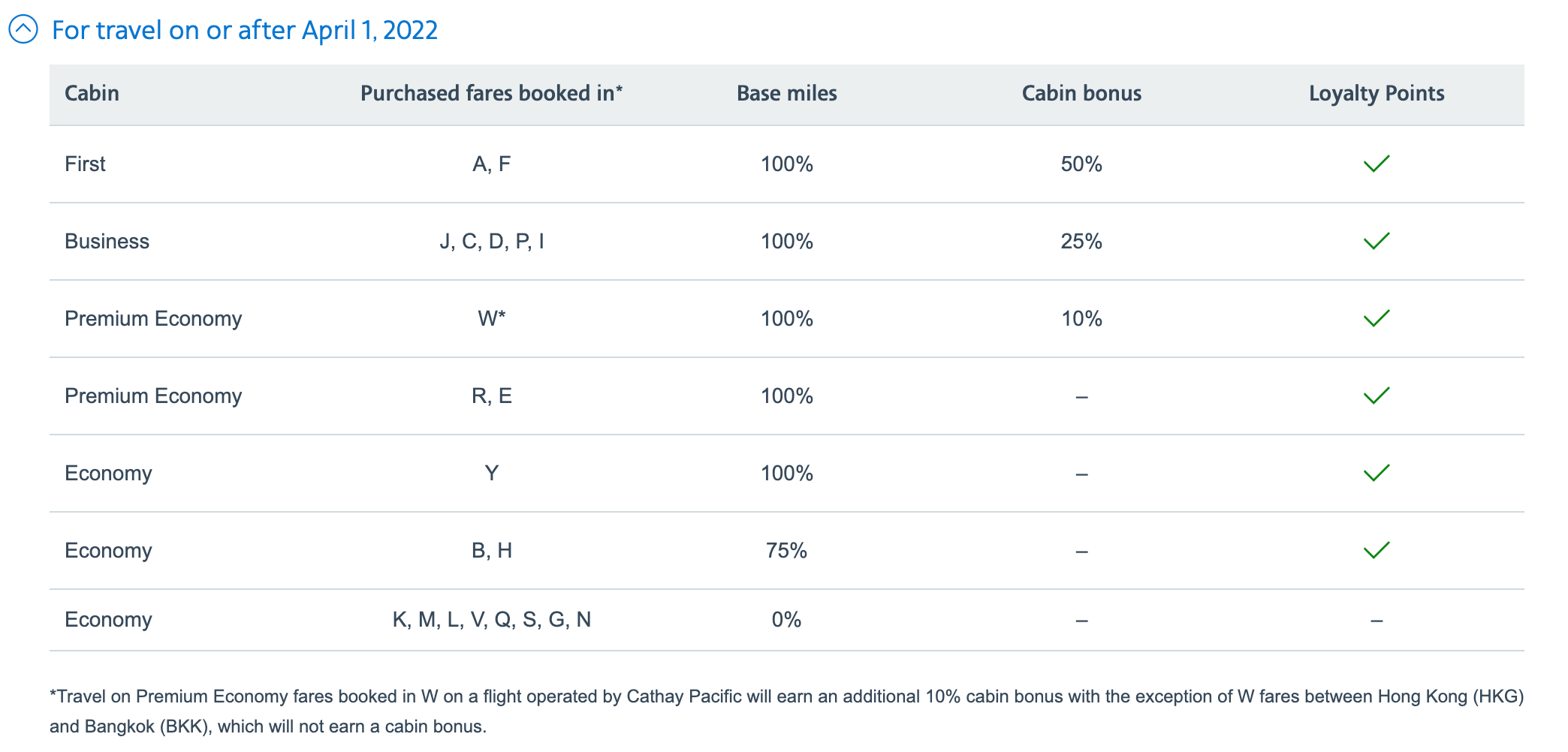

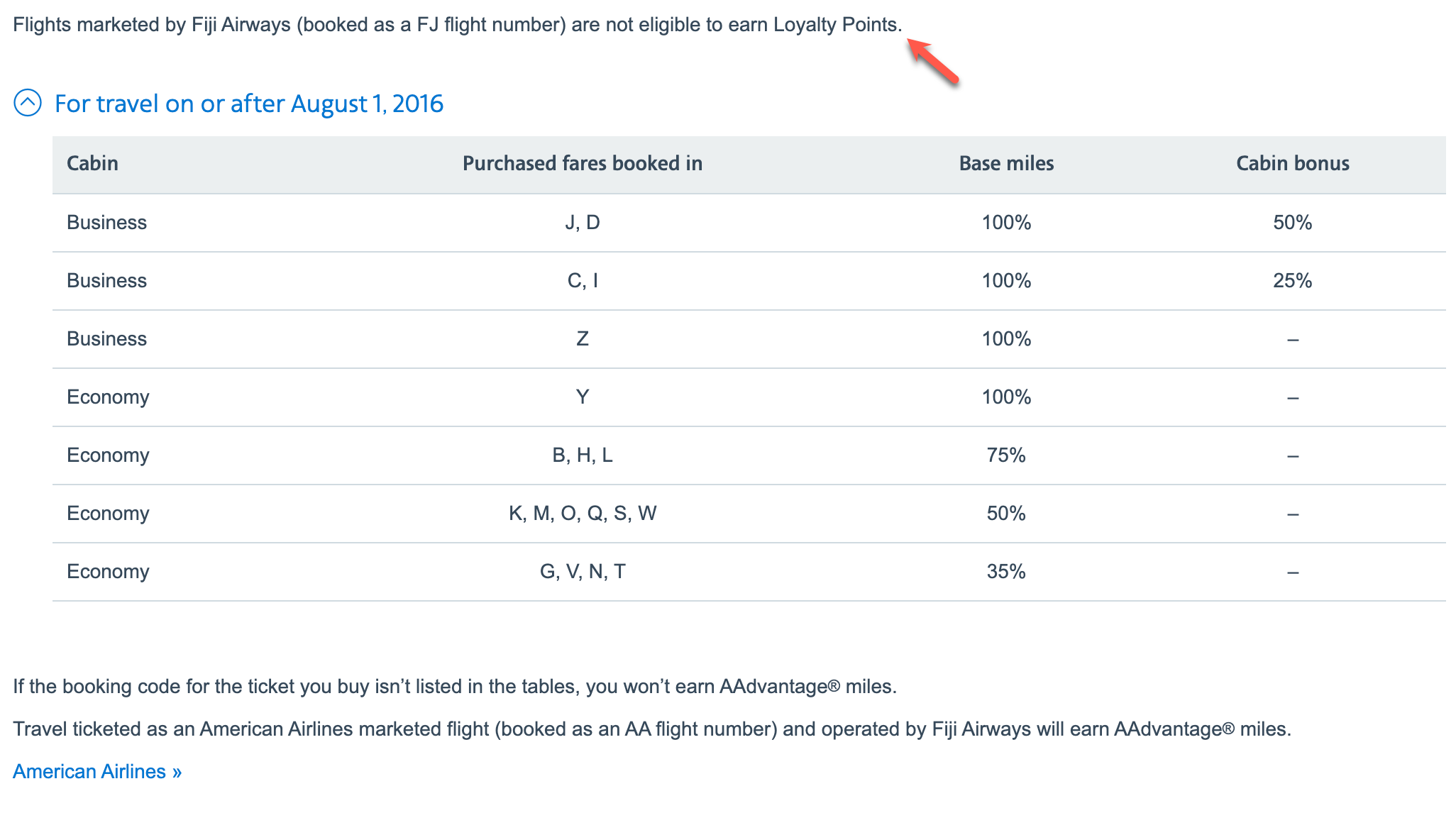

Sure accomplice fare courses

Sure accomplice fares aren’t eligible to earn miles and Loyalty Factors. As you possibly can see from the above Cathay Pacific incomes chart, many economy-class fares are ineligible for credit score. This implies you will not earn miles or Loyalty Factors on these kinds of fares.

Within the case of Fiji Airways, all fares marketed by Fiji Airways (indicated by a Fiji Airways flight quantity) do not earn Loyalty Factors.

You’ll be able to examine the complete earnings record of American’s companions right here. In case your fare class is not eligible for mileage credit score on AAdvantage, you may need to credit score the flight to a different Oneworld frequent flyer program.

Associated: Fast Factors: Earn American AAdvantage standing rapidly with accomplice flights

Backside line

Not all AAdvantage actions earn Loyalty Factors. In the event you’re after elite standing this yr, it is important to know which of them don’t. In the event you’re chasing AAdvantage elite standing, try our guides on learn how to earn Loyalty Factors and last-minute methods to earn American elite standing.