Southwest Speedy Rewards Plus Credit score Card overview

* Card ranking is predicated on the opinion of TPG’s editors and isn’t influenced by the cardboard issuer.

In a pastime that feels dominated by ultra-premium bank cards with $550-plus annual charges and laundry lists of luxurious perks, it is exhausting to think about {that a} cobranded airline bank card with a $69 annual price is likely to be beneficial to loyal Southwest prospects.

Nevertheless, the Southwest Plus card does make sense for some flyers — in some instances.

Southwest is not any stranger to doing issues in another way, together with providing three inexpensive private bank cards. Earlier than you apply, word that this card has a really helpful credit score rating of 670 or above.

Let’s take a look at how the Southwest Plus card and its perks measure up in opposition to its higher-end siblings.

Associated: How to decide on an airline bank card

Southwest Speedy Rewards Plus Credit score Card execs and cons

| Professionals | Cons |

|---|---|

|

|

Associated: Bank cards 101: The newbie’s information

Southwest Speedy Rewards Plus Credit score Card welcome provide

Each day E-newsletter

Reward your inbox with the TPG Each day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

The welcome provide is much more profitable in case you worth Southwest’s Companion Move, which you will get after incomes 135,000 factors. To get essentially the most out of the Companion Move for 2025 and 2026, apply for the cardboard in early October. Then, following your December assertion date, full the minimal spending situations to get extra factors in January 2025. This could assist you to purchase a Companion Move for 2025 and 2026.

Earlier than you rush to use for this card, there are two utility guidelines to recollect. First, the Southwest Plus card is topic to Chase’s 5/24 rule. When you’ve opened 5 or extra new bank card accounts (from any financial institution, not simply Chase) up to now 24 months, you possible will not be accredited for this card.

One other limitation applies particularly to Southwest bank cards. In case you have any private Southwest bank card — or earned a sign-up bonus on a private Southwest card within the final 24 months — you will not be eligible for the bonus on this card.

Associated: The final word information to bank card utility restrictions

Southwest Speedy Rewards Plus Credit score Card advantages

There are perks on the Southwest Plus card that transcend the factors from the sign-up bonus. You may get pleasure from the next ongoing advantages in change for the cardboard’s $69 annual price:

- Reimbursement for as much as two EarlyBird check-ins each card anniversary (a extra beneficial perk now that the pricing for EarlyBird check-ins has elevated)

- 10,000 Companion Move qualifying factors increase each calendar yr

- 3,000 bonus factors every account anniversary yr, value $42 based on TPG’s December 2024 valuations

- 25% again on inflight purchases of drinks and Wi-Fi on Southwest Airways flights

Associated: Why I select Southwest each time

Incomes factors on the Southwest Speedy Rewards Plus Credit score Card

You may additionally earn 2 factors per greenback spent on native transit and commuting (together with ride-hailing providers), 2 factors per greenback spent on web, cable and cellphone providers, 2 factors per greenback spent on choose streaming providers and 1 level per greenback spent on different purchases.

It is value declaring that purchases outdoors the U.S. will nonetheless earn bonus factors at these similar charges, however you’ll pay a 3% overseas transaction price. Thus, this is not a very good card for purchases in different nations.

These are first rate incomes charges for a cobranded airline card, however the incomes fee on Southwest purchases is decrease than the opposite private Southwest playing cards. In case your foremost motivation for getting this card is to earn bonus factors in your Southwest purchases, you will in all probability need to go together with one among them as an alternative.

Associated: Are airline bank cards value it anymore?

Redeeming factors on the Southwest Speedy Rewards Plus Credit score Card

Redeem the Speedy Rewards factors you earn on the Southwest Plus card for Southwest flights to get one of the best worth from them. Speedy Rewards additionally gives different redemption choices, together with reward playing cards, merchandise, resort stays, rental automobiles and journey experiences. Nevertheless, the redemption values on these choices are a lot decrease than what you will get when utilizing your factors for Southwest flights.

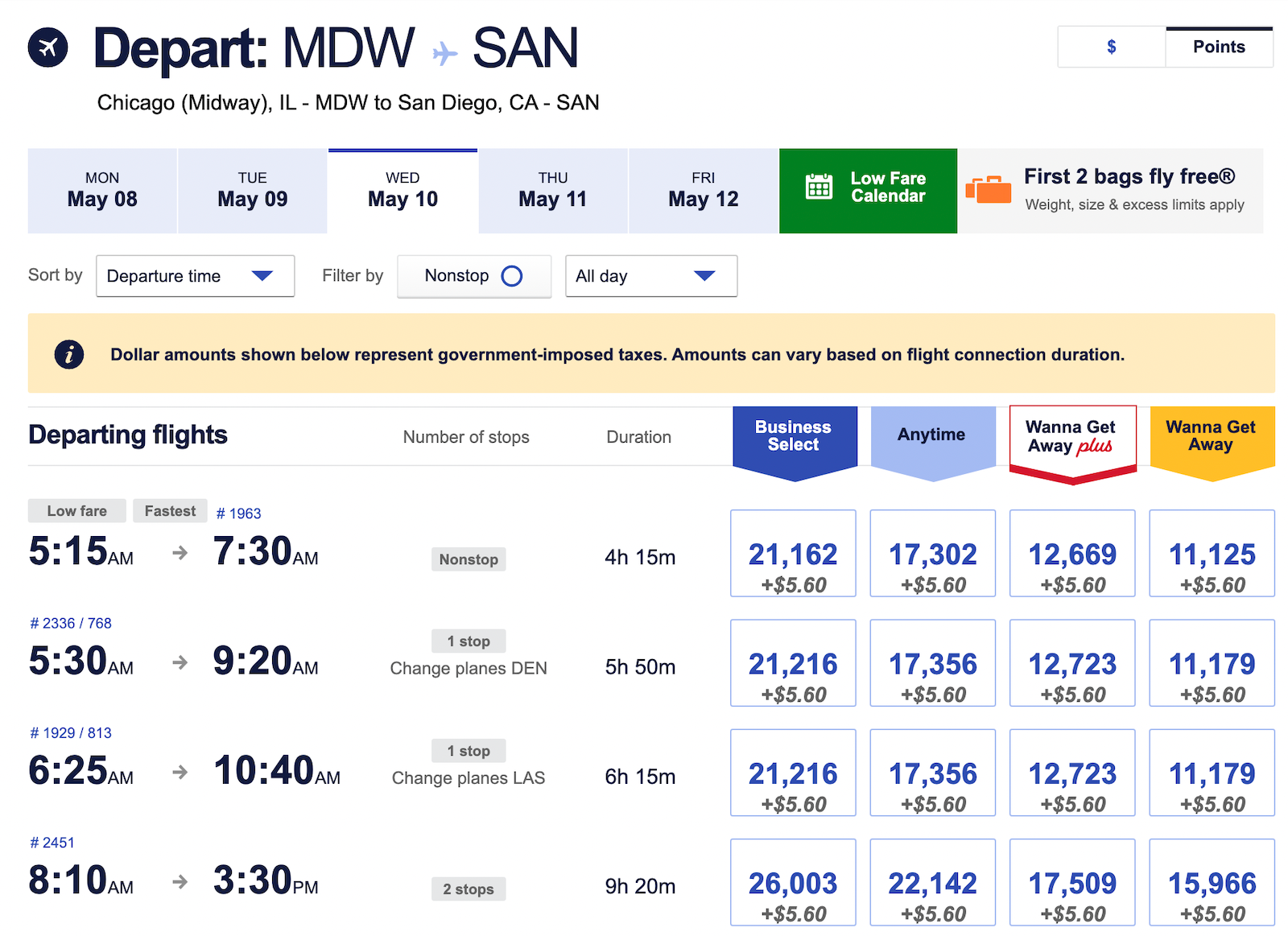

The airline gives 4 tiers of fares, starting from the most affordable Wanna Get Away tickets to the costlier Enterprise Choose possibility — with Wanna Get Away Plus and Anytime fares in between.

Award pricing is tied to the money worth of the tickets. Thus, the variety of factors you want will go up or down relying on the money worth of the flight. The optimistic is that utilizing your factors for Southwest flights is nearly at all times doable.

TPG senior director of content material Summer season Hull redeemed 11,000 Speedy Rewards factors to journey from Houston all the best way to Lihue in Hawaii. Securing redemptions like these could make your factors go even additional.

Associated: The best way to redeem factors with the Southwest Speedy Rewards program

Which playing cards compete with the Southwest Speedy Rewards Plus Credit score Card?

- If you would like extra Southwest advantages with a modest price: The Southwest Speedy Rewards® Premier Credit score Card has strong perks to justify its $99 annual price. These embrace 6,000-anniversary bonus factors, two EarlyBird check-ins per yr, 25% again on inflight purchases and tier-qualifying factors towards A-Listing standing. To study extra, learn our full evaluation of the Southwest Premier card.

- When you fly Southwest commonly and need essentially the most perks: The Southwest Speedy Rewards® Precedence Credit score Card is the premium Southwest bank card, providing 7,500-anniversary bonus factors and a $75 Southwest journey credit score annually. The cardboard has a $149 annual price. To study extra, learn our full evaluation of the Southwest Precedence card.

- If you would like extra factors that can be utilized with Southwest and in different methods: The Chase Sapphire Most popular® Card is an effective selection for incomes Chase Final Rewards factors, which you’ll redeem with Southwest and different airline and resort companions. You may additionally get quite a few journey protections, and the cardboard has a $95 annual price. To study extra, learn our full evaluation of the Sapphire Most popular.

The knowledge for the Southwest Speedy Rewards Premier bank card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or supplied by the cardboard issuer.

For extra choices, take a look at our full checklist of one of the best journey bank cards and greatest Chase bank cards.

Associated: Evaluating the Southwest Speedy Rewards Precedence, Premier and Plus bank cards

Is the Southwest Speedy Rewards Plus Credit score Card value it?

Backside line

For under $69 per yr, the Southwest Plus card permits you to earn sufficient factors to make it effectively well worth the annual price. Plus, it comes with a handful of advantages that may justify maintaining the cardboard in your pockets yearly.

Nevertheless, in case you fly with Southwest typically, one of many different two Southwest playing cards will present extra perks. Be sure you consider what’s greatest for you past merely wanting on the annual price.

Apply right here: Southwest Speedy Rewards Plus Credit score Card